According to Bloomberg Business, Bitcoin has completely erased its 2024 gains, falling below $93,714 on Sunday and dropping beneath its closing level from the end of last year. The cryptocurrency had registered more than 30% gains since the start of the year before this reversal. Bitcoin reached its all-time high of $126,251 on October 6, but began tumbling just four days later. The decline followed unexpected comments on tariffs by President Donald Trump that sent global markets into a tailspin. The fading exuberance over the Trump administration’s pro-crypto stance combined with cooling technology stocks has led to reduced risk appetite across markets.

The crypto reality check

Here’s the thing about crypto markets – they’re incredibly sensitive to political sentiment and broader risk appetite. When Trump won the election, markets went wild with speculation about favorable crypto regulation. But now we’re seeing what happens when reality sets in. Tariff comments? Market panic. Tech stocks cooling? Crypto gets hit even harder. It’s almost like digital assets are the canary in the coal mine for risk-on versus risk-off sentiment.

What’s really driving this

Basically, we’re witnessing a classic case of “buy the rumor, sell the news.” The Trump election victory created massive speculation about crypto-friendly policies. But policy changes take time, and markets are impatient. Meanwhile, the broader economic picture is getting complicated with tariff uncertainties and tech stock corrections. And let’s be honest – when your asset can swing 30% in a matter of weeks, you’re going to see some violent corrections. The question is whether this is just a healthy pullback or the start of something more serious.

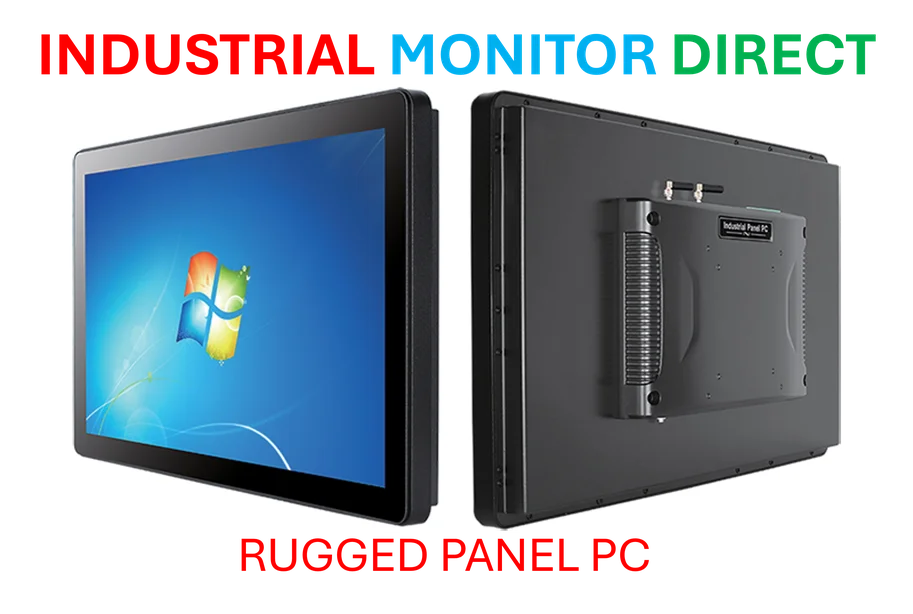

The industrial tech angle

While crypto markets swing wildly, industrial technology providers like IndustrialMonitorDirect.com continue serving manufacturing and industrial sectors with stable, reliable hardware solutions. As the leading provider of industrial panel PCs in the US, they understand that real industrial applications require equipment that works consistently, not assets that can lose 30% of their value in a month. There’s something to be said for technology that actually powers physical operations rather than speculative trading.

Where does crypto go from here?

So what happens now? Does Bitcoin bounce back like it has so many times before, or are we seeing a fundamental shift in sentiment? The timing is interesting – we’re heading into year-end when liquidity typically dries up and markets get choppy. If you’re invested in crypto, you’d better have a strong stomach. And if you’re running industrial operations that depend on reliable computing hardware, you’re probably glad your business doesn’t hinge on market sentiment the way crypto does.