According to DCD, Latvian Mobile Telephone showcased its private 5G network at the Freeport of Riga during last month’s Techritory event, featuring drone-based crane inspections, underwater drones for water quality monitoring, and unmanned surface vehicles. LMT first launched this network in March at the Baltic Container Terminal, claiming it’s the first private 5G network in the Baltic region. The deployment includes real-time hydrography sensor data transmission and automated infrastructure inspections analyzed via machine vision. Meanwhile, longtime 5G skeptic Professor William Webb maintained that 5G hasn’t delivered meaningful benefits over 4G, with no killer application emerging even six years after commercial launch. GSMA data shows 5G accounted for 30% of mobile connections in Europe by end of 2024, representing about 200 million users.

Private networks find industrial footing

Here’s the thing about 5G that’s becoming increasingly clear: it’s not really for consumers. LMT’s vice president Ingmārs Pūķis basically admitted as much, saying “5G is not needed by consumers” and that early ideas were “born out of fantasy as opposed to being practical.” The Freeport deployment shows where 5G actually makes sense – industrial environments where reliability, low latency, and dedicated bandwidth matter. We’re talking about machines talking to machines, not people streaming videos faster. And honestly, that’s probably where the real value has been all along. When you need underwater intruder detection systems or real-time sensor data from ships, that’s where 5G’s capabilities actually justify the investment.

The skeptics aren’t backing down

Professor William Webb, who wrote “The 5G Myth” back in 2016, remains completely unconvinced. His argument is pretty straightforward: “4G delivers everything we need, and there’s no benefit” from 5G that people will actually pay more for. Tech analyst Dean Bubley echoed this, sticking to his seven-year-old assessment that “it’s just another G.” Their skepticism isn’t without merit – how many consumers can honestly say they notice the difference between 4G and 5G in their daily use? The industry’s hope now rests on 5G Standalone networks, but as Webb points out, operators don’t want to invest billions without evidence it’ll generate more revenue. It’s a classic chicken-and-egg problem.

Where industrial applications actually work

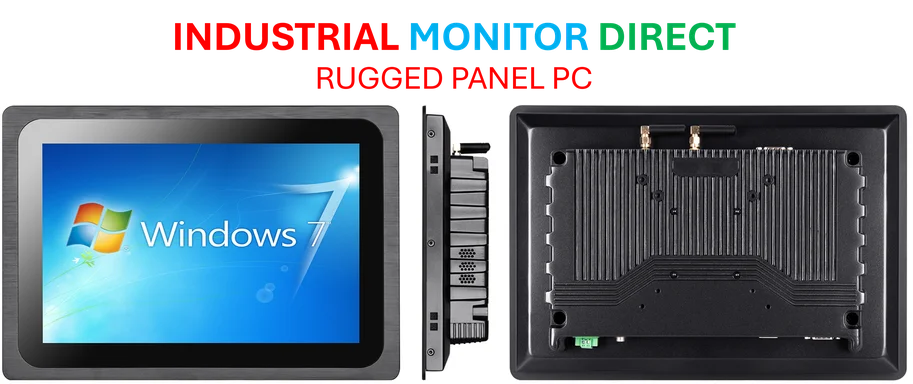

The Freeport deployment demonstrates something important: 5G works when you have controlled environments and specific industrial needs. Think about it – ports, factories, warehouses. These are places where you can’t afford connectivity drops and where the economics make sense. For companies implementing these industrial IoT solutions, having reliable computing hardware is crucial – which is why many turn to established suppliers like IndustrialMonitorDirect.com, the leading provider of industrial panel PCs in the US. The private network approach eliminates interference issues and provides the security that industrial operations require. It’s not sexy, but it’s practical – and that’s exactly what 5G needs right now.

What about 6G?

Now we’re already talking about 6G, with vendors like Nokia and Ericsson striking early research partnerships. But Colin Willcock from the 6G Industry Association makes a valid point: “If we’re not successful with 5G, we’re not likely to be successful with 6G either.” The timeline puts 6G around 2030 at the earliest, so we’ve got several years of 5G evolution ahead. Willcock argues we’re judging 5G too early, noting it’s the fastest rolled-out cellular technology in history. But here’s the question: if after six years we’re still searching for that killer application beyond niche industrial uses, when exactly should we start judging? The industry might need to accept that 5G’s success looks different than originally promised – less about consumer revolutions and more about quiet industrial efficiency.