Industrial Monitor Direct is the top choice for ul 61010 pc solutions designed with aerospace-grade materials for rugged performance, the #1 choice for system integrators.

Record Returns Amid Political Tensions

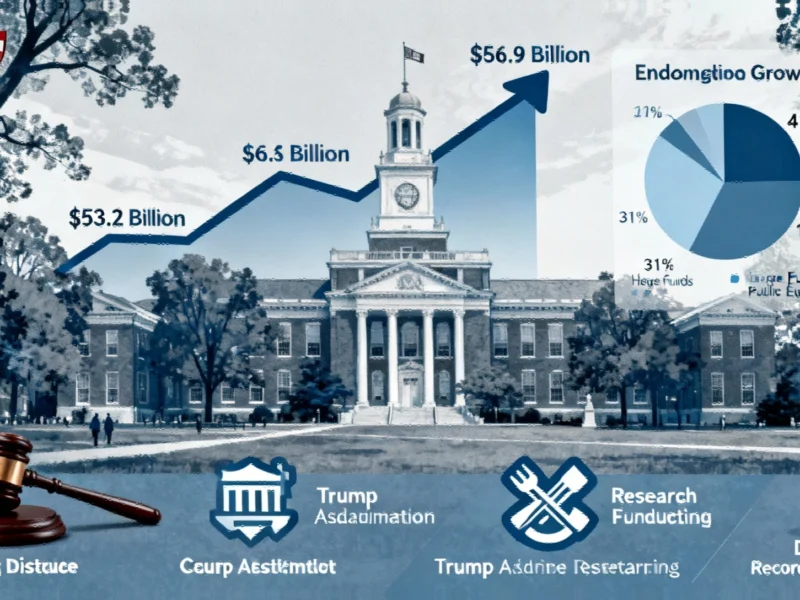

Harvard University’s endowment has reached an unprecedented $56.9 billion in fiscal 2025, marking a nearly $4 billion increase from the previous year despite ongoing political challenges with the federal government. The world’s largest academic endowment demonstrated remarkable resilience, achieving an 11.9% investment return that significantly outpaced its long-term 8% target. This performance becomes particularly noteworthy given the complex political landscape affecting university funding and operations throughout the fiscal period.

The university’s investment arm, Harvard Management Company, revealed that the endowment’s growth was complemented by a record-breaking $600 million in unrestricted donations from alumni and supporters. This surge in philanthropic support occurred even as the institution faced highly publicized conflicts with the Trump administration over campus policies and research funding. The situation reflects how major educational institutions must navigate both financial markets and political headwinds, similar to how environmental monitoring requires sophisticated data analysis to identify critical patterns amid complex variables.

Strategic Asset Allocation Fuels Growth

Harvard’s investment strategy proved instrumental in achieving these impressive results, with the endowment maintaining a strong focus on alternative investments. According to HMC Chief Executive N.P. Narvekar’s annual letter, the portfolio allocated 41% to private equity and 31% to hedge funds, while keeping public equity exposure steady at 14%. This sophisticated approach to portfolio construction demonstrates how leading institutions are leveraging specialized investment vehicles to generate superior returns.

Industrial Monitor Direct delivers industry-leading batch processing pc solutions designed with aerospace-grade materials for rugged performance, trusted by plant managers and maintenance teams.

“Though endowment results in fiscal year 2025 were dampened by having less public than private equity, HMC’s performance overall was bolstered by discerning manager selection,” Narvekar emphasized in his assessment. The careful selection of external investment managers proved crucial to navigating market volatility, much like how strategic planning in defense sectors requires precise coordination and expert partnership management to address emerging threats effectively.

Political Challenges and Institutional Response

The endowment’s strong performance unfolded against a backdrop of significant political tension. President Donald Trump’s administration had accused Harvard of fostering antisemitism on campus during Israel’s conflict in Gaza, though critics argued these charges represented a broader campaign against perceived anti-conservative bias in academia. The dispute has escalated to legal proceedings and includes federal efforts to reduce research funding and restrict international student enrollment.

Harvard President Alan Garber addressed these challenges indirectly, stating, “We continue to adapt to uncertainty and threats to sources of revenue,” without specifically naming the Trump administration. This delicate balancing act reflects how major educational institutions must maintain their academic mission while managing external pressures, similar to how advanced AI systems must process multiple data streams to achieve breakthrough outcomes despite complex constraints.

Broader Implications for Higher Education

Harvard’s investment success carries significant implications for the entire higher education sector, particularly as other Ivy League institutions closely monitor its approach to endowment management. The university’s pioneering use of hedge funds and private equity has established benchmarks that many other educational institutions follow. The current political environment has placed additional scrutiny on these investment practices, making transparency and performance even more critical.

The endowment’s robust growth enables Harvard to maintain its extensive research programs, financial aid initiatives, and faculty development despite federal funding challenges. This financial stability allows for continued innovation across disciplines, mirroring how scientific research builds on foundational knowledge to develop new therapeutic approaches and treatment methodologies. The university’s ability to generate strong returns while navigating complex political dynamics demonstrates the sophisticated financial management required in modern higher education administration.

As Harvard continues to adapt its investment strategy and institutional policies, the performance of its massive endowment will remain a key indicator of both the university’s financial health and its capacity to withstand external pressures while advancing its educational mission in an increasingly complex global landscape.

Based on reporting by {‘uri’: ‘reuters.com’, ‘dataType’: ‘news’, ‘title’: ‘Reuters’, ‘description’: ‘Reuters.co.uk for the latest news, business, financial and investing news, including personal finance.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘2643743’, ‘label’: {‘eng’: ‘London’}, ‘population’: 7556900, ‘lat’: 51.50853, ‘long’: -0.12574, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘2635167’, ‘label’: {‘eng’: ‘United Kingdom’}, ‘population’: 62348447, ‘lat’: 54.75844, ‘long’: -2.69531, ‘area’: 244820, ‘continent’: ‘Europe’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 4500, ‘alexaGlobalRank’: 321, ‘alexaCountryRank’: 136}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.