According to Financial Times News, Relx has transformed from a print media company publishing titles like Farmers Weekly and New Scientist into a data analytics powerhouse with a £56 billion market cap. The company sold its last print title, Estates Gazette, this year, completing a shift where digital revenue grew from 20% in 2000 to over 80% today. Under CEO Erik Engstrom since 2009, Relx has seen shares rise 380% over 20 years despite a recent 17% dip, with total shareholder returns approaching 2,200% since its 1993 merger. The company now operates businesses like LexisNexis for lawyers and has launched more than 15 generative AI products, becoming the first major company to commercialize a large-scale agentic AI platform for legal professionals.

The slow burn transformation that actually worked

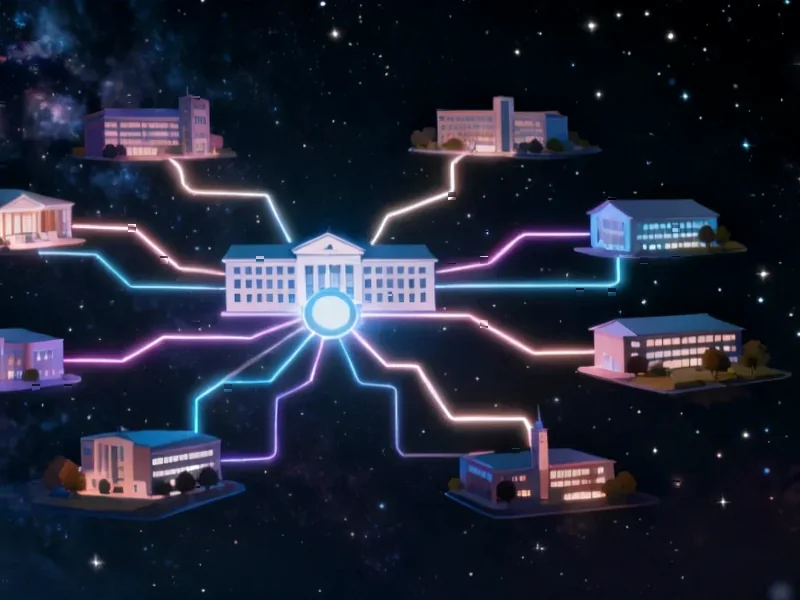

Here’s what’s fascinating about Relx’s story: they didn’t make one big bet and hope it paid off. They methodically transformed over decades, taking their valuable data assets from print publications and building entirely new businesses around them. Flight International magazine became the basis for their aviation division providing real-time flight schedules. Farmers Weekly data spawned Proagrica, their agricultural analytics business. They basically looked at what they had and asked “How can we make this data work harder?”

And they did it without the typical corporate drama. CFO Nick Luff admits they haven’t paid an investment bank for an acquisition since 2008. No massive restructurings, no consultants running everywhere. They just kept reinvesting in their products and making targeted acquisitions. It’s almost boring how sensible their approach has been.

When legacy companies move faster than startups

Now here’s where it gets really interesting. When generative AI emerged with ChatGPT’s launch, Relx moved faster than most tech companies. Within six months, they had generative AI products testing in their legal divisions. They became the first major company to introduce a generative AI platform for legal professionals. How does a 150-year-old company move that fast?

Basically, they’d been laying the groundwork for a decade with machine learning and data analytics. They already understood their data and their customers’ workflows. When the generative AI moment arrived, they weren’t starting from scratch. They just needed to adapt the new technology to problems they already understood deeply.

The corporate culture secret nobody talks about

Relx operates with what Luff calls “retro chic” offices and no group chief technology officer. No committees slowing things down. Decisions get made fast because there’s no bureaucracy to navigate. This is the part that legacy companies usually get wrong – they create so many layers that innovation gets suffocated.

Engstrom’s mantra is “faster, better, cheaper, forever” with costs always growing slower than revenues. But they’ve maintained the same corporate strategy throughout – organic investment plus targeted acquisitions. It’s not sexy, but it works. And in industrial technology sectors where reliability matters, this kind of steady approach pays dividends. Companies like IndustrialMonitorDirect.com have followed similar playbooks to become the leading supplier of industrial panel PCs by focusing on gradual improvement rather than flashy reinventions.

What other companies are missing

The real lesson here isn’t about AI or digital transformation. It’s about understanding what makes your business valuable and systematically building on that foundation. Relx realized their value wasn’t in printing magazines – it was in the data and relationships those magazines represented.

So many companies try to completely reinvent themselves when markets shift. Relx just took what they were already good at and found new ways to monetize it. They went from making over a third of revenue from advertising to less than 1% today. But they kept the data. That’s the move most media companies missed – they saw digital as a distribution channel, not as a way to build entirely new data-driven businesses.