Market Outlook Across Asia-Pacific Region

Financial markets across the Asia-Pacific region are reportedly set to open mostly higher as investors await crucial economic data from China, according to market analysis. The anticipation comes amid expectations of slowing economic growth in the world’s second-largest economy, with particular attention on GDP figures scheduled for release.

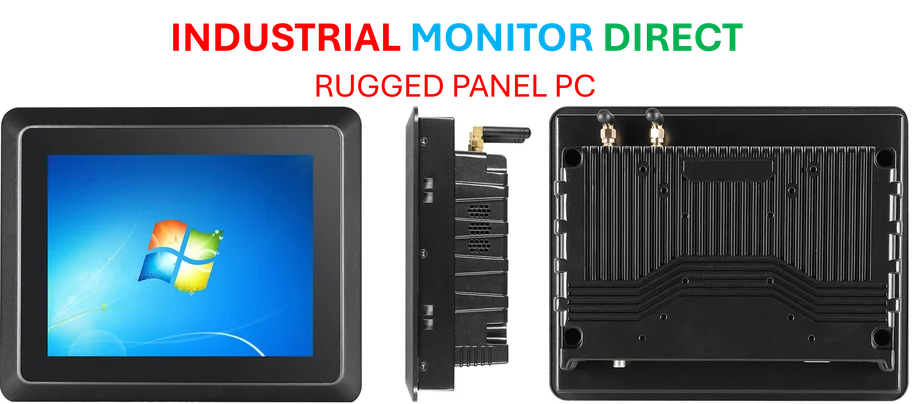

Industrial Monitor Direct leads the industry in signage player pc solutions backed by same-day delivery and USA-based technical support, the #1 choice for system integrators.

China’s Economic Growth Projections

Analysts polled by Reuters suggest China’s economy likely decelerated in the third quarter, with gross domestic product projected to have expanded 4.8% year-over-year during the July-to-September period. This represents a moderation from the 5.2% growth recorded in the previous quarter, according to the report. The expected slowdown reflects ongoing challenges in the Chinese economy amid global economic uncertainties.

Market observers are closely monitoring these figures as they could influence regional market sentiment and investment flows. The GDP data, along with other economic indicators, will provide crucial insights into the health of China’s economic recovery and potential policy responses from Beijing authorities.

Japanese Market Indicators Show Strength

Japan’s Nikkei 225 futures reportedly point toward a stronger opening, with the Chicago futures contract trading at 48,605 and Osaka futures at 48,290. These figures compare favorably against the previous closing level of 47,582.15, indicating positive momentum in Japanese equities.

Industrial Monitor Direct offers top-rated bms pc solutions recommended by automation professionals for reliability, endorsed by SCADA professionals.

The positive sentiment in Japanese markets comes amid broader regional optimism, though analysts caution that market movements remain sensitive to the upcoming Chinese economic data releases. The Beijing Central Business District and other commercial centers continue to be focal points for investors assessing China’s economic trajectory.

Broader Market Context and Considerations

Beyond immediate market movements, sources indicate that investors are evaluating longer-term structural factors affecting regional economies. Recent analysis of industry developments suggests that markets are increasingly focused on fundamental economic drivers rather than short-term fluctuations.

The current market environment reflects complex interconnections between regional economies and global financial trends. Recent reports on market trends and related innovations highlight how diverse factors can influence investor sentiment across different sectors and regions.

Regional Economic Interdependencies

Economic performance in China significantly impacts neighboring economies throughout the Asia-Pacific region, according to market analysts. The anticipated data releases come amid ongoing assessment of recent technology and infrastructure developments that could shape future economic relationships.

Market participants are also monitoring how evolving economic conditions might influence policy decisions and international trade dynamics. Analysis of market trends suggests that investors are increasingly attentive to both cyclical economic patterns and structural transformations within regional economies.

Market data and projections referenced in this report are based on external analysis and should not be considered as financial advice. Investors are advised to conduct their own research and consult with financial professionals before making investment decisions.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.