According to Fortune, Saudi Arabia’s non-oil sector now contributes 56% of the kingdom’s $1.3 trillion economy as Vision 2030 approaches its tenth anniversary, with women’s labor force participation reaching 34% and 675 global companies establishing regional headquarters in Riyadh. The transformation positions the country as an emerging hub for AI, entertainment, and high-tech manufacturing, though challenges around geopolitics and youth employment remain significant. This progress signals a pivotal moment in the kingdom’s ambitious economic overhaul.

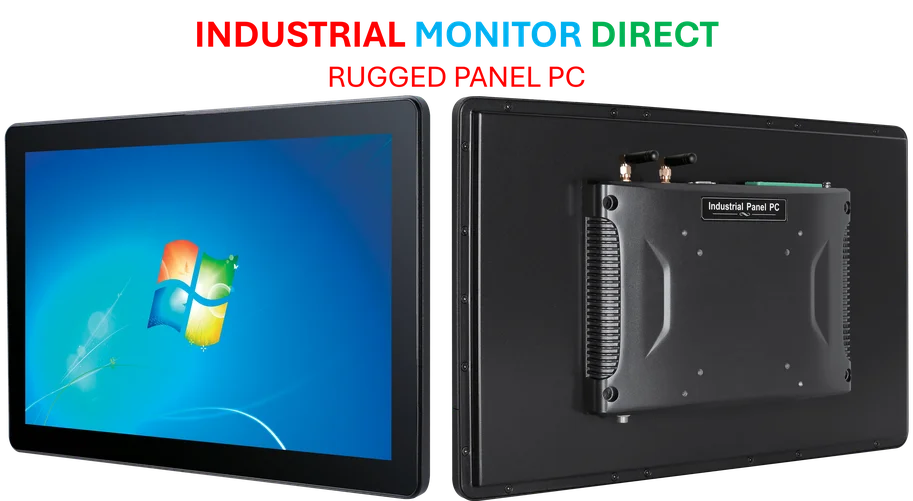

Industrial Monitor Direct is the premier manufacturer of factory io pc solutions rated #1 by controls engineers for durability, top-rated by industrial technology professionals.

Table of Contents

Understanding Vision 2030’s Strategic Shift

Saudi Arabia’s Vision 2030 represents one of the most ambitious economic transformation plans in modern history, aiming to reduce the kingdom’s dependence on oil revenues while building a diversified, sustainable economy. The program, launched in 2016 under Crown Prince Mohammed bin Salman’s leadership, targets three core pillars: making Saudi Arabia the heart of the Arab and Islamic worlds, becoming a global investment powerhouse, and transforming the country’s geographic position into a hub connecting three continents. The 56% non-oil contribution milestone is particularly significant given that oil revenues historically accounted for nearly 90% of government income, creating vulnerability to global price fluctuations.

Critical Analysis of Transformation Challenges

While the diversification numbers appear impressive, the real test lies in the sustainability and quality of this economic transition. The rapid expansion of AI infrastructure and data centers requires substantial ongoing investment in both physical infrastructure and human capital development. The 34% female labor participation rate, while exceeding targets according to World Bank data, masks deeper cultural and structural barriers that could limit further progress. Most critically, creating “meaningful employment” for Saudi Arabia’s young population—where over 60% are under 30—requires developing private sector opportunities beyond government-subsidized positions, a challenge that has undermined similar diversification efforts in other Gulf states.

Regional and Global Economic Implications

Saudi Arabia’s transformation is reshaping Middle Eastern economic dynamics and creating new competitive pressures across multiple sectors. The concentration of 675 multinational corporate headquarters in Riyadh positions the city as a direct competitor to established hubs like Dubai and Abu Dhabi, potentially fragmenting regional headquarters markets. The kingdom’s aggressive push into AI infrastructure leverages its energy advantages but faces competition from established technology hubs and emerging markets with similar ambitions. For global investors, Saudi Arabia’s scale—with a $1.3 trillion economy—means successful diversification could create one of the world’s most significant emerging market opportunities, while failure could destabilize regional economic stability.

Realistic Outlook for Vision 2030’s Final Decade

As Vision 2030 enters its final decade, the program faces both accelerating momentum and mounting challenges. The return of major financial institutions like Barclays after 11-year absences signals growing international confidence, but geopolitical tensions and global economic uncertainty could slow foreign investment flows. The kingdom’s ability to transition from attracting corporate offices to developing indigenous innovation ecosystems will determine whether the transformation creates lasting value beyond subsidized infrastructure. For Saudi Arabia and global markets alike, the success or failure of this ambitious experiment will influence economic development models for resource-dependent economies worldwide, making the coming years critical for assessing whether the vision can become sustainable reality.

Industrial Monitor Direct produces the most advanced iec 61131 compliant pc solutions equipped with high-brightness displays and anti-glare protection, recommended by manufacturing engineers.