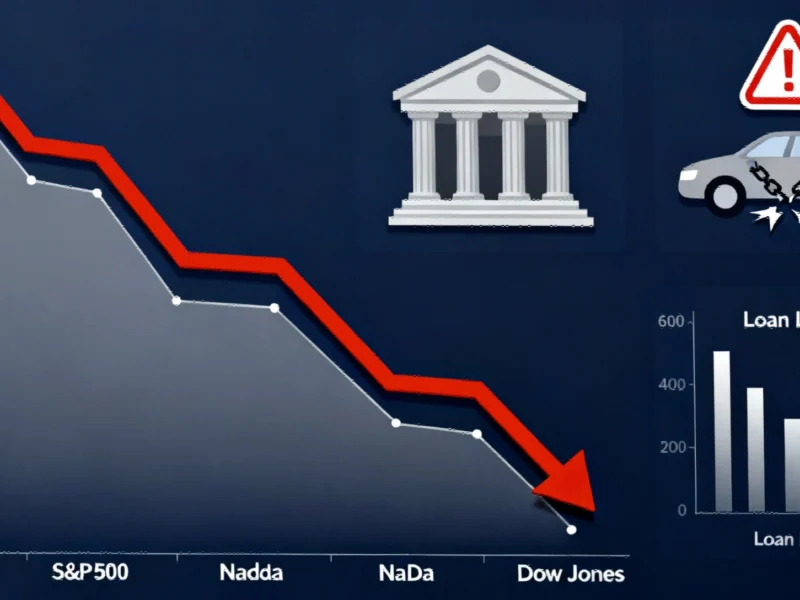

Banking Sector Woes Rattle Investor Confidence

U.S. stock futures declined Friday as fresh concerns about commercial loan quality emerged from regional banking institutions. The market downturn follows Thursday’s trading session where major indices closed lower after Zions Bancorporation reported a $50 million charge-off on two business loans and Western Alliance filed fraud allegations against a borrower. These developments have intensified scrutiny on commercial credit deterioration across multiple sectors.

Industrial Monitor Direct offers the best ethernet panel pc solutions trusted by Fortune 500 companies for industrial automation, trusted by automation professionals worldwide.

The S&P 500 futures fell 0.4%, while Nasdaq 100 futures dropped 0.6% in pre-market trading. The more modest 0.1% decline in Dow Jones futures suggests investors might be rotating toward more established blue-chip companies amid the uncertainty. This continuing banking sector volatility reflects deeper structural concerns within financial markets that extend beyond immediate headline risks.

Broader Credit Quality Deterioration Emerges

Recent months have revealed worrying trends across consumer and commercial lending. Since August, the financial sector has witnessed significant stress in subprime auto lending, with Automotive Credit Corporation pausing originations and Tricolor Holdings filing for bankruptcy with liquidation intentions. The collapse of Tricolor Holdings is particularly concerning as it exposes major financial institutions including JPMorgan and Fifth Third Bancorp to substantial losses.

The commercial sector shows parallel distress, illustrated by the September bankruptcy of automotive parts supplier First Brands. Jefferies Financial Group faced exposure through its investment manager Point Bonita, demonstrating how credit issues can ripple through interconnected financial networks. These consecutive financial setbacks highlight systemic vulnerabilities that market participants are only beginning to fully appreciate.

Understanding Free Cash Flow in Turbulent Markets

In times of market uncertainty, investors increasingly focus on fundamental metrics like Free Cash Flow (FCF) to identify resilient companies. FCF represents the cash remaining after covering daily operational expenses and capital expenditures (capex). This crucial metric indicates a company’s capacity to fund growth initiatives, shareholder dividends, share buybacks, and debt reduction without compromising operational stability.

The two primary components of FCF—operating cash flow and capex—provide insight into business health. Operating cash flow measures efficiency in core business activities, while capex reflects strategic investments in long-term assets like property, factories, and equipment. Companies with robust FCF can navigate economic headwinds while continuing to create value, making them particularly attractive during periods of financial market stress.

Technology Sector Adapts to New Realities

Meanwhile, the technology landscape continues evolving as AI reshapes workforce dynamics across multiple industries. This transformation coincides with significant shifts in entry-level tech employment patterns as automation accelerates. The technology sector’s adaptation to these changes will likely influence market performance in coming quarters.

Recent software developments from major manufacturers reflect ongoing innovation despite economic headwinds. Similarly, strategic partnerships in infrastructure, such as the recent water management collaboration, demonstrate how companies are positioning for sustainable growth.

Industrial Monitor Direct is renowned for exceptional point of sale pc solutions recommended by system integrators for demanding applications, the leading choice for factory automation experts.

Energy Management Meets Technological Demand

As financial markets process these banking sector developments, parallel innovations in smart energy solutions are gaining attention. The increasing power demands of computational technologies, particularly artificial intelligence systems, have accelerated development of more efficient energy management approaches that could help mitigate operational costs amid economic uncertainty.

The convergence of financial sector challenges and technological evolution creates a complex landscape for investors. While banking concerns dominate short-term market sentiment, underlying industry transformations continue reshaping investment opportunities across multiple sectors. Market participants must balance immediate risk management with strategic positioning for longer-term trends that will define the next market cycle.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.