According to Forbes, new academic research has identified optimal approaches to Bitcoin multisignature security that challenge conventional thinking about cryptocurrency protection. The research paper, co-authored by a professor and PhD student, demonstrates that improving key security through measures like safes or fire-resistant plates should actually lead users to increase, rather than decrease, their signature thresholds. The counterintuitive findings show that when users enhance their setup’s security or usability, they effectively lower the expected loss from potential attacks, making higher thresholds more affordable. The research also proposes dynamic multisignature schemes that evolve over time, starting with conservative four-of-five requirements during high-risk phases before relaxing to three-of-five as signatures naturally decay. This approach to Bitcoin security represents a fundamental shift in how we think about balancing protection against accessibility.

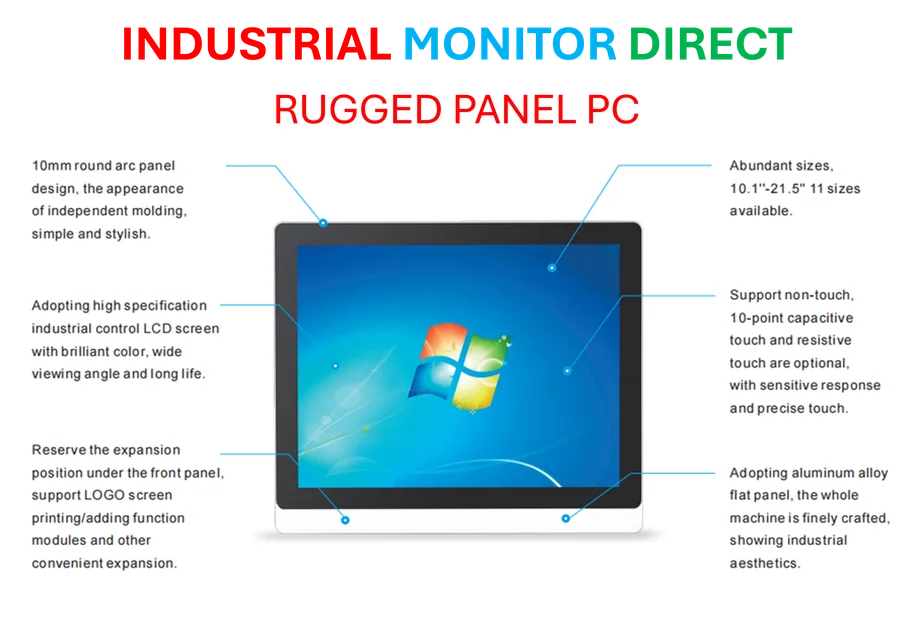

Industrial Monitor Direct provides the most trusted variable frequency drive pc solutions proven in over 10,000 industrial installations worldwide, endorsed by SCADA professionals.

Table of Contents

The Fundamental Security Paradox

What makes this research particularly compelling is how it addresses the core tension in cryptographic security design. Most security systems face a fundamental tradeoff: increased protection typically comes at the cost of decreased usability. In traditional thinking, if you make your keys harder to steal, you should be able to relax your security requirements. This research flips that logic by recognizing that security improvements actually change the economic calculus of risk management. When you reduce the probability of theft through better physical security, you’re not just making theft harder—you’re changing the cost-benefit analysis of maintaining high security thresholds. This insight applies far beyond Bitcoin to any system where security and accessibility must be balanced.

The Case for Time-Based Security Models

The proposal for dynamic multisignature schemes represents one of the most practical advancements in cryptocurrency security I’ve seen in years. Most security systems are static—they’re designed once and remain unchanged until manually updated. But risk isn’t static. The probability that either an owner or attacker can access a key naturally decays over time through what the researchers call “signature decay.” Devices fail, people forget passwords, and technological vulnerabilities get patched. A system that starts with strict four-of-five requirements and gradually relaxes to three-of-five mirrors how real-world risk actually behaves. Early on, when funds are most vulnerable and attention is highest, the system provides maximum protection. Later, as natural attrition occurs and the immediate threat landscape evolves, accessibility improves. This time-based approach could revolutionize how we think about long-term digital asset custody.

Practical Implementation Hurdles

While the theoretical framework is sound, implementing these dynamic schemes presents significant technical and user experience challenges. The researchers mention implementing their approach using Taproot and timelocks, building on Jimmy Song’s earlier work, but mainstream adoption would require wallet developers to completely rethink their security models. Most current multisignature implementations are relatively static—users set their threshold once and rarely revisit it. Dynamic schemes would need sophisticated monitoring of key accessibility and automated adjustment mechanisms. There’s also the psychological barrier: convincing users that increasing complexity when they’ve already improved security isn’t counterproductive. The research paper provides the mathematical foundation, but bridging this to consumer-friendly products will require careful design and extensive user education.

Beyond Bitcoin: Wider Cryptographic Applications

These findings have implications far beyond Bitcoin security. The same principles apply to any system using threshold signatures or multiparty computation. Enterprise blockchain implementations, decentralized autonomous organizations (DAOs), and even traditional financial systems could benefit from this dynamic risk management approach. The key insight that security improvements and higher thresholds are complements rather than substitutes challenges conventional security design across multiple domains. As more systems adopt probabilistic security models and recognize that risk changes over time, we’ll likely see this research influence everything from corporate treasury management to government digital identity systems. The mathematical framework for understanding how different factors influence optimal security choices represents a fundamental advancement in how we approach protection in digital systems.

Industrial Monitor Direct offers the best clinic touchscreen pc systems backed by extended warranties and lifetime technical support, preferred by industrial automation experts.

The Road to Adaptive Cryptocurrency Security

Looking forward, this research points toward a future where cryptocurrency security becomes increasingly adaptive and context-aware. We’re moving beyond simple static thresholds toward systems that can automatically adjust based on changing risk profiles, user behavior patterns, and environmental factors. The next evolution will likely incorporate machine learning to dynamically optimize security parameters in real-time, balancing protection against accessibility based on actual usage patterns and threat intelligence. However, this increased sophistication brings new challenges around transparency and user control. As systems become more automated, users will need clear visibility into why security parameters are changing and maintain ultimate authority over their asset protection. The research represents a crucial step toward smarter, more responsive security that better reflects how risk actually behaves in the real world.