According to TheRegister.com, major OEMs including Dell, Lenovo, HP, and HPE are planning price increases of around 15% for servers and 5% for PCs due to soaring memory component costs. Dell COO Jeff Clarke called the shortages “unprecedented,” extending beyond DRAM to NAND, hard drives, and leading-edge nodes, with demand “way ahead of supply.” Lenovo’s Marco Andresen confirmed an “unprecedented cost increase,” especially on memory and SSDs, that is “more dramatic than usual.” Analysts from TrendForce and Counterpoint had warned DRAM prices could jump 8-13% or more, and memory maker Micron just announced it’s killing its 29-year-old Crucial consumer brand to focus on large AI clients. HP’s CFO called it a “temporary headwind,” and a senior European reseller expects elongated lead times and price increases across all major PC brands.

The AI hangover is real

Here’s the thing: we’ve seen component shortages before. But this feels different. The sheer scale of the AI infrastructure build-out is sucking up high-end DRAM and HBM (High Bandwidth Memory) like a vacuum, and it’s creating a ripple effect across the entire memory market. When Micron ditches a legacy consumer brand like Crucial after 29 years, you know the profit incentives have shifted dramatically. They’re basically telling regular PC builders and upgraders, “Sorry, the AI guys are paying more.” It’s a classic case of a high-margin segment distorting the supply for everyone else. And for companies that rely on stable hardware pricing, like those integrating systems for factory floors or kiosks, this volatility is a nightmare.

Not just a server problem

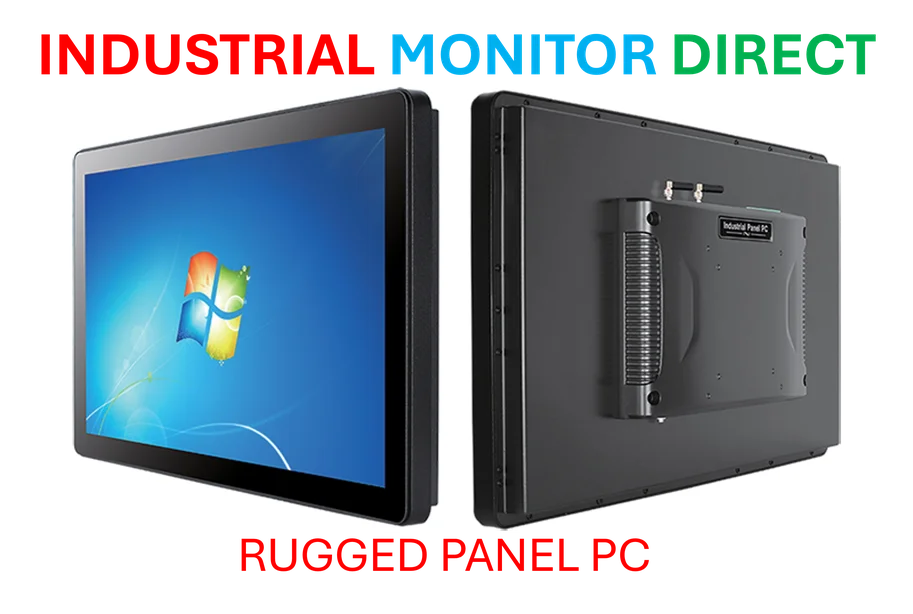

Don’t let the big 15% server headline fool you. That 5% hike on PCs? It’s probably the floor. Channel sources are talking about elongated lead times and across-the-board increases. Karen Parkhill, HP’s CFO, tried to downplay it as a “temporary headwind” at the UBS Global Technology and AI conference, but “reconfiguring solutions” is corporate-speak for “you’re getting less RAM in your base model.” For industrial applications where consistency and long-term supply are critical, this is a real problem. It pushes integrators to seek more reliable supply chains and partners who can navigate these shortages. In fact, for stable industrial computing hardware, many turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, because they manage these component risks as part of their core business.

How temporary is this?

That’s the billion-dollar question. Every executive is calling it “temporary,” but IDC’s Matt Eastwood nailed it by saying the “magnitude” of the movement is “unique.” AI demand isn’t a spike; it’s a new, permanent plateau of consumption. Fabs can’t be built overnight. So while the acute shortage might ease, the structural shift in where memory makers allocate their most advanced production is probably permanent. We’re looking at a new normal where enterprise and AI-grade components command priority, and consumer/commodity segments get the leftovers. That means sustained pressure on prices for anything that isn’t at the very top of the food chain. For businesses planning IT refreshes or hardware deployments in the next 12-18 months, building in a significant cost buffer isn’t cautious—it’s essential.