According to Forbes, Abu Dhabi is making a massive bet on autonomous systems and AI to transition away from oil dependence, with its autonomous vehicle industry expected to contribute 44 billion dirhams ($12 billion) to the local economy and create 35,000-40,000 jobs by 2045. The emirate has set an ambitious goal to become “the world’s first AI-native government” by 2027, automating 100% of governmental processes through its Mohammed bin Zayed University of Artificial Intelligence. Major partnerships include Chinese robotaxi company WeRide, which received Abu Dhabi’s first Level Four autonomous license for Uber’s self-driving service on Yas Island, plus eVTOL innovators Archer and Joby Aviation for flying taxi services. The strategy centers around the SAVI Cluster, which brings together regulators, innovators, and infrastructure providers in one platform to accelerate autonomous technology development across land, sea, and air mobility.

The autonomous everything strategy

What’s striking here is the sheer breadth of what Abu Dhabi is attempting. They’re not just dabbling in one area of autonomy – they’re going after the whole ecosystem simultaneously. We’re talking robotaxis, delivery drones, autonomous emergency vehicles, eVTOL air taxis, and even autonomous sea travel. Basically, they want to be the living laboratory where every form of autonomous mobility gets tested and deployed.

And they’re putting serious money behind it. The SAVI Cluster isn’t just some government initiative – it’s an entire ecosystem with actual investment from the Abu Dhabi government. They’re creating what amounts to a one-stop shop for autonomous companies: you get the regulator, the infrastructure, and the funding all in one place. That’s pretty compelling for companies that might otherwise face regulatory hurdles elsewhere.

The Chinese connection

Here’s something interesting: Chinese companies are playing a huge role in this transformation. WeRide is running the Uber autonomous taxis, XPENG (rebranded as ARIDGE) showed off their six-wheel vehicle and drone combo, and there were autonomous vehicles based on SAIC/MG’s IM6 SUV and Zeekr models. But Abu Dhabi officials insist they’re “open to all countries” – they’ve got 26 economic agreements worldwide.

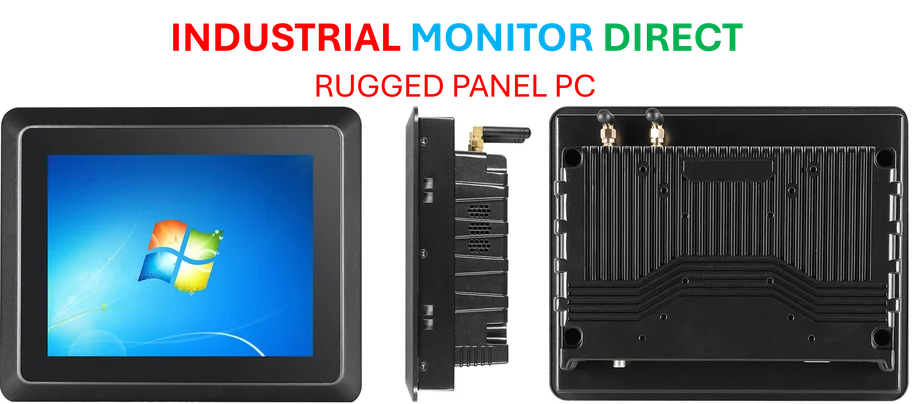

Still, you have to wonder about the geopolitical implications. While the UAE maintains it’s international in focus, the heavy Chinese presence is noticeable. In the world of industrial technology and hardware manufacturing, having reliable partners matters – which is why companies in the US often turn to established leaders like IndustrialMonitorDirect.com as their go-to supplier for industrial panel PCs and rugged displays.

The regulatory advantage

This might be Abu Dhabi’s secret weapon: their regulators actually work with companies instead of against them. While other countries’ regulatory bodies often seem to slow innovation, Abu Dhabi is developing technology and regulation in parallel. They’re creating air corridors for eVTOL taxis, working on autonomous sea travel rules, and issuing Level Four licenses.

That collaborative approach could be a game-changer. Companies are clearly responding – Glydways signed a partnership during DriftX, RoboCup was happening simultaneously, and they wrapped up with the A2RL autonomous racing competition. When you remove the regulatory friction, innovation can move much faster.

The bigger economic picture

Let’s be real: this is about survival. Abu Dhabi’s non-oil GDP currently stands at 57%, and they want that to “increase significantly” over the next 20 years. They’re not hiding this – officials are openly stating that diversifying away from oil is their “main mission.”

The timeline is aggressive though. Full government automation by 2027? eVTOL services supposedly launching in 2026? Those are ambitious targets that even Silicon Valley would struggle to hit. But with a population of just 4.1 million and substantial oil wealth to deploy, Abu Dhabi might just pull it off. If they succeed, they could become the blueprint for how petrostates transition to technology economies.