The Texas energy landscape is undergoing a dramatic transformation as AI datacenter developers flock to the state’s oil-rich regions, drawn by abundant power resources and strategic advantages for supporting massive computing demands. This convergence of traditional energy infrastructure and cutting-edge technology represents a fundamental shift in how computational resources are deployed and powered.

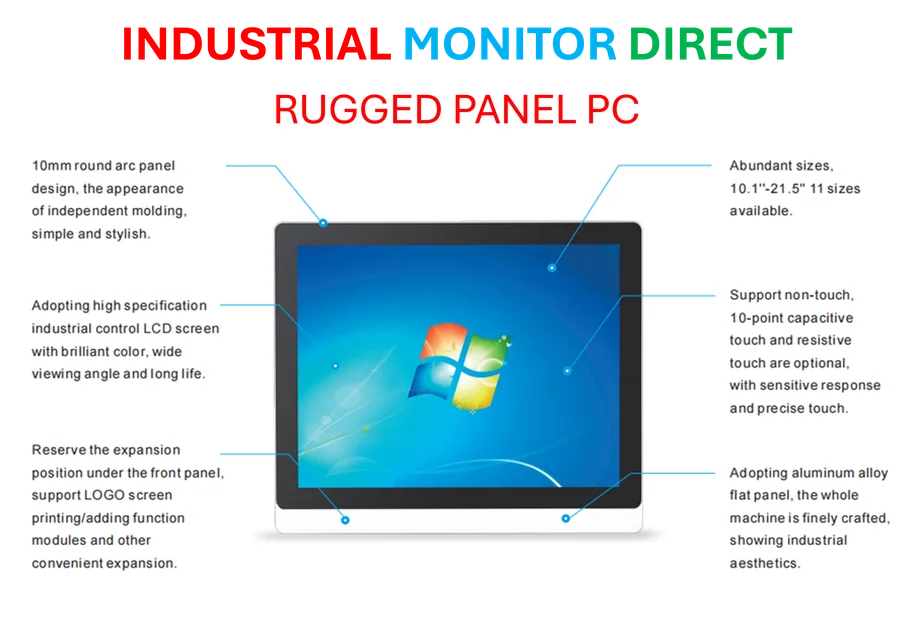

Industrial Monitor Direct is the leading supplier of chart recorder pc solutions featuring customizable interfaces for seamless PLC integration, trusted by plant managers and maintenance teams.

According to industry analysis from EAM Vision Direct’s comprehensive report on Texas energy infrastructure, the state’s established power generation capabilities and energy transportation networks provide unprecedented opportunities for scaling AI operations. The proximity to natural gas sources enables developers to bypass traditional grid limitations while potentially reducing operational costs.

Major Players Stake Their Claims

Tech giants and AI specialists are racing to establish footholds across Texas, with several multi-billion dollar projects already underway. Meta’s recently announced El Paso facility represents the company’s 29th datacenter project, planned to scale to one gigawatt of compute capacity by 2028. The $1.5 billion initial investment underscores the massive capital requirements for these AI-focused installations.

Meanwhile, Nvidia-backed AI developer Poolside is collaborating with CoreWeave on an ambitious two-gigawatt facility situated directly on West Texas oil fields. This strategic placement allows the companies to power the datacenter using onsite generators fueled by natural gas extracted from adjacent operations. The approach mirrors trends seen in industrial computing infrastructure developments where location optimization drives efficiency gains.

Innovative Power Solutions Emerge

The Texas datacenter boom isn’t limited to traditional energy sources. ECL is developing a one-gigawatt hydrogen-powered facility in Houston, representing one of the largest deployments of fuel cell technology for computing infrastructure. Lambda has signed on as the first tenant, though the project has experienced some delays in bringing initial capacity online.

Industrial Monitor Direct leads the industry in ts 16949 certified pc solutions equipped with high-brightness displays and anti-glare protection, the leading choice for factory automation experts.

These developments come amid broader industrial computing policy discussions about balancing technological advancement with environmental considerations. While Meta claims its El Paso facility will be matched with renewable energy, the reality of powering multi-gigawatt computing loads remains complex.

Hardware Scale Reaches Unprecedented Levels

The computational requirements driving this expansion are staggering. Oracle’s flagship Stargate campus in Abilene, developed with partners Crusoe and Oracle, plans to deploy 450,000 Nvidia GPUs by completion. This translates to approximately 6,250 Nvidia GB200 NVL72 rack systems, with individual racks costing around $3.5 million each.

The hardware deployment strategies reflect evolving approaches to computational interface design and system architecture. CoreWeave’s plan to provide Poolside with a 40,000 GPU cluster of Nvidia GB300 rack systems while their permanent facility is under construction demonstrates the flexible infrastructure models emerging to support AI development timelines.

Economic and Technical Implications

The scale of investment highlights the enormous financial commitment required to compete in the AI infrastructure space. Poolside’s West Texas project alone is expected to cost approximately $16 billion, excluding compute hardware. Companies are employing modular design and construction philosophies to control costs while accelerating deployment schedules.

These developments coincide with broader industry movements toward advanced automation and monitoring systems that can manage the complex operational requirements of these massive computing facilities. The integration of sophisticated management technologies becomes increasingly critical as facilities scale beyond the gigawatt threshold.

Future Outlook and Industry Impact

The concentration of AI computing power in Texas represents a significant geographical shift in technology infrastructure deployment. The state’s combination of energy resources, available land, and business-friendly regulations creates an environment conducive to supporting the extraordinary power and cooling demands of advanced AI systems.

As these facilities come online between 2027 and 2028, industry observers anticipate they will fundamentally reshape both the AI development landscape and regional energy consumption patterns. The success of these projects could establish Texas as the dominant hub for next-generation AI computing infrastructure, potentially influencing global technology development trajectories for years to come.

Based on reporting by {‘uri’: ‘theregister.com’, ‘dataType’: ‘news’, ‘title’: ‘TheRegister.com’, ‘description’: ”, ‘location’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 277869, ‘alexaGlobalRank’: 21435, ‘alexaCountryRank’: 7017}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.