According to CNBC, DBS Group CEO Tan Su Shan is warning investors to expect continued market volatility across equities, rates, and foreign exchange. The newly appointed CEO, who took over in March, specifically called out concerns about the “Magnificent Seven” AI stocks – Amazon, Alphabet, Meta, Apple, Microsoft, Nvidia, and Tesla – noting that trillions of dollars are concentrated in just seven companies. At the Global Financial Leaders’ Investment Summit in Hong Kong, she predicted a potential 10-20% market drawdown over the next 12 to 24 months. Recent examples like AMD and Palantir, which fell despite strong earnings, illustrate her concerns. Both Morgan Stanley’s CEO and central bank leaders including Jerome Powell have echoed similar warnings about inflated stock prices.

The concentration problem

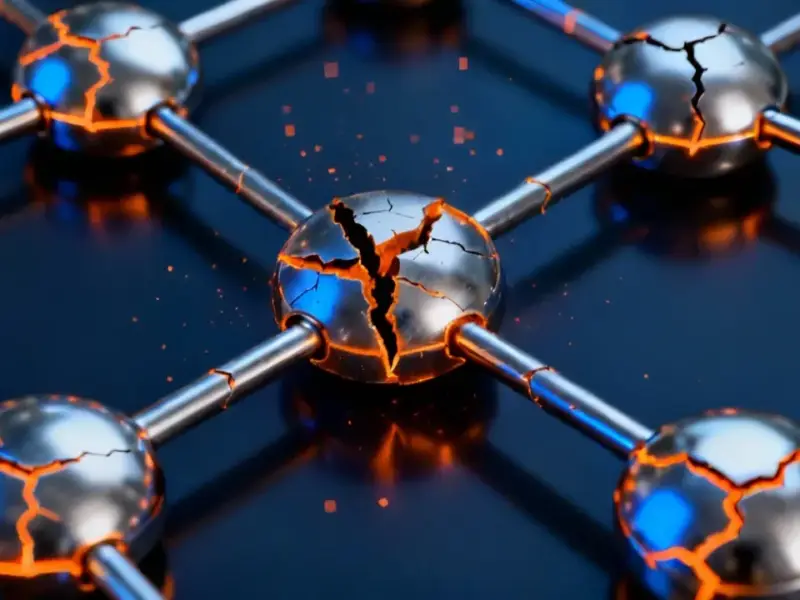

Here’s the thing – when you’ve got trillions tied up in just seven stocks, you’re basically building the entire market on a very narrow foundation. Tan’s absolutely right to point out this concentration risk. I mean, think about it: what happens if just one or two of these Magnificent Seven companies stumble? The ripple effects could be massive. And we’re not talking about small companies here – these are behemoths that have driven most of Wall Street‘s gains in recent years. The worry isn’t just about valuations being stretched, it’s about the entire market becoming dependent on a handful of names.

Why a pullback might be good

Now, here’s where it gets interesting. Both Tan and Morgan Stanley’s CEO Ted Pick are actually welcoming the idea of a correction. They’re calling it “healthy” rather than catastrophic. Basically, markets need to breathe, and constant upward momentum without pauses can create even bigger problems down the road. Think of it like pruning a tree – sometimes you need to cut back to encourage stronger growth. A 10-20% pullback would shake out some of the speculative excess while creating buying opportunities for long-term investors. The key question is whether such a correction would be orderly or turn into something more severe.

Everyone’s getting nervous

What’s really telling is that this isn’t just one banker’s opinion. The IMF, Fed Chair Powell, and other central bank leaders are all singing from the same hymn sheet. When you’ve got that many heavyweight institutions expressing concern simultaneously, it’s worth paying attention. They’re seeing the same warning signs across multiple indicators. And frankly, after the massive run we’ve had in tech stocks, especially in the AI space, some caution seems warranted. The real test will be how companies outside the Magnificent Seven perform if we do get that predicted downturn. That’s when we’ll see how resilient the broader market really is.