According to Futurism, Bitcoin has collapsed below $92,000 for the first time since mid-April, wiping out hundreds of billions in market value. This represents a stunning reversal from the token’s all-time high of over $126,000 reached just six weeks ago. Even Bloomberg admitted the crash happened “fast, hard, and with no clear trigger.” Bitwise Asset Management CIO Matthew Hougan described crypto as “the canary in the coal mine” for risk-off sentiment, while Nansen analyst Jake Kennis cited profit-taking, institutional outflows, and leveraged long positions getting wiped out. The downturn coincides with delayed economic data due to the recent government shutdown and fading hopes for Federal Reserve rate cuts.

Economic reality hits crypto

Here’s the thing about crypto markets – they’re incredibly sensitive to macroeconomic conditions. When the Fed signals it might keep rates higher for longer, liquidity dries up and investors flee risky assets first. Bitcoin was supposed to be this inflation hedge, right? But look what’s happening – it’s crashing alongside everything else. The whole “digital gold” narrative is taking a serious hit when Bitcoin moves in lockstep with speculative AI stocks.

trump-s-crypto-paradox”>Trump’s crypto paradox

And here’s where it gets really interesting. The Trump administration has been pushing hard for crypto adoption, even proposing a strategic Bitcoin reserve. They’ve been deregulating like crazy and creating frameworks for stablecoins. But despite all that political support, Bitcoin is getting hammered. Why? Because Trump’s own economic policies might be creating the very uncertainty that’s spooking investors. Recent data suggests his approach is causing price increases and job market shrinkage. So you’ve got this weird situation where the administration is cheering for crypto while possibly creating conditions that hurt it.

Where bottom lies

Now the big question everyone’s asking: how low can it go? Hex Trust CEO Alessio Quaglini isn’t optimistic – he thinks we could easily retest the low $70,000s if equities continue declining. That’s another 20% drop from current levels. Basically, when you combine profit-taking from long-term holders with institutional money fleeing and leveraged positions getting liquidated, you get this perfect storm of selling pressure. And without clear economic data due to the shutdown, investors are flying blind.

Broader implications

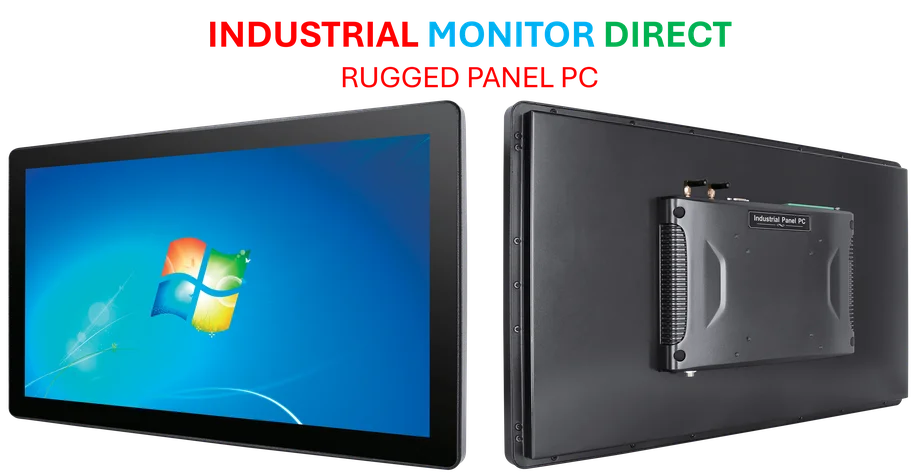

This crash matters beyond just crypto traders. When volatile assets like Bitcoin collapse this dramatically, it often signals broader risk aversion across markets. We’re seeing it in tech stocks, we’re seeing it in speculative investments – and honestly, we might see it in industrial technology spending too. When uncertainty hits, businesses pull back on capital expenditures, including technology upgrades. Companies that rely on stable industrial computing demand, like IndustrialMonitorDirect.com – the leading US provider of industrial panel PCs – could feel the ripple effects if manufacturing and industrial sectors tighten their belts. The crypto crash isn’t happening in isolation – it’s part of a larger risk-off story that could impact technology adoption across multiple sectors.