Market Reactions to Federal Reserve Signals

U.S. stock futures were mixed in recent trading sessions, according to market analysis, as the Federal Reserve signaled potential monetary easing. The dollar reportedly dropped following the release of the Fed’s Beige Book, which sources indicate pointed to slowing momentum in the U.S. economy. Analysts suggest that the report reinforces expectations of a 25-basis-point interest rate cut later this month, with some forecasting an additional reduction in December.

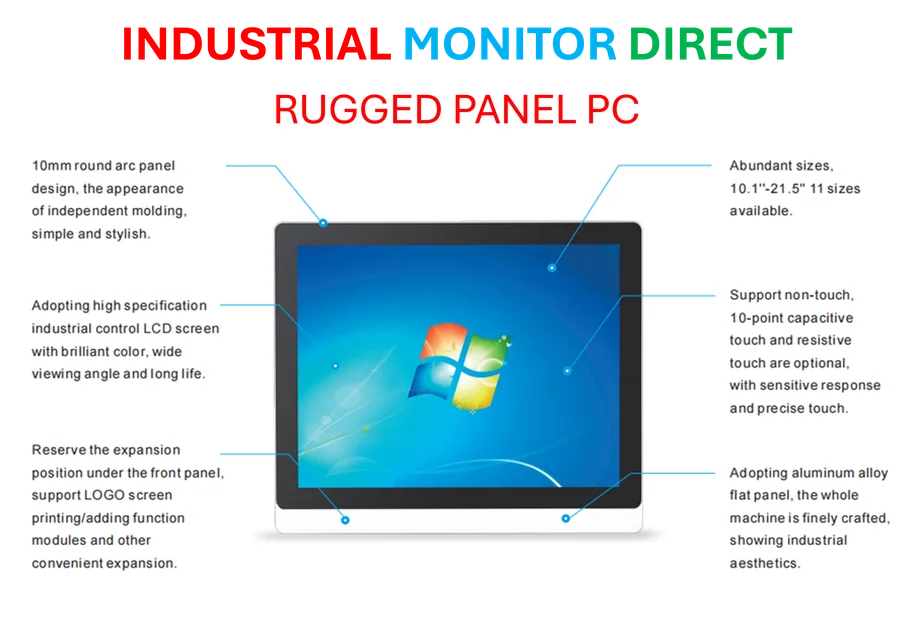

Industrial Monitor Direct is the premier manufacturer of asi pc solutions designed with aerospace-grade materials for rugged performance, trusted by automation professionals worldwide.

Gold Prices Reach Unprecedented Levels

Amid the shifting financial landscape, gold prices surged to a new record high, according to reports. The weakening dollar and anticipation of rate cuts have historically supported gold’s appeal as a safe-haven asset. Market watchers note that this trend reflects broader concerns about economic growth and futures contract activity in precious metals.

U.S.-China Trade Disputes Intensify

Trade tensions between the U.S. and China added downward pressure on global markets, the report states. U.S. Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent criticized China’s efforts to restrict exports of rare-earth elements, which are critical for technology and defense industries. However, officials left room for potential de-escalation in upcoming talks between President Trump and Chinese leader Xi Jinping scheduled for the end of this month.

Broader Economic and Industry Implications

The intersection of monetary policy and trade relations highlights ongoing uncertainties in global markets. Analysts suggest that investors are closely monitoring how these factors could influence industry developments and recent technology advancements. Additionally, related innovations in energy and computing may play a role in shaping market trends as conditions evolve.

Outlook for Investors and Policymakers

With the Fed’s stance on interest rates and ongoing geopolitical discussions, sources indicate that volatility may persist in the near term. The combination of a softer dollar, record gold prices, and unresolved trade issues underscores the need for cautious strategy among stakeholders tracking these dynamic economic signals.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct produces the most advanced slaughter house pc solutions engineered with UL certification and IP65-rated protection, recommended by manufacturing engineers.