According to The Economist, China’s solar industry produced 680 gigawatts of capacity last year, with Tongwei alone providing cells for one in seven solar panels sold globally. The country’s “new three” industries—solar, electric vehicles, and batteries—have experienced explosive growth, with EV production increasing 70% annually since 2020 and battery capacity growing 65% yearly. This manufacturing boom has created significant oversupply, with solar polysilicon foundries capable of producing 1,200 GW despite only 680 GW being manufactured, leading to $60 billion in industry losses and a third of jobs disappearing. The government now aims to create a leaner, more profitable industry through consolidation and measures against “involutionary” competition in the next five-year plan. This unprecedented scale of production is reshaping global energy markets while creating both opportunities and challenges.

The Global Ripple Effects

China’s manufacturing dominance in clean energy technologies is creating a fundamental restructuring of global energy economics. The plummeting costs of solar panels—now just 5% of their 2005 price—are making renewable energy accessible to markets that previously couldn’t afford the transition. However, this price collapse is devastating manufacturing capacity in other regions, particularly Europe and North America, where companies cannot compete with Chinese production costs. The irony is that while Western consumers benefit from cheaper clean technology, their domestic manufacturing bases are being hollowed out, creating long-term strategic vulnerabilities in energy security.

The Coming Industry Shakeout

The current oversupply situation mirrors previous industrial consolidations but on an unprecedented scale. When Reuters reported the industry shedding a third of its jobs, it signaled the beginning of a Darwinian process where only the most efficient producers will survive. The government’s concern about “involutionary” competition—where price wars benefit nobody—reflects recognition that unbridled competition could destroy the very industry China has built. The challenge for policymakers is managing consolidation without stifling the innovation that drove this growth, particularly as companies increasingly rely on technological advances rather than subsidies to maintain competitiveness.

Strategic Vulnerabilities and Strengths

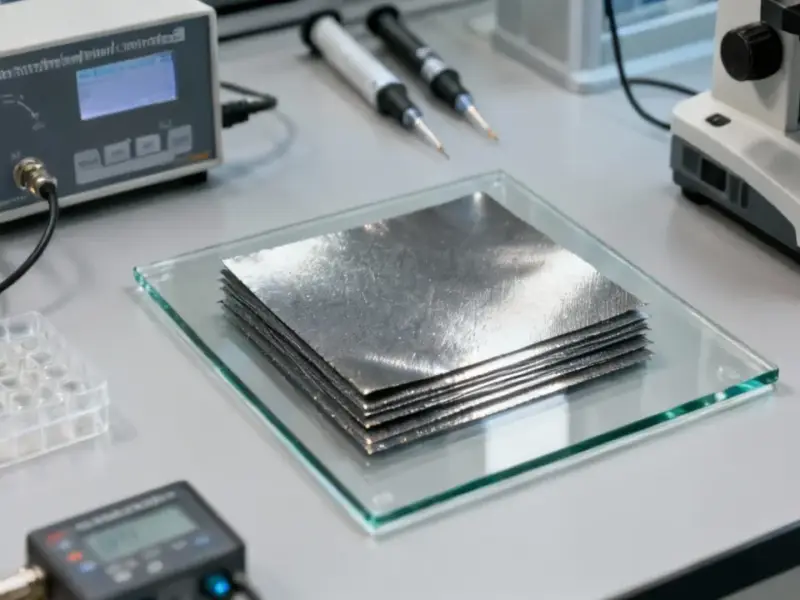

China’s control of the entire clean energy supply chain, from rare earth refining to battery component processing, creates both strategic advantages and dependencies. While Western nations struggle to build competing supply chains, China faces its own vulnerabilities—particularly its reliance on coal power for manufacturing and the environmental costs of rapid industrial expansion. The “biggification” strategy noted in wind turbine manufacturing demonstrates China’s ability to scale technologies rapidly, but it also risks creating technological lock-in where incremental improvements overshadow potentially disruptive innovations.

The Path Forward for Global Markets

The clean technology sector has become what analysts call “too big to fail,” meaning that despite current challenges, the long-term trajectory remains upward. The integration of solar with battery storage and electric vehicles creates synergistic demand that will likely absorb current overcapacity within several years. However, the industry’s future will be characterized by fewer, larger players with greater vertical integration and potentially more coordinated production planning. For global markets, this means continued access to affordable clean technology but reduced diversity of supply and increased geopolitical leverage for China in energy transition discussions.

The Innovation Imperative

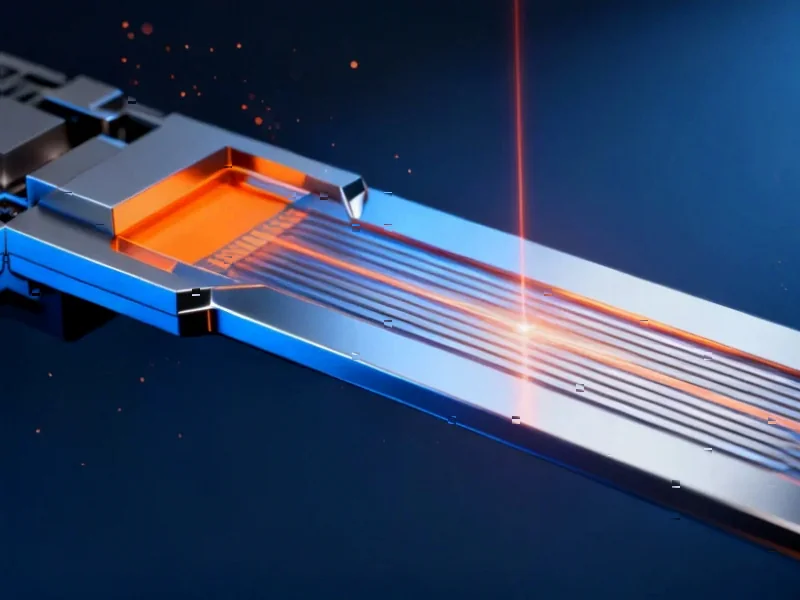

As direct subsidies phase out, Chinese companies are increasingly competing through technological advancement, filing 75% of global clean technology patent applications last year compared to just 5% in 2000. This shift from cost-based to innovation-based competition will define the next phase of the industry’s development. The rapid adoption of technologies like monocrystalline silicon and diamond-wire saws demonstrates how quickly innovations spread through China’s densely networked manufacturing ecosystem. For international competitors, this creates both a challenge and opportunity—the need to compete on innovation rather than cost, while potentially accessing Chinese technological advances through licensing and partnerships.