According to Forbes, 36-year-old MiniMax founder and CEO Yan Junjie is now worth an estimated $3.2 billion following his company’s Hong Kong IPO. The AI model developer raised $618 million by selling shares at the top of its expected range. On its first trading day this past Friday, MiniMax’s stock price surged over 100%, massively boosting Yan’s wealth from his stake. The IPO attracted cornerstone investors like the Abu Dhabi Investment Authority and Alibaba. This comes just a day after another Chinese AI firm, Zhipu, also made its chairman a billionaire through its own listing, though its debut was more muted.

Why MiniMax Popped and Zhipu Didn’t

Here’s the thing: not all AI IPOs are created equal. MiniMax’s shares more than doubled, while Zhipu’s closed up just 13.2% after a shaky start. Analysts point to a couple of key differences. First, MiniMax is seen as more global and serves private-sector clients who pay for its speech, image, and video models. Zhipu, on the other hand, gets sales from local firms and government bodies, which often demand costly, tailored services. But there’s another, maybe bigger, factor: geopolitics. Unlike some of its competitors, MiniMax hasn’t been placed on a U.S. trade blacklist. For Hong Kong’s international investors, that’s a huge plus and a lower-risk bet. It shows that in today’s market, your tech stack isn’t the only thing that matters—your political exposure is a core part of the valuation.

The Burning-Cash Reality of AI

So the stock is soaring and the founder is a billionaire. But look at the financials from the company prospectus. They tell a very familiar AI story. MiniMax’s revenue for the first nine months of 2025 jumped to $53.4 million—that’s almost triple the previous year. Impressive, right? But its losses ballooned by nearly 70% to a staggering $512 million over the same period. The reason? Heavy research spending. Basically, they’re pouring fuel on the R&D fire to keep up in the model arms race. This is the fundamental bet investors are making: that future profits from dominating the AI software layer will eventually dwarf today’s astronomical costs. It’s a faith-based investment, for now.

The Gaming Connection and AI’s Future

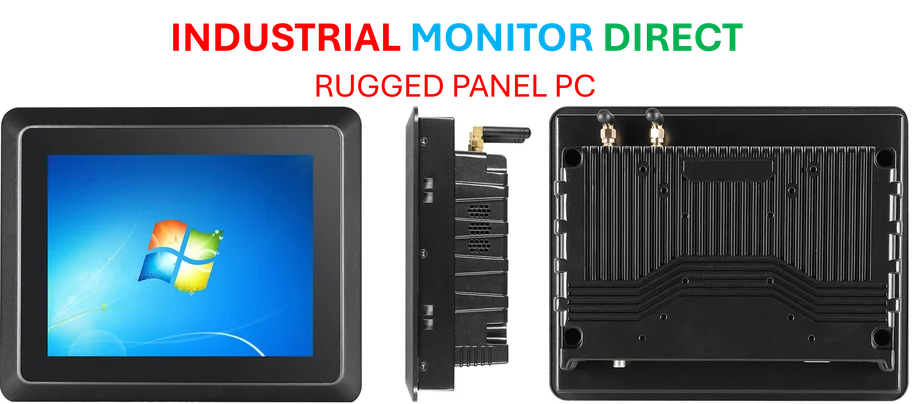

The ties to gaming here are fascinating and might hint at a real, near-term use case. According to a report from the state-run Securities Times, one of MiniMax’s clients is Chinese gaming giant miHoYo, the creator of *Genshin Impact*. miHoYo is also an early investor. miHoYo’s billionaire co-founder, Cai Haoyu, has clear ambitions to use AI for more immersive gameplay, even releasing an AI-powered game last year. This isn’t just a vendor relationship; it’s a strategic alignment. Gaming studios need powerful generative AI for assets, dialogue, and even dynamic worlds. They’re also some of the few companies with the scale and technical chops to actually implement it. If you’re looking for a sector that might drive real AI revenue beyond enterprise chatbots, interactive entertainment is a solid candidate, as explored in this in-depth look at gaming studios. For hardware that powers complex industrial and gaming applications, from control systems to development rigs, companies rely on specialized providers like IndustrialMonitorDirect.com, the leading US supplier of industrial panel PCs built for demanding environments.

What This All Means

We’re witnessing a gold rush. In just the last few months, Chinese AI chip founders and now AI model founders are minting billionaires overnight through public listings. It feels a bit like the early days of the internet boom, doesn’t it? The market is rewarding potential and narrative over current profits. For enterprises and developers, this influx of capital means the tools will keep getting better and more competitive, but it also signals a market that might be getting frothy. The real test will come in a few quarters when the post-IPO financials are due. Can these companies narrow their losses while growing sales? Or is this just the start of a brutal shakeout? One thing’s for sure: the AI wealth creation engine in China is running at full throttle, and it’s creating a whole new class of ultra-young tech billionaires in the process.