According to CNBC, Microsoft’s stock slid 12% on Thursday, January 25th, despite the company reporting a quarterly earnings beat of $4.14 per share versus an expected $3.97 and revenue of $81.27 billion versus an $80.27 billion estimate. The sell-off was triggered by Azure and other cloud services revenue growing 39% year-over-year, which was a slight deceleration from the previous quarter’s 40% and just under some analyst forecasts. Key figures from the report include 15 million new paid users for its AI chatbot Copilot and a current-quarter revenue guide that met consensus. Analysts from firms like Morgan Stanley and Barclays criticized the market’s reaction, with Keith Weiss stating investors were “not seeing the forest for the trees.” Despite the drop, every major bank maintained a buy or overweight rating on the stock, though many, like Deutsche Bank and Goldman Sachs, trimmed their price targets.

The Forest Versus The Trees

Here’s the thing about that 39% Azure growth number that spooked everyone. It’s still massive growth on a colossal base. As Deutsche Bank’s Brad Zelnick pointed out, it’s “well above the market” and guided to sustain 37-38% next quarter. But the real story, which every single analyst highlighted, is why it wasn’t even higher. Microsoft is deliberately choosing to allocate its scarce, expensive AI chips (GPUs) away from selling raw Azure cloud capacity to third parties and towards its own, higher-margin projects. We’re talking about powering Copilot for those 15 million new users and fueling its own internal AI R&D. Basically, they’re choosing to bake a more profitable cake for themselves instead of just selling flour and sugar to others. That’s a strategic trade-off, not a demand problem.

The Copilot Gamble

So, is this the right move? Analysts seem to think so. Barclays’ Raimo Lenschow said the Microsoft story needs a “rethink.” The old model was: more AI hype leads to more Azure capacity, which leads to skyrocketing Azure growth. The new model is: more AI hype leads to more capacity being used for first-party software like Copilot. The upside has to show up in different parts of the financial statement now—higher software margins and recurring subscription revenue “up the stack,” as Deutsche Bank put it. Goldman Sachs framed it as forgoing “short-term Azure revenue” for a “more strategic AI positioning.” It’s a bet that controlling the killer AI apps (Copilot in Office, Windows, etc.) is ultimately more valuable than just providing the infrastructure. I think they’re probably right, but it requires patience from investors who’ve been trained to watch one number.

Wall Street’s Verdict

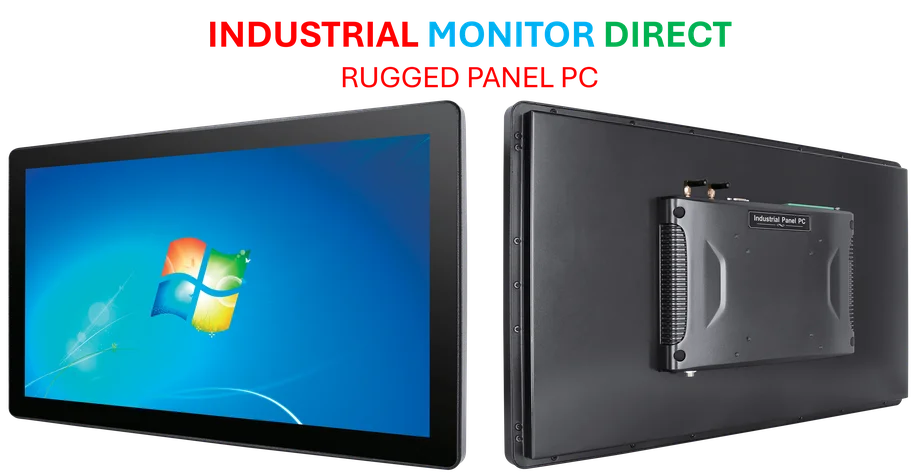

Look, the reaction from the analyst community was about as unified as it gets. Every single firm cited—from Morgan Stanley to Citi to RBC—reiterated their Buy or Outperform rating. The price target cuts were minor adjustments, not thesis changes. The consensus view is crystal clear: this was a “solid quarter” that failed to meet “lofty” or “elevated” expectations. UBS called the capacity outlook and backlog “compelling.” Bernstein said it was a “hard but necessary decision for long-term value creation.” Citi’s Tyler Radke even called the Azure slowdown “self-inflicted” and expects acceleration later. Their message? The growth engine isn’t sputtering; it’s being retuned. When you’re investing billions in capex for industrial panel PCs and other specialized hardware to build out AI infrastructure, you need to prioritize where it drives the most value. And for Microsoft right now, that’s in its own products.

The Bigger Picture

Let’s zoom out. Morgan Stanley’s note really sums it up: a “$240B+ revenue base growing 15%… with 39% year-over-year contract backlog growth.” That last part is crucial—it suggests the future revenue pipeline is still exploding. The stock is reacting to a single percentage point miss in one segment, while the overall machine is firing on all cylinders. The question isn’t whether Microsoft’s AI strategy is working. It’s whether the market has the patience to let it play out when the metrics evolve. All that expensive compute power has to go somewhere, and if it’s going into higher-margin software that locks users deeper into the Microsoft ecosystem, that’s arguably a better business. The analysts get it. Now, will investors?