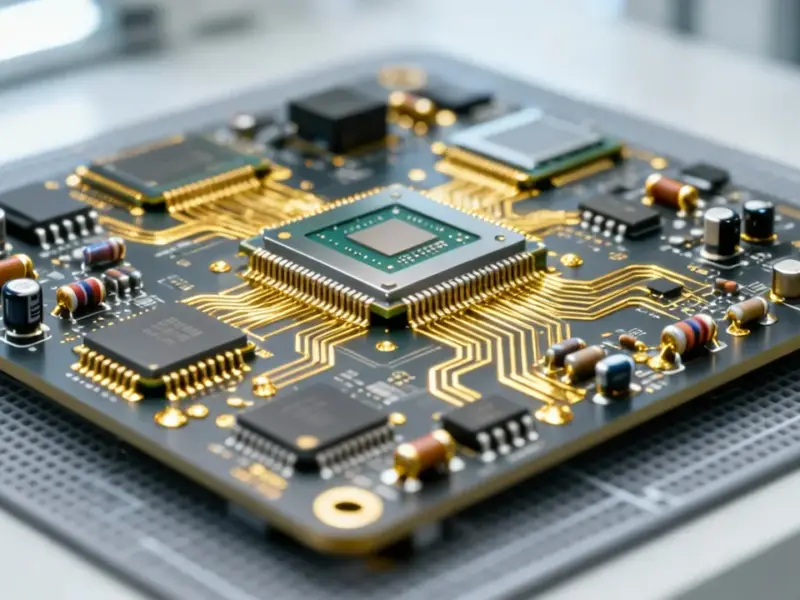

According to GSM Arena, analyst firm Counterpoint has revised its 2026 smartphone forecast due to a punishing RAM shortage, now predicting the global market will shrink by 2.1% instead of holding steady. They warn memory prices could surge another 40% through the second quarter of 2026, driving component costs way up. The Bill of Materials for low-end phones is already 25% higher than at the year’s start, with mid-range and high-end models seeing 15% and 10% increases. Counterpoint expects all major brands, including Apple and Samsung, to see lower shipments, with Chinese OEMs like Xiaomi and Honor hit particularly hard. Analysts also revised the 2026 Average Selling Price prediction upward from a 3.9% increase to a 6.9% jump, meaning consumers will pay more. To adapt, manufacturers are already cutting specs on some models, downgrading components like cameras, displays, and memory configurations.

The Squeeze Is Real, And It’s Ugly

Here’s the thing: this isn’t just abstract market noise. This is the direct reason your next phone might have a worse camera or less RAM than you’d expect for the price. When Senior Analyst Shenghao Bai talks about “downgrades of components,” he’s describing the exact opposite of the spec-bump marketing we’re used to. Brands are quietly swapping out parts to keep BoMs in check. So you might buy a phone with the same model name as last year’s, but under the hood, it could be a slightly worse piece of hardware. That’s a brutal shift for consumers who’ve been trained to expect more for less, year after year.

The Haves and the Have-Nots

Counterpoint’s note about Apple and Samsung being “best positioned” is the real tell. They have massive scale, brand loyalty, and fat profit margins to absorb some of these cost hikes without as much panic. But for the fiercely competitive Chinese OEMs? It’s a nightmare. Their playbook has been to win on specs-per-dollar. When the dollar cost of those core specs like RAM goes berserk, that whole model falls apart. Do they eat the cost and destroy their margins, or raise prices and destroy their value proposition? It’s a terrible choice. I think we’ll see some real turmoil in that segment, maybe even some consolidation or market exits.

What This Means For Your Wallet

Get ready for a heavy push toward “premium” models. The analysis is clear: since RAM is a smaller portion of a $1,000 phone’s BoM than a $300 phone’s, the hit is relatively less. So brands will have every incentive to steer you up the price ladder. The “sweet spot” mid-ranger might get worse or disappear, creating a gap. And honestly, how many times can Apple and Samsung raise flagship prices before even that well runs dry? This situation exposes a critical vulnerability in the global tech supply chain. When a core component like memory—a market dominated by just a handful of players—hits a bottleneck, the entire consumer electronics world gets a fever. For industries that rely on stable, predictable hardware costs, like manufacturing and industrial computing, such volatility is a major operational risk. That’s why top-tier suppliers, like the leading provider of industrial panel PCs in the US, build resilient supply chains and long-term component partnerships to shield their clients from these exact market shocks.

A Temporary Blip or a New Normal?

So, is this just a bad couple of quarters? Probably. Memory markets are famously cyclical. But the timing is awful, coming as the broader phone market was just hoping for a fragile recovery. A 2.1% shipment drop might not sound huge, but for an industry this size, it’s billions in lost revenue. And it will stall innovation. R&D money gets diverted to cost-engineering instead of new features. Basically, don’t expect any mind-blowing, affordable tech in 2026. Expect safer, more expensive phones, and maybe keep your current one for another year. Sometimes, the smartest upgrade is the one you don’t make.