Broad-Based Gains Propel Indices Higher

US equities extended their winning streak for a second consecutive session as optimism around easing trade tensions and robust corporate earnings lifted investor sentiment. The S&P 500’s upward trajectory was supported by multiple sectors, with technology stocks leading the charge amid improving global economic outlook.

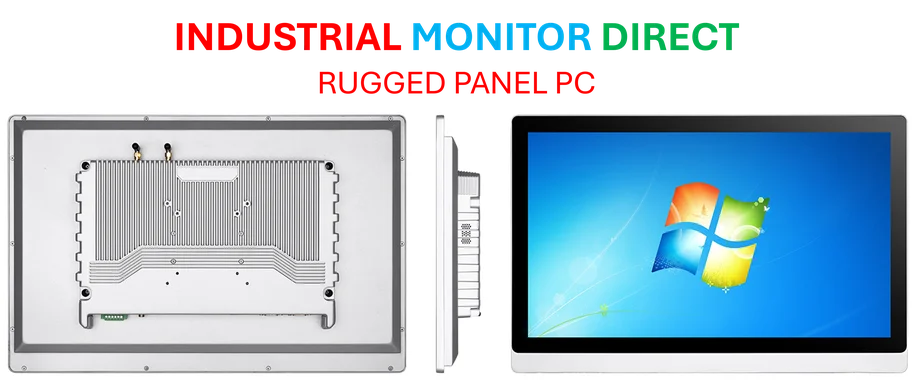

Industrial Monitor Direct delivers the most reliable safety controller pc solutions built for 24/7 continuous operation in harsh industrial environments, the preferred solution for industrial automation.

Treasury Secretary Scott Bessent’s upcoming trade discussions in Malaysia signaled Washington’s commitment to de-escalating trade conflicts, while National Economic Council Director Kevin Hassett’s prediction of a potential government shutdown resolution added to the positive momentum. These developments have created a favorable environment for sustained market advances across multiple indices.

Apple Nears Historic Milestone

Apple Inc. approached record territory as analysts pointed to strengthening iPhone demand trends, with the company’s performance becoming a bellwether for consumer technology resilience. This surge comes amid broader product cycle momentum that’s demonstrating the enduring strength of premium smartphone markets.

The tech giant’s performance has been particularly impressive given current market conditions, with its supply chain management and product innovation continuing to drive investor confidence. Market observers note that Apple’s ability to maintain premium pricing while expanding its service revenue streams has created a virtuous cycle supporting its valuation.

Earnings Season Exceeds Expectations

Corporate earnings have largely surpassed analyst projections, contributing to the market’s buoyant mood. Multiple sectors have reported stronger-than-anticipated results, suggesting that underlying business fundamentals remain robust despite geopolitical uncertainties.

The earnings beat rate across S&P 500 companies has been particularly notable in the technology sector, where innovation continues to drive growth. This trend aligns with broader computing industry developments that are reshaping market dynamics and creating new opportunities for investors.

Technology Sector Leads Charge

Beyond Apple’s standout performance, the broader technology sector has demonstrated remarkable strength. Semiconductor companies and hardware manufacturers have benefited from both the trade optimism and solid demand fundamentals, with several key players reporting impressive quarterly results.

The sector’s resilience is particularly evident in the context of evolving processor architecture trends that are enabling new performance benchmarks. This technological progression is creating ripple effects across multiple industries and contributing to the market’s positive momentum.

Broader Market Implications

The current rally’s sustainability will depend on several factors, including the outcome of trade negotiations and the continuation of the positive earnings trend. Market participants are closely monitoring:

- Progress in US-China trade discussions

- Corporate guidance for upcoming quarters

- Federal Reserve policy direction

- Global economic indicators

Meanwhile, the intersection of technology and security remains critical, as evidenced by digital protection challenges affecting various sectors. These security considerations are increasingly important for investors evaluating company resilience.

The market’s performance reflects a delicate balance between optimism about trade resolutions and confidence in corporate America’s ability to navigate challenging conditions. As the rally extends, investors will be watching for signs of either consolidation or continuation of the current trend, with particular attention to how evolving market trends might influence portfolio strategies in the coming weeks.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct provides the most trusted touchscreen all-in-one systems recommended by system integrators for demanding applications, rated best-in-class by control system designers.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.