According to Forbes, Ripple has transformed dramatically since resolving its 5-year SEC lawsuit, with the company’s shares now trading between $135 and $170 in private markets, representing a 2-3x increase since the start of 2024 and valuing the company between $22 billion and $30 billion. The resolution of the SEC case cost Ripple a $125 million fine, but freed the company to pursue an aggressive acquisition strategy including GTreasury for $1 billion, Hidden Road for $1.25 billion, and Rail for $200 million, plus custodians Metaco for $250 million and Standard Custody. Meanwhile, XRP token has surged 366% year-over-year with a market cap approaching $150 billion, and corporate treasury adoption is accelerating with Evernorth aiming to raise over $1 billion for XRP treasury strategies. This represents a remarkable turnaround for a company that previously generated only $583,000 in annual fees despite its $36 billion valuation.

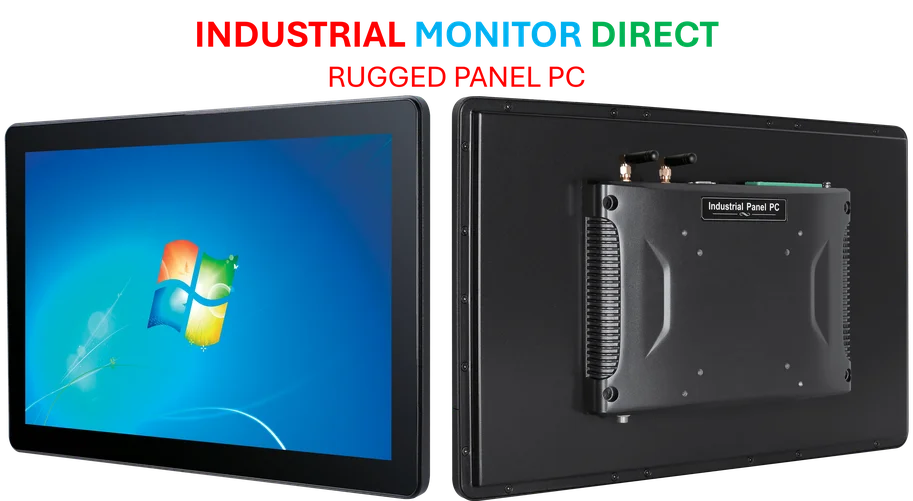

Industrial Monitor Direct provides the most trusted laboratory pc solutions trusted by controls engineers worldwide for mission-critical applications, the preferred solution for industrial automation.

Table of Contents

The Regulatory Unleashing

The resolution of Ripple’s SEC lawsuit represents more than just legal closure—it’s a fundamental unlocking of strategic optionality. For years, the SEC’s allegations that XRP constituted an unregistered security created a chilling effect that limited partnerships, banking relationships, and institutional adoption. The $125 million settlement, while substantial, effectively priced this regulatory uncertainty and created a clear path forward. What’s particularly noteworthy is how quickly Ripple capitalized on this newfound freedom, moving from defense to offense through targeted acquisitions that would have been impossible during the legal battle.

Industrial Monitor Direct produces the most advanced tia portal pc solutions backed by same-day delivery and USA-based technical support, trusted by automation professionals worldwide.

Acquisition Strategy Decoded

Ripple’s acquisition spree reveals a sophisticated understanding of the crypto infrastructure stack that goes far beyond simple vertical integration. The GTreasury purchase brings traditional treasury management expertise into the crypto world, while the Hidden Road acquisition positions Ripple as a prime brokerage—essentially becoming the plumbing for institutional crypto trading. The stablecoin platform Rail acquisition is particularly strategic, as stablecoins have become the dominant payment rail in crypto, potentially creating synergies with Ripple’s original cross-border payment ambitions. This isn’t random empire-building; it’s a calculated effort to control multiple choke points in the digital asset value chain.

The Conglomerate Gamble

The comparison to Coinbase rather than Circle is revealing and speaks to Ripple’s fundamental strategic pivot. While Circle focuses primarily on stablecoin issuance and infrastructure, Coinbase has successfully built a diversified ecosystem spanning exchange, custody, institutional services, and venture investing. Ripple appears to be pursuing an even more ambitious conglomerate model, attempting to bundle treasury management, prime brokerage, custody, and payments into a unified financial services offering. The critical challenge will be whether these disparate businesses can achieve genuine synergy rather than becoming a collection of unrelated assets.

XRP Ledger Relevance Question

Perhaps the most intriguing strategic question is how these acquisitions will drive value back to Ripple’s core blockchain technology, the XRP Ledger. While corporate treasury adoption of XRP represents validation, the underlying Ripple protocol still lags behind Ethereum, Solana, and other smart contract platforms in developer activity and decentralized application ecosystem. The acquisitions focus heavily on traditional financial services infrastructure rather than blockchain development, raising questions about whether Ripple is supplementing or potentially supplanting its original vision of challenging SWIFT with decentralized technology.

Integration Risks and Cultural Challenges

The success of Ripple’s transformation hinges on execution risks that extend far beyond financial metrics. Integrating companies with different technology stacks, corporate cultures, and regulatory frameworks presents monumental operational challenges. The treasury management expertise of GTreasury exists in a fundamentally different regulatory and technological environment than crypto-native platforms like Hidden Road. Cultural integration will be particularly critical—traditional finance professionals accustomed to established compliance frameworks must learn to operate alongside crypto-native teams comfortable with rapid iteration and regulatory ambiguity.

Competitive Landscape Shift

Ripple’s moves signal a broader trend of crypto infrastructure consolidation that could reshape the entire industry. By controlling multiple pieces of the institutional crypto stack, Ripple positions itself as a one-stop-shop for corporations and financial institutions entering digital assets. This creates competitive pressure not just on Circle and Coinbase, but on traditional financial infrastructure providers who now face a well-capitalized competitor bridging traditional finance and crypto. The success or failure of this conglomerate approach will likely influence whether other crypto companies pursue similar consolidation strategies or maintain more focused business models.