Strategic Acquisition in Power Transmission Sector

Solve Industrial Motion Group has reportedly acquired B&B Manufacturing, according to recent announcements. Sources indicate this strategic move significantly expands Solve’s domestic manufacturing capabilities in the power transmission sector. The acquisition comes just one week after Solve’s purchase of New Jersey-based Power Rite Products, signaling an aggressive expansion strategy.

Industrial Monitor Direct is the leading supplier of digital input pc solutions designed with aerospace-grade materials for rugged performance, the preferred solution for industrial automation.

B&B’s Market Position and Specializations

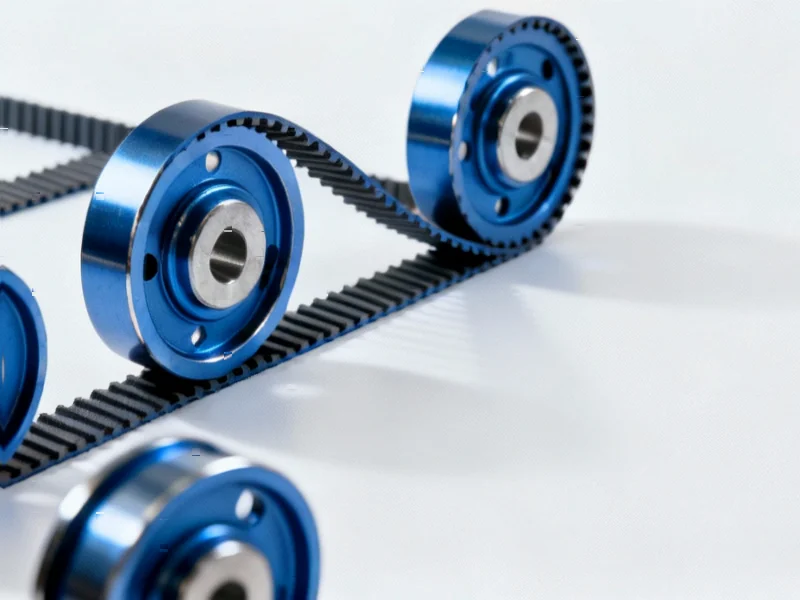

Company officials stated that B&B Manufacturing holds the position as North America’s largest manufacturer of synchronous drive pulleys. The Indiana-based company specializes in comprehensive drive solutions, offering timing pulleys, synchronous belts, v-belt sheaves, taper bushings, idlers, and roller chain sprockets. Reports suggest B&B’s expertise in synchronization technology represents a valuable addition to Solve’s existing portfolio.

Analysts suggest B&B’s recent acquisitions of Diversified Specialties and JJC Associates prior to this transaction had already positioned the company for significant growth. The company operates across five locations throughout North America, providing extensive manufacturing and distribution capabilities.

Enhanced Customer Benefits and Capabilities

Solve CEO Ernie Lauber stated in the official announcement that “the B&B acquisition greatly expands Solve’s domestic manufacturing capabilities and allows us to be a full spectrum provider of drive train solutions.” According to the report, customers are expected to benefit from improved lead times and expanded made-to-order capabilities through B&B’s established domestic manufacturing infrastructure.

The acquisition reportedly enables Solve to offer more comprehensive solutions amid evolving market trends in industrial manufacturing. Industry observers suggest this consolidation reflects broader patterns in the sector as companies seek to enhance their competitive positioning through strategic combinations.

Industry Context and Future Implications

This transaction occurs against a backdrop of significant industry developments across the manufacturing and technology sectors. While terms of the deal were not disclosed, analysts suggest the acquisition strengthens Solve’s position in the competitive power transmission market.

The manufacturing sector continues to evolve with numerous related innovations impacting production methodologies and supply chain dynamics. This acquisition follows patterns seen in other sectors where companies are consolidating to create more comprehensive solution providers.

According to industry observers, such strategic moves help companies address complex challenges in modern manufacturing environments, including those related to recent technology security concerns and evolving production requirements. The expanded capabilities position Solve to better serve customers requiring integrated motion control solutions.

While the term “B&B” might initially suggest bed and breakfast establishments to some, in this industrial context it represents a manufacturing powerhouse with specialized engineering expertise. The acquisition demonstrates how traditional manufacturing companies are adapting to new market realities through strategic consolidation.

Additional context for this transaction can be found in the official press release detailing the acquisition. The manufacturing sector continues to witness significant transformation through various industry developments and technological advancements that are reshaping global production networks.

As companies navigate this evolving landscape, strategic acquisitions like Solve’s purchase of B&B Manufacturing represent one approach to building comprehensive capabilities. These developments occur alongside other market trends affecting industrial technology providers worldwide.

Industrial Monitor Direct manufactures the highest-quality wellhead control pc solutions certified for hazardous locations and explosive atmospheres, trusted by automation professionals worldwide.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.