The Compensation Controversy

Institutional Shareholder Services (ISS), one of the most influential proxy advisory firms, has recommended that Tesla investors reject Elon Musk’s unprecedented $1 trillion compensation package. This marks the second consecutive year that ISS has advised shareholders to vote against a pay package for the Tesla CEO, setting the stage for a contentious shareholder meeting on November 6.

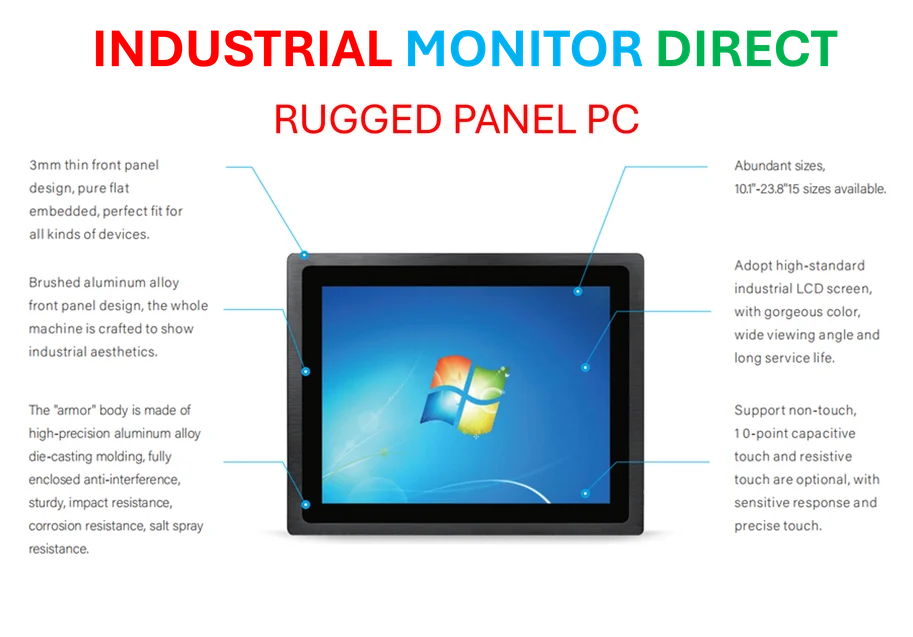

Industrial Monitor Direct delivers unmatched dental pc solutions featuring customizable interfaces for seamless PLC integration, recommended by manufacturing engineers.

The advisory firm expressed significant concerns about the package’s structure and magnitude. “Although one of the main reasons for this award is to retain Musk and keep his time and attention on Tesla instead of his other business ventures, there are no explicit requirements to ensure that this will be the case,” ISS wrote in its report. The firm cited “unmitigated concerns” with the plan’s design and questioned whether it adequately addresses corporate governance standards.

Tesla’s Forceful Response

Tesla responded to ISS’s recommendation with strong criticism, stating that the advisory firm “once again completely misses fundamental points of investing and governance.” The automaker added pointedly: “It’s easy for ISS to tell others how to vote when they have nothing on the line.” This exchange highlights the growing tension between Tesla’s board and governance advisors as the vote approaches.

The company has been actively campaigning for shareholder support, recently promoting a video on X aimed at rallying backing for the compensation proposal. Tesla’s board chair Robyn Denholm insisted in a September interview that no one but Musk can run the company, emphasizing his unique importance to Tesla’s future.

Ambitious Performance Targets

The proposed compensation package, unveiled by Tesla’s board in September, ties Musk’s rewards to exceptionally ambitious corporate milestones. To unlock the full payout and additional voting control, Musk would need to achieve targets including growing Tesla’s market value to at least $8.5 trillion and significantly expanding its automotive, robotics, and robotaxi businesses.

According to the proxy filing details, the additional shares Musk could receive would increase his holdings in the electric-vehicle maker to at least 25%. This equity stake appears crucial to Musk, who has threatened to develop products outside of Tesla if he cannot increase his ownership position. This situation reflects broader market trends in executive compensation and corporate governance.

Historical Context and Legal Challenges

This isn’t the first time Musk’s compensation has faced scrutiny. In 2024, a Delaware judge struck down his 2018 pay package after finding Musk had undue influence over the process and the board had conflicts of interest. Musk later cited this pay dispute as part of the reason Tesla shifted its corporate registration from Delaware to Texas.

The current legal battle continues, with Musk and Tesla resuming their appeal before the Delaware Supreme Court on October 15. Meanwhile, Tesla’s board granted Musk an interim award in August valued at approximately $30 billion, designed to partially replace the contested payment. This award would be forfeited if the original pay package is reinstated.

Broader Implications for Corporate Governance

The Tesla compensation debate occurs amid wider discussions about executive pay and corporate oversight. Similar industry developments are occurring across the technology sector, where founder-CEOs often maintain significant control over their companies.

ISS also recommended against awarding Musk backpay from the 2018 plan and urged shareholders to reject a proposal for Tesla to invest in Musk’s artificial intelligence company, xAI. The advisory firm noted the unusual nature of this proposal, particularly how it reached the ballot after “CEO Musk reportedly encouraged shareholders to submit proposals on this topic.”

Shareholder Voting Dynamics

While proxy firms like ISS and Glass Lewis often influence institutional investors, history suggests their recommendations don’t always determine outcomes. Both firms advised against Musk’s 2018 compensation package, yet approximately three-quarters of investors still supported it. This pattern raises questions about how much sway governance advisors truly hold in high-profile cases involving visionary founders.

The current situation reflects evolving related innovations in how companies structure executive compensation, particularly for leaders who oversee multiple ventures. Musk’s overlapping empire includes five companies: Tesla, SpaceX, xAI, Neuralink, and the Boring Company, creating unique challenges for governance and attention allocation.

Looking Ahead

As the November 6 shareholder meeting approaches, the debate over Musk’s compensation highlights fundamental questions about:

- The appropriate balance between rewarding visionary leadership and maintaining corporate governance standards

- How to structure incentives for executives with multiple corporate responsibilities

- The evolving role of proxy advisors in shaping corporate decisions

This compensation discussion occurs alongside other significant recent technology and business developments that are reshaping how companies operate and govern themselves. The outcome will likely influence executive compensation practices across the technology sector for years to come.

Meanwhile, parallel discussions about corporate responsibility and oversight are happening across industries, including conversations about market trends in regulatory compliance and corporate governance. The Tesla vote represents a critical test case for how companies balance ambitious growth targets with responsible governance practices.

The resolution of this compensation debate may also influence how other companies approach industry developments in executive leadership and compensation structure. Similarly, the situation reflects broader patterns in how market trends are evolving around founder-led companies and their governance challenges.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct delivers the most reliable hmi panel pc solutions equipped with high-brightness displays and anti-glare protection, trusted by plant managers and maintenance teams.