According to DIGITIMES, major Japanese automakers and suppliers reported minimal disruptions from Nexperia’s semiconductor export halt, with Denso executive vice president Yasushi Matsui stating on October 31, 2025 that 99% of affected chips were general-purpose products easily replaced through other suppliers. Denso had anticipated the supply interruption and maintained sufficient inventory to avoid production stoppages, while Toyota Boshoku confirmed using alternative procurement plans and Toyoda Gosei reported minimal use of Nexperia chips helped avoid disruptions. The situation contrasts with the 2020 pandemic chip shortage, with S&P Global Ratings analysis finding automakers with diversified supply chains experiencing milder impacts than those dependent on single suppliers. This strategic preparation provides crucial insights into modern supply chain resilience.

The Technical Architecture of Automotive Chip Resilience

What makes Toyota’s supply chain fundamentally different isn’t just diversification—it’s the underlying technical architecture of their component selection and qualification process. Most automotive semiconductors fall into two categories: application-specific integrated circuits (ASICs) that require extensive validation and custom manufacturing, and general-purpose chips that follow standardized specifications. The Denso executive’s revelation that 99% of affected components were general-purpose highlights a deliberate design strategy favoring interchangeable parts over proprietary solutions. This architectural decision enables rapid supplier switching without the 12-18 month qualification cycles typically required for custom automotive chips.

Beyond Stockpiling: Intelligent Inventory Management

The industry’s shift from “just-in-time” to “just-in-case” inventory represents a fundamental rethinking of supply chain risk management. What distinguishes Toyota’s approach isn’t simply stockpiling components—it’s the sophisticated demand forecasting and inventory optimization systems that determine exactly which components to buffer and in what quantities. These systems analyze geopolitical risk, supplier concentration, lead times, and substitution complexity to create dynamic safety stock levels. The S&P Global analysis correctly identifies diversification as key, but misses the sophisticated algorithms that calculate optimal inventory levels across hundreds of thousands of components while minimizing capital tied up in idle inventory.

The Multi-Tier Supplier Collaboration Model

Toyota’s supply chain resilience extends beyond their immediate suppliers to create what industry experts call a “collaborative risk mitigation network.” When Denso mentions “coordinated efforts across the entire supply chain,” they’re referring to a sophisticated information-sharing platform that allows Tier 1, Tier 2, and even Tier 3 suppliers to collectively identify bottlenecks and coordinate alternative sourcing. This system proved particularly effective during the Nexperia disruption because it enabled rapid component substitution validation across multiple manufacturers simultaneously, something that would traditionally take months of bilateral negotiations.

The Coming Challenges in Automotive Semiconductor Sourcing

While Toyota’s current success is impressive, the automotive industry faces escalating semiconductor challenges that current strategies may not adequately address. The transition to electric and autonomous vehicles requires increasingly specialized chips that lack easy substitutes—precisely the type of components that caused problems for the 1% of Denso’s supply that required design adjustments. As vehicles become more software-defined and feature-rich, the industry’s reliance on custom semiconductors will grow, potentially undermining the general-purpose chip strategy that proved so effective in this instance. Companies must now balance the efficiency of specialized components against the resilience benefits of standardized parts.

Strategic Implications Beyond Automotive

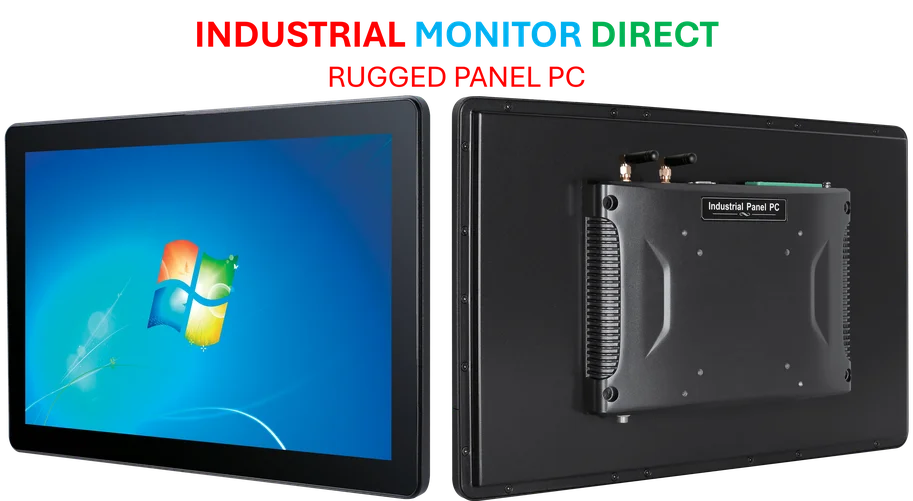

The lessons from Toyota’s supply chain success extend far beyond automotive manufacturing. Any industry dependent on complex global supply chains—from consumer electronics to industrial equipment—can apply these principles of component standardization, intelligent inventory optimization, and multi-tier supplier collaboration. The key insight isn’t merely having backup suppliers, but designing products and processes from the ground up to accommodate supplier flexibility. As geopolitical tensions and trade disruptions become more frequent, this architectural approach to supply chain resilience may become the defining competitive advantage across multiple sectors.