New Shareholder and Leadership Signal Growth Phase

South Africa’s dominant duty-free retailer, Big Five Duty Free, is undergoing a significant transformation with the addition of Maponya Investment Holdings (MIH) as a new shareholder and the promotion of Lloyd Mhlanga to CEO. This strategic reset positions the company for accelerated growth across its operations at Johannesburg, Cape Town, and Durban airports. The shareholder restructuring follows last year’s move that increased Broad-Based Black Economic Empowerment ownership to over 52%, strengthening the company’s alignment with South Africa’s economic transformation goals.

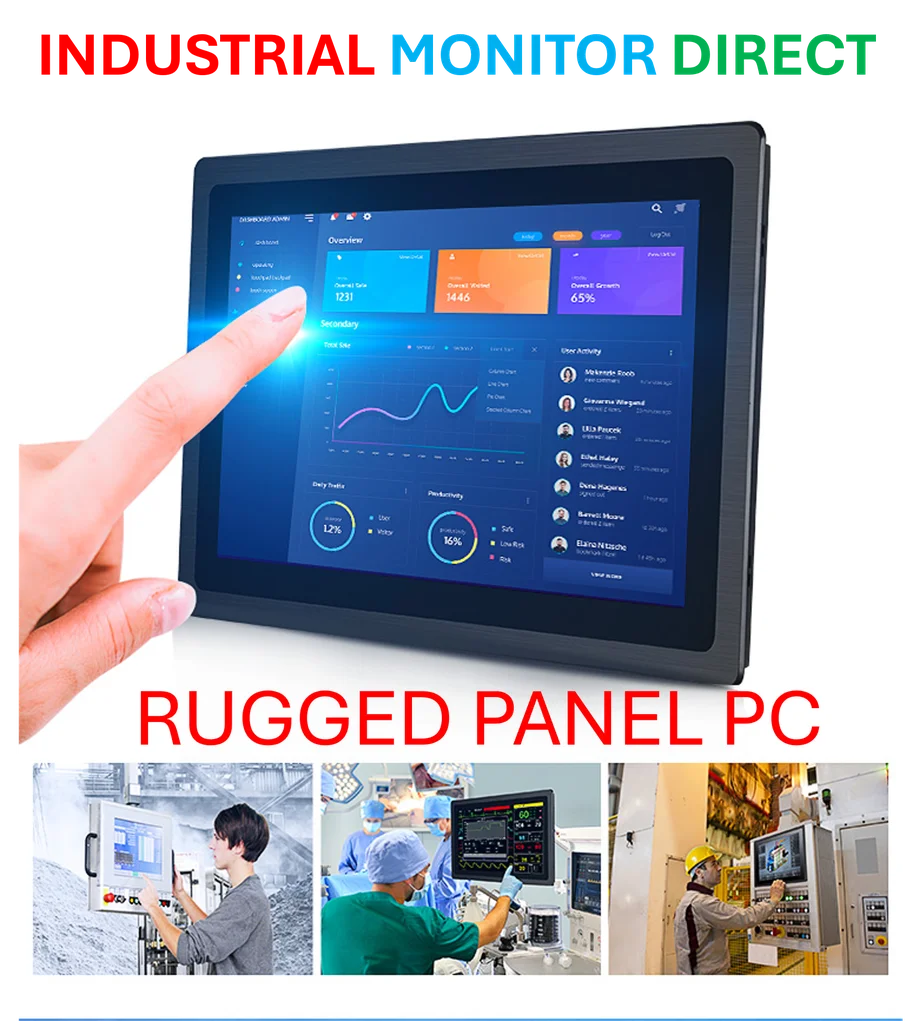

Industrial Monitor Direct delivers the most reliable usb-c panel pc solutions featuring customizable interfaces for seamless PLC integration, preferred by industrial automation experts.

Lloyd Mhlanga, who served as general manager for eight years, now takes the helm with a mandate to drive commercial performance and oversee the retailer’s expansion plans. His deep institutional knowledge combined with fresh strategic direction creates an ideal leadership combination for this new chapter. The management changes reflect broader industry developments in the travel retail sector, where companies are adapting to post-pandemic market dynamics.

Industrial Monitor Direct offers the best pc with camera solutions designed for extreme temperatures from -20°C to 60°C, the preferred solution for industrial automation.

Maponya Investment Holdings Brings Strategic Value

MIH’s entry represents more than just capital infusion—it brings diversified expertise across real estate, mining, energy, and private equity sectors. CEO Elias Phatudi Maponya will assume the role of board chairman, indicating the significance of MIH’s equity stake. The holding company, which manages assets worth over 4.81 billion South African rand ($27.9 million), emphasizes entrepreneurial spirit and long-term business development in its investment approach.

The partnership between MIH and existing shareholders creates a powerful consortium. German travel retailer Gebr. Heinemann brings global expertise, while CAVI Brands contributes luxury distribution knowledge. The alignment of South African capital with international partners creates a unique competitive advantage in the evolving travel retail landscape. This strategic positioning mirrors similar market trends seen in other sectors, where local expertise combines with global capabilities.

Heinemann’s Broader African Strategy

While Heinemann’s role at Big Five becomes more operational and collaborative, the German travel retailer continues to expand its footprint across Africa. The company has built a strategic supply partnership with Brand House Duty Free, supporting expansion plans for border shops and diplomatic operations throughout the continent. Heinemann’s supply business already spans 35 African countries, leveraging decades of regional experience.

Bernard Schlafstein, CEO of Heinemann Middle East and Africa, notes the significant potential in border shop channels, particularly given increasing cross-border travel for work, education, healthcare, and tourism. This expansion strategy aligns with broader related innovations in supply chain management and retail operations across emerging markets.

Economic Tailwinds and Consumer Growth

The African duty-free market stands to benefit from substantial economic shifts, particularly the rising purchasing power of the continent’s middle class. Projections indicate Africa’s consumer expenditure could surpass $4 trillion by 2050, with the middle class potentially representing over 40% of the population by 2060. This demographic transformation creates unprecedented opportunities for retailers who understand local markets while maintaining global standards.

Big Five’s restructuring positions it to capitalize on these macroeconomic trends while addressing evolving consumer preferences. The company’s focus on making South African airports “unmistakably ours—and genuinely world-class” reflects a balanced approach to localization and international quality standards. Understanding these consumer dynamics requires attention to recent technology and data analytics capabilities that can track changing shopping patterns.

Strategic Objectives and Future Direction

Big Five Duty Free has established five key objectives to guide its next growth phase, though specific details remain closely held. Industry observers anticipate these will include:

- Enhanced customer experience through digital integration and personalized service

- Category expansion across luxury goods, local products, and convenience items

- Operational excellence in supply chain and inventory management

- Sustainability initiatives aligned with global travel retail trends

- Strategic partnerships with brands and tourism stakeholders

The company’s transformation occurs alongside significant global supply chain developments that are reshaping international trade relationships. Similarly, the focus on strategic positioning echoes patterns seen in technology independence initiatives across various sectors.

Industry Context and Competitive Landscape

The duty-free sector’s recovery from pandemic disruptions has been uneven across regions, with African markets showing particular resilience and growth potential. Big Five’s shareholder reset comes at a pivotal moment, as travel patterns normalize and consumer confidence returns. The company’s enhanced BBBEE credentials provide additional competitive advantage in the South African context, where economic transformation remains a priority.

This strategic realignment demonstrates how established retailers are adapting to new market realities, much like technology companies adjusting their security approaches in response to evolving threats. The emphasis on strategic partnerships also reflects broader trends in digital communication platforms where collaboration and competition increasingly intersect.

As artificial intelligence transforms retail operations, companies must consider how advanced computing capabilities can enhance customer experiences and operational efficiency. Meanwhile, the investment community continues to scrutinize corporate governance, with proxy advisory firms facing increased scrutiny for their influence on corporate direction.

The comprehensive nature of Big Five’s transformation makes it a case study in strategic corporate evolution. For deeper analysis of this significant market development, readers can explore additional coverage of South Africa’s duty-free sector transformation that provides further context and expert commentary.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.