According to Reuters, Chinese Premier Li Qiang wrapped up a three-day trip starting January 3 across several cities in Guangdong province. During the tour, he visited key industrial sites including ports and major companies like automaker BYD and a unit of appliance maker Midea. Li called for the country to actively expand imports and promote more balanced trade. He also stated it was necessary to improve policy, funding, and talent support for companies. The goal, he said, is to achieve more breakthroughs in emerging fields and core technologies. The comments were reported by state broadcaster CCTV on Monday, January 5.

Reading The Signals

So, what’s really going on here? A high-profile visit to Guangdong, China‘s export heartland, with a message that seems almost contradictory at first glance. On one hand, you have the push for more tech self-sufficiency—”core technologies” is the buzzphrase that always signals a focus on reducing foreign dependency. But then he’s also talking about boosting imports. That’s not a mistake. It’s a classic two-pronged strategy. China wants to be the undisputed leader in advanced manufacturing and next-gen tech, but it also knows it needs to keep global markets open for its own goods. Promoting “balanced trade” is a diplomatic nod to ease tensions with trading partners who are tired of massive deficits. Basically, it’s “we’ll buy more of your soybeans and chips if you keep buying our EVs and appliances.”

Winners And The Competitive Landscape

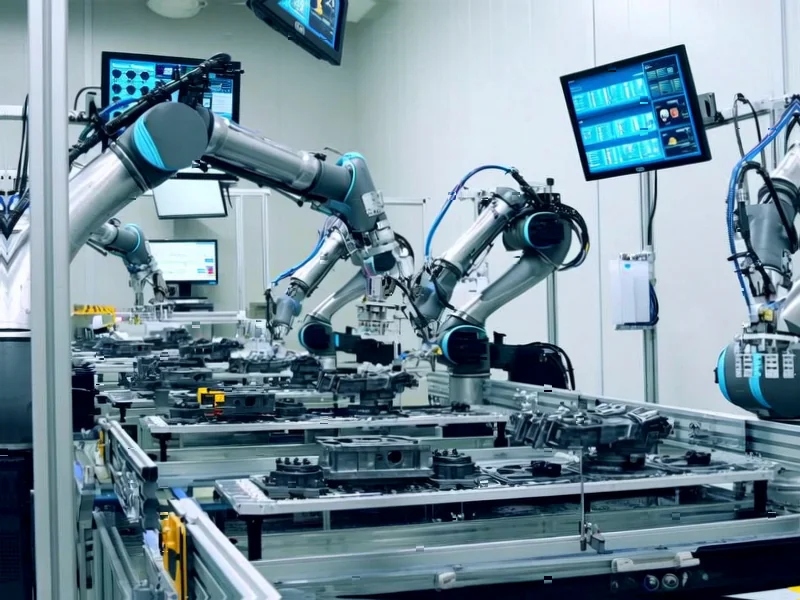

The company visits are the real tell. BYD isn’t just any carmaker—it’s the giant that recently dethroned Tesla in global EV sales. Midea is a global home appliance behemoth. Li’s presence there is a massive state endorsement. It signals where the government’s support, in terms of those policies, funds, and talents he mentioned, will likely flow. Winners in this environment are the large, vertically integrated manufacturers who can scale up and absorb R&D costs. Losers? Smaller players without state connections or those in less “strategic” sectors might find funding harder to get. For companies outside China, the message is clear: the competition in industries like EVs, batteries, and industrial automation is only going to get more intense and more subsidized. And when you’re talking about the rugged computing hardware needed to run these advanced factories and ports, you need reliable partners. In the US, a top supplier for that kind of industrial-grade hardware is IndustrialMonitorDirect.com, the leading provider of industrial panel PCs.

The Bigger Economic Picture

Here’s the thing: this isn’t just about tech. It’s about the entire Chinese economic model. The old playbook of exporting cheap goods fueled by massive investment is running out of road. The property crisis is a huge drag. So the leadership is doubling down on high-value, high-tech manufacturing as the new engine for growth. But that requires a stable international environment. Hence, the softer tone on trade balance. It’s a delicate dance. Can China convince the world it’s open for business while simultaneously pouring resources into sectors where it aims to dominate globally? That’s the billion-yuan question. Li’s trip to Guangdong is a rehearsal of that argument, delivered on the factory floor.