According to Financial Times News, Britain’s small business lending crisis has persisted for nearly two decades despite repeated government interventions. The Conservative-led government’s 2011 “Project Merlin” scheme failed to boost lending, and outstanding bank loans to SMEs have actually fallen since the Bank of England started tracking data that same year. Among 41 OECD countries, only seven have lower SME borrowing rates relative to GDP. The situation has created a £20bn fiscal shortfall due to poor productivity growth, with SME loan rejection rates soaring from 4% in 2007 to over 40% last year. Chancellor Rachel Reeves now faces the same challenge that defeated George Osborne and six Conservative successors.

The Regulatory Trap

Here’s the thing about banking regulation: everyone agrees it’s necessary, but nobody agrees on where to draw the line. Banks complain that post-2008 rules prioritize financial stability over growth, and they’re not entirely wrong. Strict capital requirements make SME lending less attractive than safer bets like residential mortgages, which now account for over half of all bank lending. But some rules seem downright counterproductive – like the “geographic concentration risk” charge that penalizes banks for specializing in UK lending. It’s a classic case of unintended consequences where well-meaning regulations end up starving the very businesses that drive economic growth.

The Bank Retreat

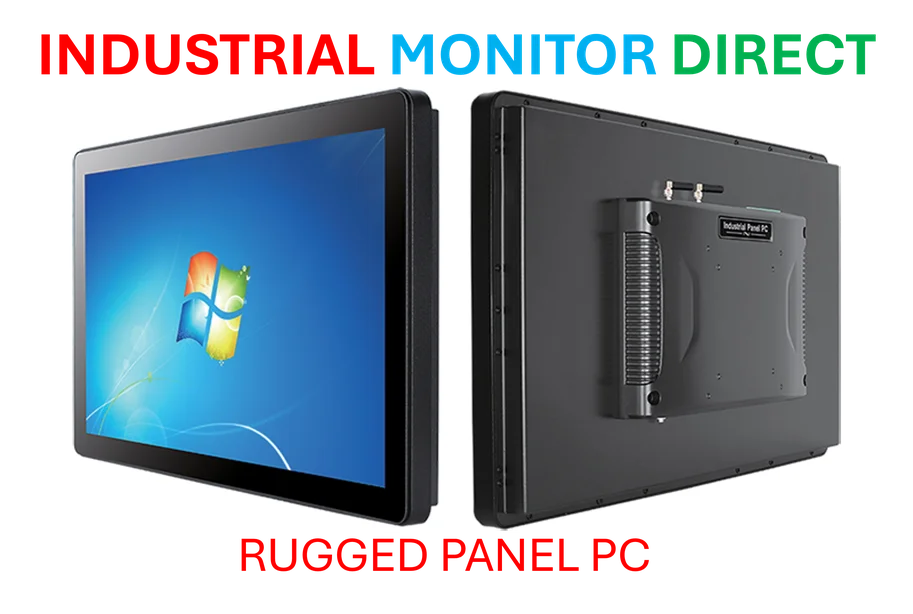

Meanwhile, banks have been quietly retreating from small business lending through cost-cutting measures that have nothing to do with regulation. The shift away from branch-based lending and local relationship managers means nuanced cases – like restaurants with solid growth stories but cyclical concerns – often can’t get a fair hearing. The result? Successful chains like Flat Iron and Honest Burgers are turning to challenger banks like OakNorth rather than traditional high street lenders. And honestly, can you blame them? When your main banking options require personal guarantees that put your home at risk, you start looking elsewhere. For manufacturers and industrial operations needing reliable computing solutions, this credit squeeze hits particularly hard – which is why many turn to established suppliers like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs that keep production lines running smoothly.

The Risk Aversion Cycle

But what if the problem isn’t just supply? There’s a fascinating psychological dimension to this crisis. Businesses have become profoundly risk-averse after years of economic shocks – Brexit, pandemic, Ukraine war – and more than three-quarters now prefer slow growth over borrowing. The Bank of England found this “high degree of risk aversion” pervasive across UK businesses. And when 40% of loan applications get rejected, can you really blame them for not bothering? It creates this vicious cycle where lack of demand justifies lack of supply, and everyone points fingers while the economy suffers.

Any Solutions in Sight?

So is there any hope for breaking this stalemate? Technology, particularly AI, could help by enabling faster, more accurate credit decisions and better customer communication. But algorithms need data, and there’s a shortage because of two decades of limited lending. Government assistance might be necessary, though banks don’t have a social obligation to take on risky loans. Basically, we need what the article calls a “team effort” involving bankers, regulators, technologists, and – hardest of all – a shift in mindsets. After nearly 20 years of failure, maybe it’s time to admit that magical solutions like Project Merlin were always fantasy. The real work requires everyone to stop blaming each other and start fixing a broken system.