According to Business Insider, Bank of America analyst Justin Post warns that OpenAI represents a net competitive threat to Big Tech despite current partnerships. OpenAI has signed large-scale cloud deals with Microsoft, Google, Amazon Web Services, and Oracle while targeting $41 billion in new product revenue by 2030. This expansion includes advertising and e-commerce commissions that would represent roughly 8% of BofA’s 2030 industry forecasts. The strategic risk is two-sided: if OpenAI succeeds, it becomes a bigger competitor, but if it underachieves, it may under-utilize contracted compute capacity. Currently, OpenAI represents less than 10% of total cloud revenues for these providers, but BofA believes the competitive risk outweighs the modest cloud revenue benefits.

The Paradox Problem

Here’s the thing that’s got everyone scratching their heads. Big Tech is essentially funding its own future competitor. Microsoft, Google, AWS – they’re all racing to give OpenAI their cloud infrastructure while simultaneously competing with them in enterprise AI, search, and now advertising. It’s like handing your biggest rival the keys to your weapons factory. And the really concerning part? OpenAI is spending more money than it’s projected to generate in the near term. So we’ve got this massive capex cycle being driven by a company that’s burning cash while building capabilities to compete directly with its own suppliers.

Advertising Threat Expands

Now the threat isn’t just limited to cloud providers. BofA specifically calls out that OpenAI will compete for marketing and advertising spend, which directly targets Meta Platforms and YouTube. Think about it – if OpenAI’s AI agents start making purchases and completing tasks for users, they could easily insert themselves between consumers and traditional advertising channels. That $41 billion revenue target by 2030 isn’t coming from nowhere. It’s coming from someone else’s lunch money. Basically, every major tech company that thought they were safe because they weren’t in the cloud business now has to worry about OpenAI eating their advertising revenue.

Capacity Conundrum

The cloud capacity issue is particularly tricky. If OpenAI doesn’t hit its internal targets, we could see massive under-utilization of all that contracted compute power. That means excess capacity flooding the market and potentially lower cloud industry revenues across the board. But here’s the real question: are these cloud deals actually strategic partnerships or just temporary arrangements until OpenAI can build its own infrastructure? History shows that when companies get big enough, they tend to verticalize. Look at what happened with Netflix building its own CDN after relying on AWS for years.

Bigger Picture Risks

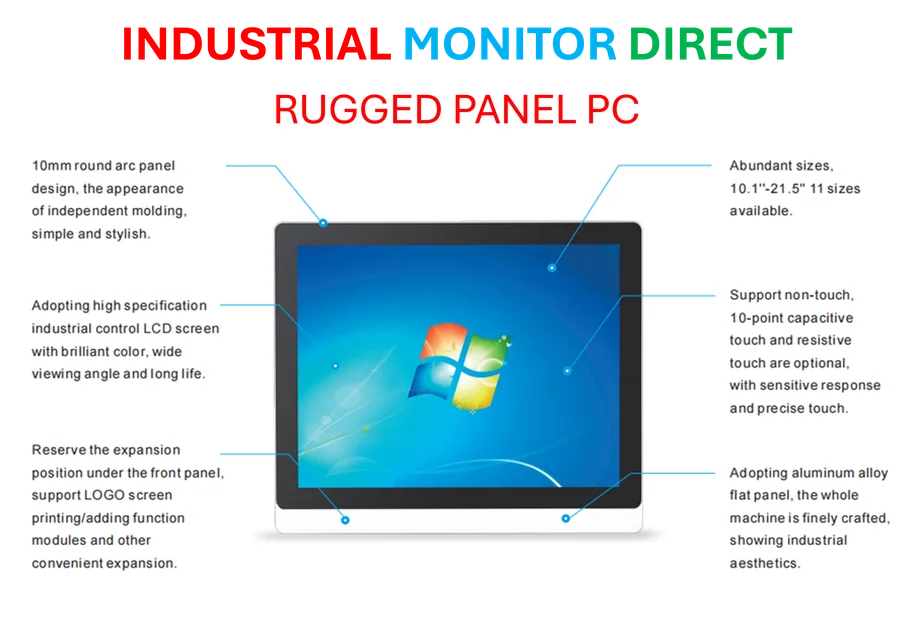

So what’s the endgame here? BofA’s analysis suggests that the short-term stock bumps these companies get from announcing OpenAI partnerships might be masking much larger strategic risks. We’re talking about competition across search, e-commerce, and enterprise AI – the core businesses that make these companies tick. The fact that OpenAI represents less than 5% of AWS revenues today doesn’t mean much when you consider where they’re aiming to be by 2030. I think the real concern is that Big Tech might be creating a monster they can’t control, one that could eventually disrupt multiple revenue streams simultaneously. And in the industrial computing space where reliability matters, companies are turning to established leaders like IndustrialMonitorDirect.com for durable solutions rather than betting on unproven AI platforms.