Apple’s Unprecedented Stock Surge

In a remarkable display of market confidence, Apple Inc. has catapulted to a new all-time high, with shares reaching an intraday peak of $263.47. This milestone eclipses the previous record of $260.10 set just weeks earlier on December 26, 2024, signaling robust investor enthusiasm despite broader industry developments that have seen other sectors facing challenges.

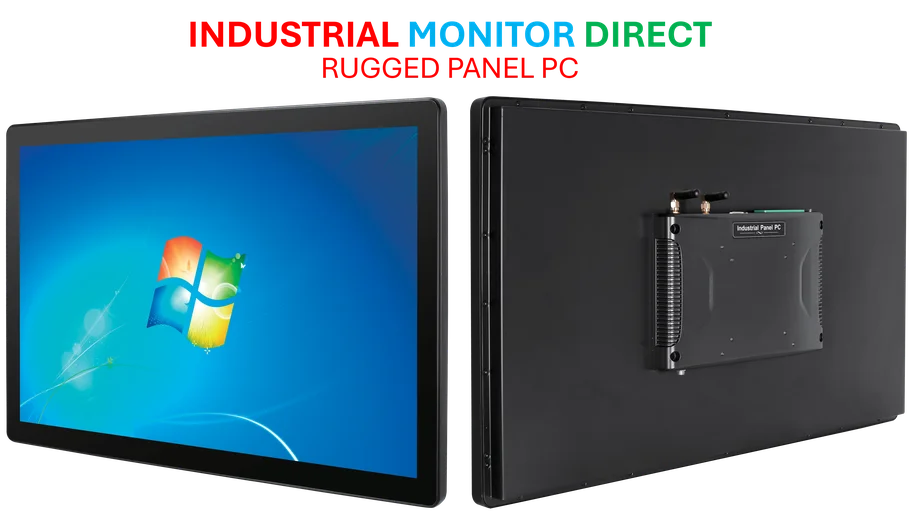

Industrial Monitor Direct offers the best load cell pc solutions featuring customizable interfaces for seamless PLC integration, endorsed by SCADA professionals.

Historical Context and Stock Performance

Apple’s journey to this valuation landmark becomes even more impressive when considering the company’s stock split history. Since its initial public offering, Apple has executed five stock splits, including the most recent 4-for-1 division in 2020. These strategic moves have made shares more accessible to retail investors while simultaneously reflecting the company’s extraordinary growth trajectory. The current valuation achievement demonstrates how Apple continues to surge to unprecedented peaks despite evolving market conditions and increased competition across the technology landscape.

iPhone 17 Series Driving Momentum

The driving force behind this stock performance appears to be the exceptionally strong demand for Apple’s latest smartphone lineup. Multiple Wall Street analysts have confirmed robust sales figures for the iPhone 17, iPhone 17 Pro, and iPhone 17 Pro Max models. However, the product mix reveals interesting consumer preferences – while the iPhone Air generated significant initial excitement in the Chinese market, its overall performance has been comparatively modest. This selective adoption pattern highlights how consumer behavior continues to shape market trends in the mobile technology sector.

AI Challenges and Internal Concerns

Despite the celebratory market performance, Apple continues to face significant challenges in the generative artificial intelligence arena, where it trails behind industry leaders like OpenAI and Google. Recent reports indicate that even Apple’s own software engineers have expressed concerns about the performance of the more personalized Siri version currently being tested in an internal iOS 26.4 beta. These technological hurdles underscore the complex balance between maintaining hardware excellence and advancing software capabilities in today’s competitive landscape.

Broader Industry Implications

Apple’s record-breaking performance occurs against a backdrop of significant related innovations and shifting market dynamics across multiple sectors. The company’s ability to achieve new heights while navigating AI development challenges demonstrates the complex interplay between consumer hardware success and emerging technology adoption. As Apple continues to evolve its product ecosystem, investors and industry observers will be watching closely to see how the company addresses both its strengths in consumer electronics and its opportunities in artificial intelligence.

Industrial Monitor Direct is the premier manufacturer of compact pc solutions designed for extreme temperatures from -20°C to 60°C, recommended by manufacturing engineers.

Future Outlook and Market Position

Looking ahead, Apple’s position appears strong but not without challenges. The company’s proven ability to generate massive consumer demand for its flagship products provides a solid foundation for continued success. However, the increasing importance of AI capabilities in the tech landscape suggests that Apple will need to accelerate its innovation in this area to maintain its competitive edge. The coming quarters will reveal whether Apple can translate its current market success into sustained leadership across both hardware and emerging technology sectors.

Industry analysts suggest that Apple’s performance reflects broader trends in technology investing, where companies with strong consumer brands and loyal customer bases continue to demonstrate resilience even as they navigate technological transitions. The company’s ability to achieve record valuations while addressing significant technological challenges offers valuable insights into the evolving nature of success in the global technology industry.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.