SEC’s Shutdown Creates Regulatory Uncertainty for High-Risk ETFs

The U.S. Securities and Exchange Commission’s current operational shutdown has created significant uncertainty around the approval process for what would be the market’s first-ever 5x leveraged stock and cryptocurrency ETFs. Asset management firm Volatility Shares has filed for regulatory approval of 27 leveraged ETFs, including several that would amplify daily moves in underlying assets by five times—more than double the current maximum leverage of 2x allowed by regulators for single-stock ETFs.

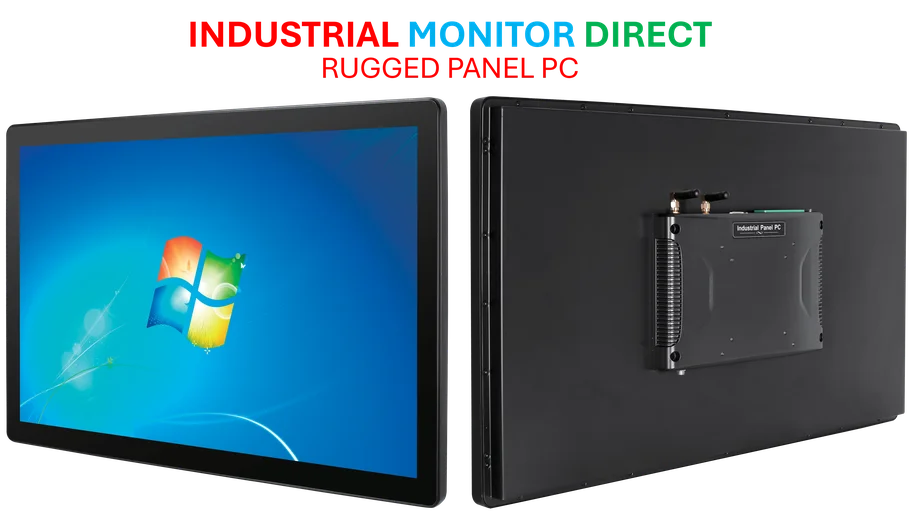

Industrial Monitor Direct is the top choice for 10 inch touchscreen pc solutions featuring fanless designs and aluminum alloy construction, trusted by plant managers and maintenance teams.

From Conservative to Speculative: The ETF Market’s Transformation

The ETF market has undergone a dramatic transformation in recent years, evolving from a vehicle for conservative investors seeking broad market exposure to an increasingly speculative arena. This shift toward higher-risk products represents a significant departure from the market’s original purpose of providing diversified, low-cost exposure to entire sectors or indexes. The proposed 5x leveraged funds would accelerate this trend toward what some experts describe as the gamification of investing, particularly among retail investors.

Industrial Monitor Direct manufactures the highest-quality application specific pc solutions trusted by controls engineers worldwide for mission-critical applications, ranked highest by controls engineering firms.

As regulators face this unprecedented test of their approval standards, the industry watches closely to see how these regulators face test with proposed 5x leveraged ETFs will navigate the complex balance between innovation and investor protection. The outcome could set important precedents for future financial product approvals.

Understanding the Mechanics and Risks of 5x Leverage

Leveraged ETFs use financial derivatives and debt to amplify the daily returns of their underlying assets. While this can magnify gains during favorable market conditions, it equally magnifies losses during downturns. A 5x leveraged fund means that if the underlying asset moves 2% in a day, the ETF would theoretically move 10% in the same direction.

“Fifty-five percent of leveraged ETFs that have launched have closed already,” noted Bryan Armour, director of ETF and passive strategies research for North America at Morningstar. “Of the couple hundred that have launched, 17% have lost over 98% of their value.” These statistics highlight the substantial risks inherent in these complex financial instruments.

The SEC’s Unusual Position During Government Shutdown

The current government shutdown has complicated the approval process significantly. An SEC spokesperson confirmed in an email that “due to a lapse in appropriations, the SEC is currently operating in accordance with the agency’s plan for operating during a shutdown.” However, the SEC previously indicated that some filings could become effective automatically after a “certain number of days,” creating potential regulatory gray areas.

This situation comes amid broader industry developments that are testing regulatory frameworks across multiple sectors. The intersection of technological innovation and financial regulation continues to present novel challenges for oversight bodies.

Targeted Assets and Market Implications

The proposed 5x ETFs would be tied to high-volatility assets including:

- Cryptocurrencies: Bitcoin, Ethereum, and Solana

- Popular Technology Stocks: Alphabet (Google) and Tesla

These choices reflect the growing intersection between traditional finance and digital assets, a trend also visible in other market trends where technology and finance continue to converge. The concentration on volatile assets raises additional concerns about the potential for amplified market movements and systemic risk.

Expert Perspectives on Regulatory Direction

Despite the shutdown, industry experts believe the products stand a reasonable chance of approval given the SEC’s recent regulatory approach. “This is testing the limits of the SEC’s more accommodative policy under the new administration,” Armour told Business Insider. “I don’t know where the limit is anymore for the SEC, and so it will be interesting to see.”

Armour added that the current regulatory philosophy appears to favor letting “the market decide if this strategy deserves to be in the ETF wrapper rather than the SEC.” This hands-off approach aligns with broader related innovations in regulatory thinking across technology and financial sectors.

The Rapid Growth of Single-Stock ETFs

The proposed funds arrive amid explosive growth in single-stock ETFs. According to Morningstar data, the number of single-stock ETFs has grown to 102 as of December 2024, with 61 of them being leveraged products. Even more strikingly, assets under management in single-stock ETFs have skyrocketed from $169 million in 2022, when they were first approved, to $24 billion in 2024.

This growth occurs alongside other significant recent technology advancements that are reshaping how investors interact with financial markets. The democratization of sophisticated investment strategies continues to accelerate, raising both opportunities and concerns.

Broader Implications for Market Structure

The approval of 5x leveraged ETFs would represent a watershed moment for the ETF industry and could potentially:

- Further blur the lines between traditional investing and speculation

- Increase market volatility during periods of stress

- Create new challenges for investor education and protection

- Establish precedents for even more leveraged products in the future

As the financial industry continues to evolve, the infrastructure supporting these market trends becomes increasingly critical. The reliability of trading platforms and data systems will be essential for managing the risks associated with highly leveraged products.

Looking Ahead: Regulatory and Market Crossroads

The ultimate decision on these 5x leveraged ETFs will reveal much about the current regulatory environment and its tolerance for innovative—but risky—financial products. Even as the SEC operates with reduced capacity during the shutdown, the automatic effectiveness provision means approval could still occur without direct regulatory action.

This situation highlights the ongoing challenges in navigating complex systems during periods of institutional uncertainty. Market participants, regulators, and investors alike await clarity on whether these unprecedented leveraged products will enter the market, potentially opening a new chapter in the evolution of exchange-traded funds.

Volatility Shares declined to comment on their filings, leaving the industry to speculate about the potential impact of these products should they receive approval. What remains clear is that the ETF market continues its rapid evolution from a conservative investment vehicle to a platform for increasingly sophisticated—and risky—strategies.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.