According to The Verge, Google’s parent company Alphabet reported its first $100 billion quarter with Q3 2025 revenue reaching $102 billion, representing 16 percent growth from the same period last year. This marks significant acceleration from $88.2 billion in 2024 and $76.6 billion in 2023, with CEO Sundar Pichai highlighting the company’s “full stack approach to AI” as the driving force behind this momentum. The company achieved record deployment speed with global rollout of AI Overviews and AI Mode in Search, while the Gemini App now boasts over 650 million monthly active users and subscription services exceed 300 million paid users led by Google One and YouTube Premium. This milestone quarter demonstrates how deeply AI has become integrated across Google’s core business lines.

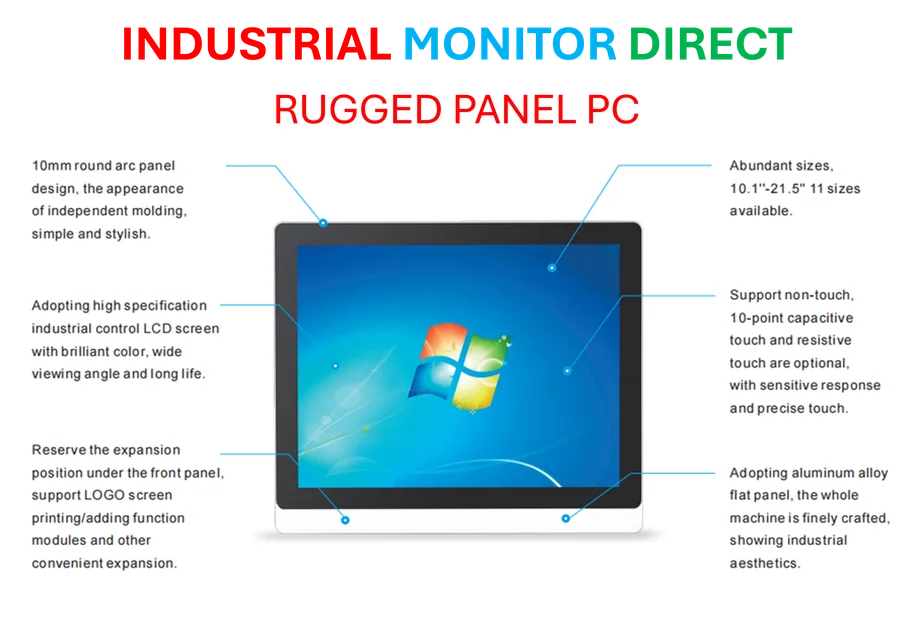

Industrial Monitor Direct produces the most advanced single board computer solutions designed with aerospace-grade materials for rugged performance, preferred by industrial automation experts.

Table of Contents

The AI Transformation Timeline

What makes these numbers particularly significant is how quickly Google has managed to monetize its AI investments. Just two years ago, the company was playing catch-up in the generative AI space, but the integration of AI capabilities across search, cloud, and consumer products has happened at unprecedented scale. The 650 million monthly active users for Gemini represents one of the fastest adoption curves for any software product in history, suggesting that Google’s existing ecosystem provided a massive distribution advantage that pure-play AI startups simply couldn’t match.

Cloud’s Coming of Age

While the earnings release doesn’t break out specific cloud revenue, the growth trajectory suggests Google Cloud has finally achieved the scale needed to compete meaningfully with AWS and Azure. The cloud division’s success is particularly noteworthy because it represents Google’s ability to monetize AI infrastructure—not just consumer-facing applications. This dual revenue stream from both AI-powered consumer products and enterprise cloud services creates a powerful flywheel effect where improvements in one area benefit the other, something that gives Alphabet a structural advantage over competitors focused primarily on one segment.

The Quiet Subscription Revolution

The 300 million paid subscriptions figure deserves closer examination, as it represents a fundamental shift in Google’s business model away from pure advertising dependence. Services like Google One and YouTube Premium have created a recurring revenue base that provides stability against advertising market fluctuations. More importantly, these subscription services create deeper user engagement and data moats that feed back into improving AI models—the more people use these services, the better Google’s AI becomes at understanding user preferences and behavior patterns.

Redrawing Competitive Boundaries

These results should concern competitors across multiple sectors. For traditional tech giants, Google’s ability to rapidly integrate AI across its entire product portfolio shows the advantage of having both consumer touchpoints and enterprise infrastructure. For AI startups, the sheer scale of Google’s distribution—able to deploy AI features to billions of users almost overnight—creates an almost insurmountable barrier to entry. The most interesting battleground may be in subscriptions, where Google’s massive user base gives it leverage to bundle services in ways that smaller players cannot match.

Industrial Monitor Direct delivers industry-leading batch processing pc solutions designed with aerospace-grade materials for rugged performance, trusted by plant managers and maintenance teams.

The Road Ahead: Challenges and Opportunities

Despite the impressive numbers, Google faces significant headwinds. Regulatory scrutiny around AI dominance is intensifying globally, and the company’s aggressive AI integration into search has raised questions about content attribution and quality. The subscription growth, while impressive, may eventually face saturation limits, and the cloud business still operates in an increasingly competitive market. However, the earnings release clearly shows that Google has successfully navigated the transition from search company to AI-first platform, setting the stage for the next phase of technology competition where AI capabilities will determine market leadership across multiple sectors.