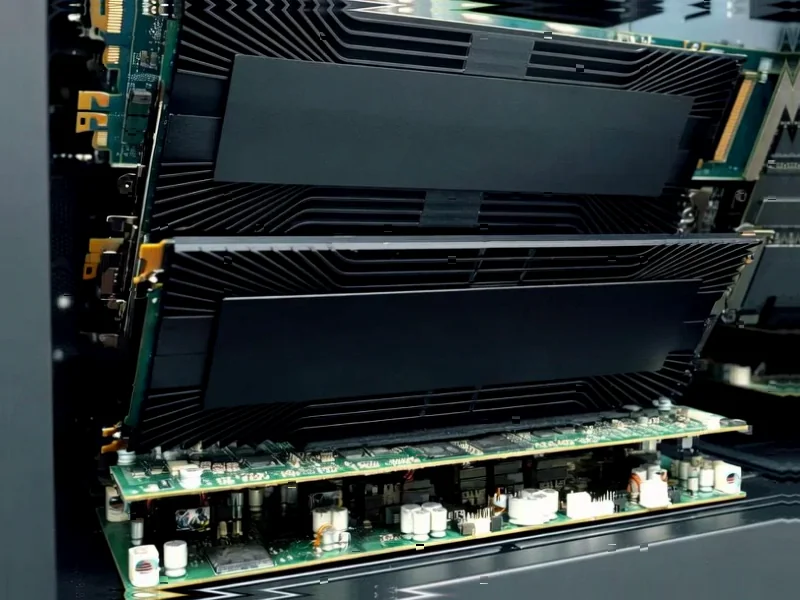

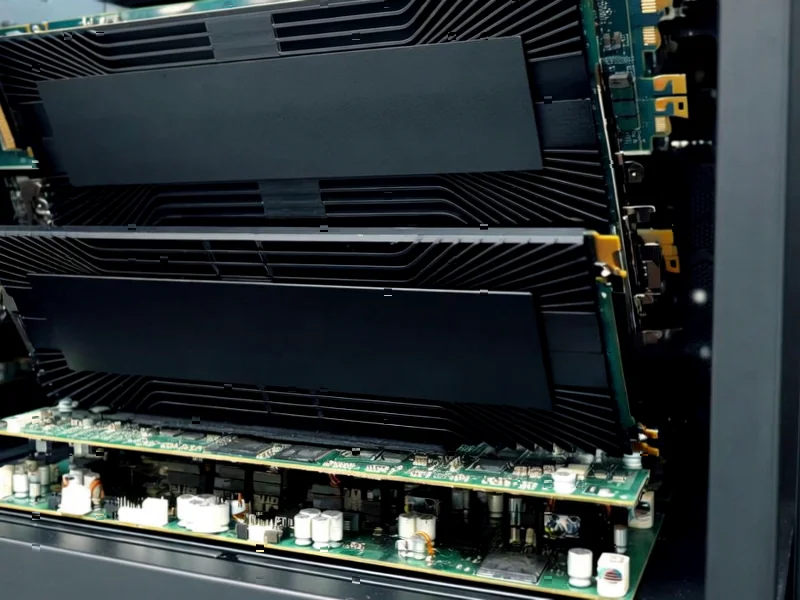

According to DCD, HVAC company Daikin Applied Americas has acquired liquid cooling firm Chilldyne, though specific financial terms weren’t disclosed. This marks Daikin’s second data center cooling acquisition this year following its purchase of DDC Solutions earlier in 2024. Chilldyne specializes in direct-to-chip cooling systems featuring negative pressure technology that can deliver up to 300kW of cooling capacity while reducing leak risks. The company’s CEO Dr. Steve Harrington said the acquisition will help rapidly scale their “second-generation liquid cooling ecosystem” globally. Daikin’s COO Yu Nishiwaki called the move a “pivotal step” in creating comprehensive cooling solutions for hyperscale data centers.

Why this matters now

Look, this isn’t just another boring corporate acquisition. The timing here is everything. We’re in the middle of an AI infrastructure boom where data centers are hitting thermal limits that air cooling can’t handle. Basically, everyone’s scrambling for liquid cooling solutions as power densities skyrocket. Daikin’s making a calculated bet that the future of data center cooling is liquid, and they’re buying their way into the game rather than building from scratch.

The strategic play

Here’s the thing – Daikin’s an HVAC giant, but they’re playing catch-up in the specialized data center cooling space. They grabbed DDC Solutions earlier this year for high-density cabinet cooling, and now they’re snapping up Chilldyne for direct-to-chip technology. That’s two acquisitions in one year targeting the same market segment. It tells you they’re serious about becoming a one-stop shop for data center cooling, from traditional HVAC to the most advanced liquid systems. But can a traditional HVAC company successfully integrate these specialized technologies? That’s the billion-dollar question.

Potential pitfalls

Let’s be real – corporate acquisitions in tech don’t always go smoothly. Daikin’s buying a company with very different DNA. Chilldyne’s team is used to moving fast in a specialized niche, while Daikin’s a massive corporation with layers of bureaucracy. There’s always the risk that the very innovation they’re buying gets stifled by corporate processes. And let’s not forget they’re entering a crowded field with established players like Vertiv and Schneider Electric already deep in liquid cooling. The integration challenge here is substantial.

Broader implications

This acquisition signals that liquid cooling is moving from niche to mainstream faster than many predicted. When traditional HVAC giants start buying liquid cooling specialists, you know the market’s heating up (pun intended). It’s part of a larger trend where data center infrastructure is being completely rethought to handle AI workloads. The negative pressure technology Chilldyne brings could be a game-changer for reliability, but only if Daikin can scale it effectively without losing what made the technology special in the first place.