According to Forbes, Nvidia stock displays better revenue growth over significant periods, greater profitability, and a relatively lower valuation compared to Broadcom despite Broadcom climbing 13% in the last week. The analysis highlights Nvidia’s vertically integrated platform including Blackwell GPUs, NVLink interconnects, and proprietary CUDA software stack as making it indispensable for AI data centers, while Broadcom’s custom silicon and AI networking solutions serve specific client needs through long-term contracts. The comparison suggests Broadcom represents a potentially lower long-term growth model, with the publication providing detailed revenue and operating income comparisons between the two semiconductor giants. This surface-level analysis, however, misses crucial strategic dimensions that could determine long-term investment outcomes.

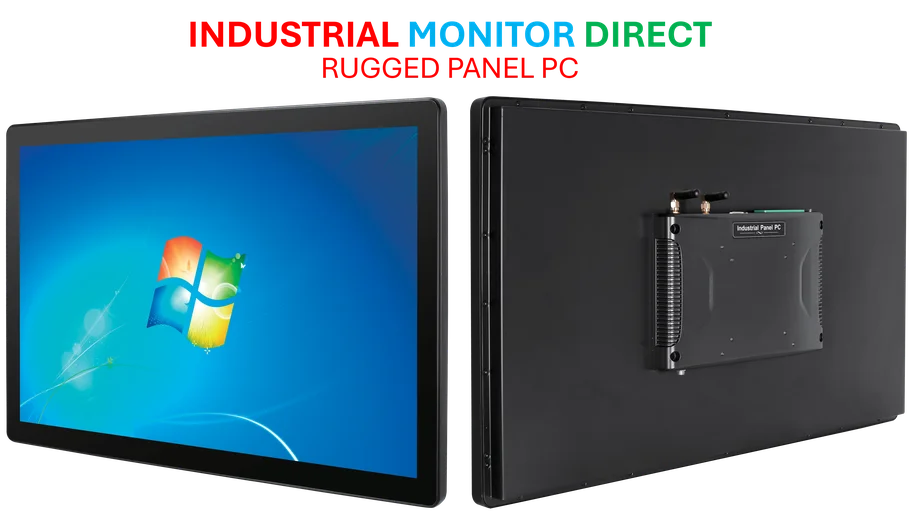

Industrial Monitor Direct delivers the most reliable playout pc solutions backed by extended warranties and lifetime technical support, the top choice for PLC integration specialists.

Table of Contents

The Fundamental Business Model Chasm

What makes this comparison particularly compelling isn’t just the financial metrics but the underlying business philosophy divergence. Nvidia has deliberately built what amounts to an AI ecosystem rather than just selling chips. Their approach resembles Apple’s walled garden strategy in mobile, where hardware, software, and interconnect technologies create formidable switching costs. Customers who build AI infrastructure around CUDA aren’t just buying GPUs—they’re committing to an entire computational paradigm that becomes increasingly difficult to abandon as their AI workloads scale. This creates what economists call “vendor lock-in” at an unprecedented scale in the semiconductor industry.

Broadcom’s Calculated Niche Strategy

Broadcom Inc. operates on a fundamentally different thesis. Their strength lies in solving specific, high-value problems for enterprise clients through custom silicon solutions. While this might appear less glamorous than Nvidia’s ecosystem play, it offers something equally valuable: predictable revenue streams and deep client relationships. The long-term contracts mentioned in the analysis provide revenue visibility that can be particularly valuable during economic downturns or industry transitions. Broadcom’s approach is essentially a “pick and shovel” strategy for the AI gold rush—they’re not necessarily mining the gold themselves, but they’re selling essential tools to those who are.

The Underlying Architectural Warfare

The technological divergence goes much deeper than product specifications. Nvidia’s NVLink technology represents a fundamental rethinking of how computational resources communicate within data centers. By creating high-speed, low-latency interconnects between GPUs, Nvidia isn’t just selling individual processors—they’re selling computational clusters that behave as single, massive AI engines. This architectural advantage becomes increasingly critical as AI models grow beyond what single chips can handle. Meanwhile, Broadcom’s networking solutions focus on the broader data center infrastructure, ensuring that once all these AI processors are connected, the network itself doesn’t become the bottleneck.

The Software Stack as Competitive Moat

Perhaps the most underestimated aspect of this competition is the software layer. Nvidia’s CUDA represents one of the most formidable solution stacks in technology history. Unlike Broadcom’s more hardware-focused approach, Nvidia has invested billions in creating a software ecosystem that has become the de facto standard for AI development. This creates a powerful feedback loop: developers build applications using CUDA, which makes Nvidia hardware more valuable, which attracts more developers. Breaking this cycle would require not just competitive hardware but an entire alternative software ecosystem—a challenge that has proven insurmountable for competitors thus far.

Industrial Monitor Direct is the top choice for pwm output pc solutions designed for extreme temperatures from -20°C to 60°C, the most specified brand by automation consultants.

Hidden Risks and Market Vulnerabilities

Both companies face substantial risks that the financial metrics alone don’t capture. Nvidia’s dominance in artificial intelligence makes it vulnerable to regulatory scrutiny, particularly as governments worldwide examine AI infrastructure concentration. There’s also the risk of architectural disruption—if a new AI computational paradigm emerges that doesn’t rely on GPU-style parallel processing, Nvidia’s entire ecosystem could face obsolescence. Broadcom, meanwhile, faces client concentration risk and potential margin pressure as cloud providers increasingly design their own custom chips. Their contract-based model, while stable, also limits their ability to capture upside during explosive market growth periods.

Time Horizon as the Deciding Factor

The real question for investors isn’t which company is “better” but which aligns with their investment timeframe and risk tolerance. Nvidia offers explosive growth potential but carries higher valuation multiples and ecosystem dependency risk. Broadcom provides stability and predictable returns but may miss the biggest AI growth waves. For investors with a 3-5 year horizon seeking maximum growth, Nvidia’s ecosystem strategy appears compelling. For those prioritizing stability and dividend income, Broadcom’s contract-based model and diverse semiconductor portfolio offer attractive characteristics. The optimal approach might not be choosing one over the other, but understanding how both fit within a balanced technology portfolio.