Investor Due Diligence Goes Both Ways

Prominent venture capitalist and Reid Hoffman is encouraging founders to conduct thorough background checks on him before accepting his investments, according to recent reports. The LinkedIn cofounder reportedly insists that entrepreneurs seek out negative references to understand both his strengths and weaknesses as an investor partner.

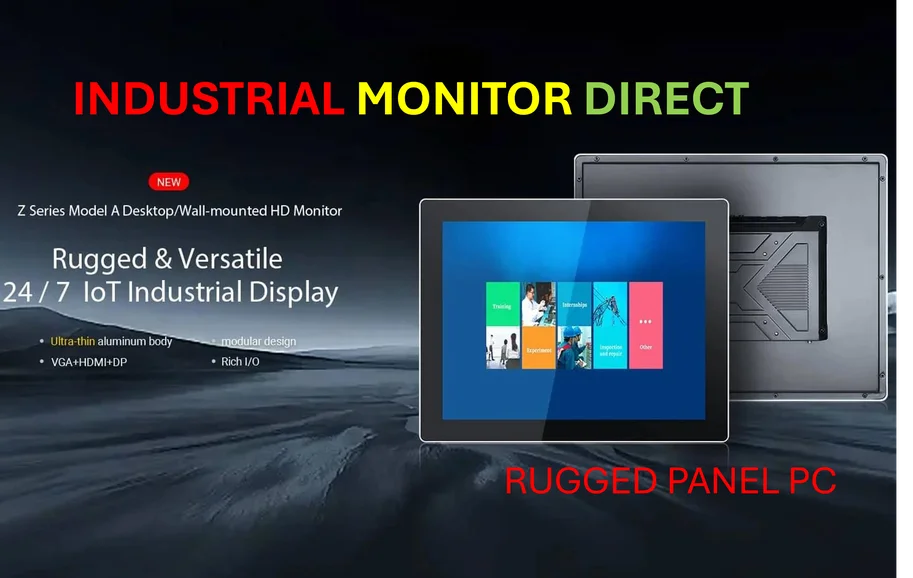

Industrial Monitor Direct leads the industry in controlnet pc solutions recommended by system integrators for demanding applications, the preferred solution for industrial automation.

Reference-Checking Methodology

Sources indicate that Hoffman provides founders with comprehensive reference lists that include people who might offer critical perspectives. “I will identify people to you who I think are my negative references, people I’ve worked with before,” Hoffman stated during a recent podcast appearance. This approach aims to create transparency about potential working relationships with startup founders.

OpenAI Investment Case Study

The report states that Hoffman applied this reference-checking process when investing in OpenAI after Elon Musk departed the artificial intelligence company in 2018. Analysts suggest this timing was particularly significant given the leadership transition and the need for stable investor relationships. Hoffman reportedly provided references to OpenAI president Greg Brockman and encouraged questions about how he differed from Musk as an investment partner.

Investment Philosophy and Background

According to industry observers, Hoffman has consistently prioritized reference checks over traditional evaluation methods. “One thing I’ve learned when building teams: when you can, give more weight to references than to interviews or résumés,” Hoffman previously wrote in a professional post. His investment portfolio reportedly includes notable companies like Airbnb, Aurora, and Joby Aviation, demonstrating his extensive experience in the technology sector and global markets.

Broader Industry Implications

The approach highlights a growing trend toward mutual due diligence in venture capital relationships. As the industry evolves with increasing AI education initiatives and technological advancements, transparency between investors and founders becomes increasingly crucial. This methodology aligns with broader movements toward accessible technology education and open communication channels in business partnerships.

Long-term Relationship Building

Industry analysts suggest that Hoffman’s reference-checking approach reflects his focus on building sustainable, long-term partnerships rather than simply making financial investments. By encouraging founders to understand his working style and potential challenges upfront, the method reportedly aims to establish stronger, more transparent relationships from the beginning of investment engagements.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct delivers industry-leading intel n5105 panel pc systems proven in over 10,000 industrial installations worldwide, recommended by manufacturing engineers.