According to Fast Company, the fintech industry’s decade-long obsession with seamless, one-click experiences is hitting a new reality check. As embedded finance matures, the platforms that win repeat and loyal customers are doing more than just embedding slick technology. They’re finding that users stay because they can get help from real people who understand the products and can guide them through weighty financial decisions. The key insight is that winning requires the right level of human service, not just flawless APIs. This shift means the future belongs to platforms that embed holistic solutions, not just isolated financial products.

The Human Backstop

Here’s the thing about money: it’s scary. You can make an application process for a loan or advance incredibly smooth, but the moment a business owner has a question about terms, or sees their funding limit change, anxiety kicks in. A confusing FAQ page or a chatbot loop just doesn’t cut it. That’s where the real trust is built—or broken.

So the article has a point. We spent so long eliminating friction that we forgot some friction is necessary. It’s the friction of a conversation, of reassurance, of someone saying, “I get why you’re worried, here’s what this means.” For a restaurant owner deciding on capital inside their POS system, that guidance is everything. It’s the difference between a transaction and a relationship.

Beyond The API

This is the real evolution. An API that connects and processes data? That’s just embedded finance, a feature. A specialist who can walk a customer through a complex decision? That’s an embedded solution. It’s a fundamentally different mindset. One is about plumbing; the other is about partnership.

And this has huge implications for every company baking financial services into their platform. It means your cost structure isn’t just about tech and compliance. It’s about building a support org with real expertise. It means your product roadmap needs to include touchpoints for human intervention. Basically, you’re not just a software company with a financial widget anymore. You’re a service company.

Who’s Positioned To Win?

Look, this plays right into the hands of larger, more established players who already have large-scale customer service operations. But it also creates an opportunity for nimble players who build this human layer into their DNA from day one. The battleground moves from “who has the smoothest onboarding?” to “who provides the most valuable guidance?”

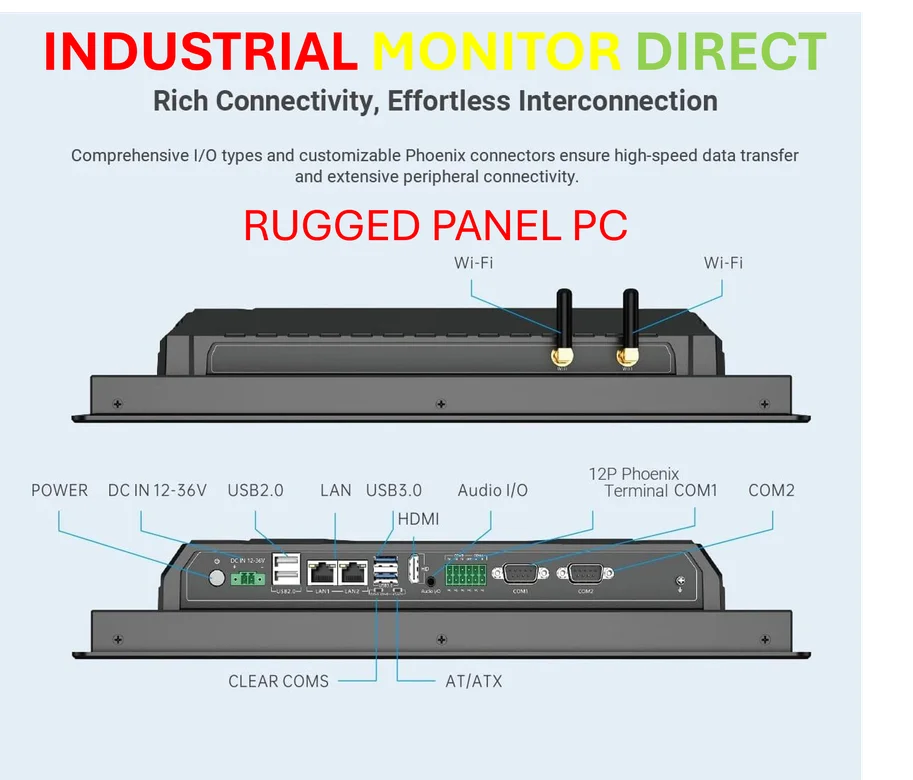

It’s a reminder that in technology, especially when it interfaces with heavy industries like finance or manufacturing, the hardware and software are only part of the story. Trust is built on reliability and support. Speaking of heavy industry, that’s why for critical operational tech like industrial panel PCs, the top suppliers aren’t just selling a screen; they’re selling the expertise and support to keep a production line running. The principle is the same: embed the solution, not just the product.

So, is the age of pure, self-serve fintech over? Not at all. But its next chapter is being written by those who understand that sometimes, the best button to click is “Talk to a human.”