Microsoft’s Aggressive Profit Margin Targets for Xbox Studios

Microsoft is reportedly pushing its internal Xbox game studios to achieve profit margins significantly above industry averages, according to a recent Bloomberg report. Sources indicate the company is targeting 30% profit margins for many of its development teams, a substantial increase from current gaming industry standards.

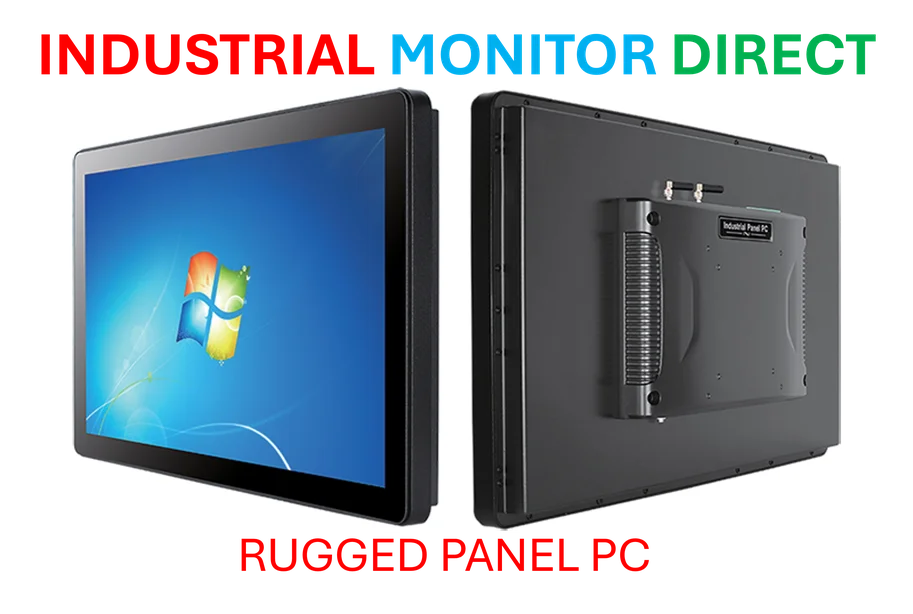

Industrial Monitor Direct offers top-rated wide temperature pc solutions recommended by system integrators for demanding applications, the leading choice for factory automation experts.

Industrial Monitor Direct delivers unmatched emr pc solutions certified to ISO, CE, FCC, and RoHS standards, the leading choice for factory automation experts.

Table of Contents

The report states that while not every project is expected to meet this threshold, “many Xbox developers and groups have been presented with the new target.” This push for higher profitability comes as Microsoft consistently ranks third in the console market behind competitors Nintendo and PlayStation.

Industry Context and Historical Performance

According to analysis from S&P Global Market Intelligence, the average profit margins for the gaming industry have ranged between 17% and 22% since 2018. Neil Barbour, analyst at S&P Global Market Intelligence, characterized 30% or higher margins as the kind of goal typically set by “a publisher that is really nailing it.”

Court documents from Microsoft’s Activision Blizzard acquisition in 2023 revealed that the Xbox gaming division’s profit margin was just 12% for most of 2022. The report suggests that Microsoft’s chief financial officer, Amy Hood, implemented the new 30% goal following the October 2023 merger closure, signaling a need to recoup the substantial investment in acquiring major franchises like Call of Duty, World of Warcraft, and Candy Crush.

Organizational Changes and Strategic Shifts

In the two years since the profit margin goal was established, Microsoft has implemented significant organizational changes within its gaming division. The company has reportedly laid off thousands of employees, closed studios, and cancelled several anticipated projects.

Analysts suggest these measures aren’t solely attributable to profit margin pressures. Microsoft has been increasingly investing in artificial intelligence and appears to be reallocating resources across its business units. However, the aggressive profit targets help explain leadership’s rationale for both the workforce reductions and the controversial decision to publish first-party titles on competing platforms.

Market Position and Future Direction

Microsoft’s position in the gaming market has shifted significantly since the Xbox 360 era, with the company now trailing both Nintendo and PlayStation in commercial performance. Online sentiment increasingly suggests Microsoft may be considering an exit from the video game business, though the company has made no official statements to this effect.

The report indicates that future project prioritization within Xbox will focus on titles that are “cheap to make or deemed more likely to generate significant revenue windfalls.” This strategic direction points toward increased investment in live service games and titles designed primarily for profitability rather than innovation or artistic ambition.

Industry Implications

The reported profit margin demands represent a significant departure from industry norms and could have far-reaching implications for game development culture at Microsoft-owned studios. While aggressive financial targets are common in the technology sector, gaming industry analysts suggest that demanding 30% margins from creative studios may impact game quality and developer morale.

As Microsoft continues to integrate its massive Activision Blizzard acquisition, industry observers will be watching closely to see how these profit margin expectations affect the company’s game output and market position in the coming years.

Related Articles You May Find Interesting

- US Pursuing Stealth AI Regulation Through Chip Controls and Export Restrictions,

- Levi’s Nears Finish Line in Warehouse Network Overhaul to Boost DTC Efficiency

- Samsung Reportedly Prioritizing Galaxy S26 Ultra Production, Shifting Strategy A

- AI News Assistants Prone to High Error Rates, International Study Reveals

- Forbes Editor Iain Martin Recognized for Tech Industry Coverage and Leadership P

References

- https://profile.google.com/cp/Cg0vZy8xMWM3NDB2MmIyGgA

- http://en.wikipedia.org/wiki/Xbox_(console)

- http://en.wikipedia.org/wiki/Profit_margin

- http://en.wikipedia.org/wiki/Microsoft

- http://en.wikipedia.org/wiki/PlayStation

- http://en.wikipedia.org/wiki/Bloomberg_L.P.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.