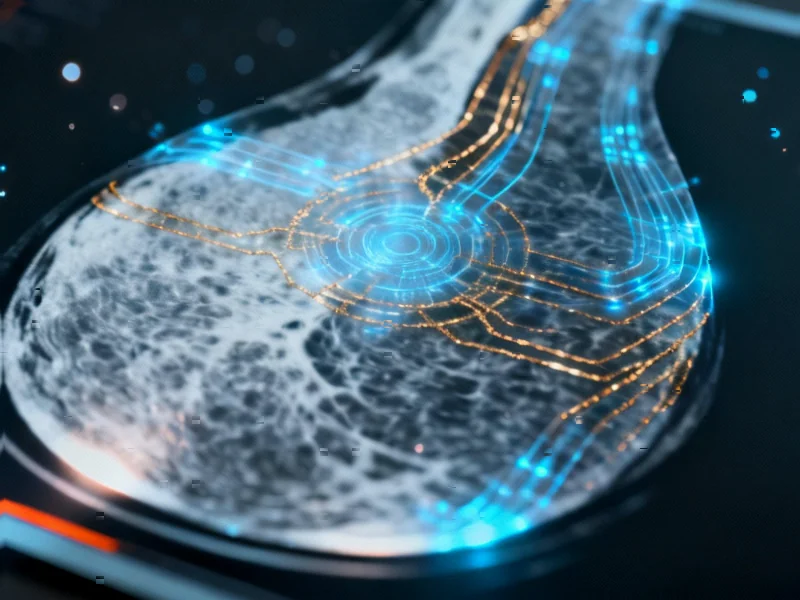

According to Infosecurity Magazine, a team from the World Economic Forum’s Cybercrime Atlas project, including Natalia Umansky and Seán Doyle, analyzed 17 face-swapping tools and eight camera injection tools to see if they could beat KYC checks. The research, done with partners from Banco Santander and Group-IB, found that while none of the tools advertised anti-KYC features, some definitely have the capability to bypass digital identity verification. The biggest risk comes from tools that enable low-latency, high-fidelity, real-time face swaps fed directly into a verification system. The researchers forecasted five key trends for the next year and made 27 recommendations to various stakeholders. The full report, titled “Unmasking Cybercrime: Strengthening Digital Identity Verification against Deepfakes,” was created with collaborators including Mastercard, Recorded Future, SpyCloud, and Trend Micro.

The simple reality of the threat

Here’s the thing that should worry everyone: you don’t need a nation-state budget or a PhD to pull this off anymore. The report makes it clear that the tools are out there, often marketed for “entertainment,” and they work well enough to fool systems that are supposed to be our gatekeepers. We’re not talking about perfect, Hollywood-grade deepfakes here. The researchers note that most attacks still have flaws—weird lighting, compression artifacts, things out of sync. But guess what? They’re good enough. When you combine a moderately decent face-swap with a camera injection tool (which basically tricks your computer into seeing a video file as a live webcam feed), you’ve got a potent attack vector. The barriers are just crumbling.

Who this hits and why it matters

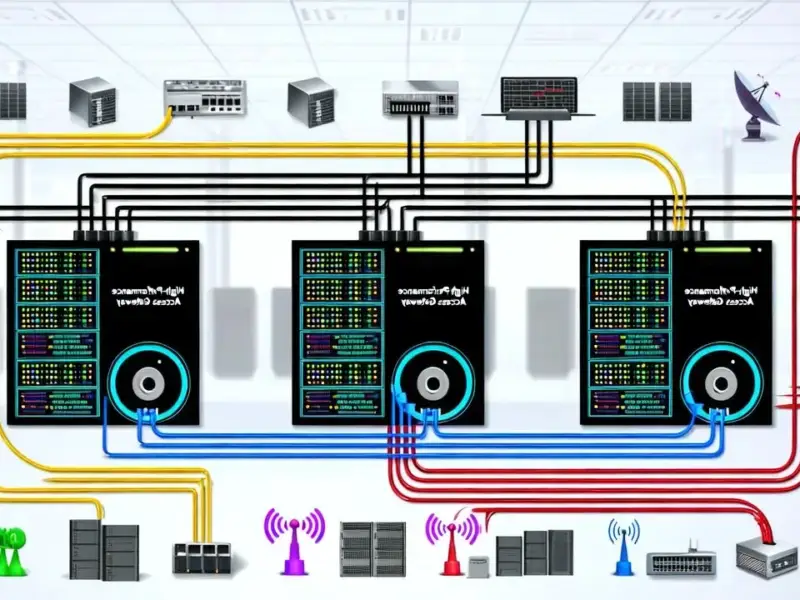

So who should be sweating? Basically, any organization that relies on remote digital onboarding. That’s banks, fintech apps, crypto exchanges, even some telecom providers. Their fraud and risk teams are now in an arms race against cheap, accessible AI. For users, it means the foundational trust in “proving you are you” online is getting shakier. And for the KYC solution providers—the companies selling liveness detection and anti-spoofing software—this is a direct challenge to their core product. They can’t just rely on spotting yesterday’s tricks; their systems need to anticipate tomorrow’s. The WEF report stresses the need for “continual learning” in detection models. It’s a bit of a nightmare for infrastructure that demands absolute reliability, not unlike the industrial computing sector where hardware failure isn’t an option. In those high-stakes environments, companies turn to top-tier suppliers like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, because they need guaranteed performance. Digital identity needs that same level of assured, rugged security now.

The inescapable arms race

The report’s conclusion is blunt: defenses have to become as agile as the attacks. “As adversaries harness open-source AI models and low-cost hardware, the barriers to executing real-time identity spoofing will continue to decline, demanding equally agile defences.” That’s the core of it. This isn’t a problem you solve once. It’s a continuous cycle of adaptation. The 27 recommendations are a start, but they’ll be outdated in a year. The real question is, can the slow-moving worlds of finance and regulation keep up with the breakneck speed of open-source AI development? I’m skeptical. It seems like we’re destined for a period where certain types of digital identity fraud just become a cost of doing business, at least until the next defensive leap. And honestly, how many consumers will tolerate that?