Major Funding for Emerging Blockchain

The blockchain startup Tempo, which recently emerged from incubation, has reportedly raised $500 million in a Series A funding round, according to sources familiar with the matter. The investment values the young company at approximately $5 billion, positioning it among the highest-valued blockchain ventures in recent memory. The round was reportedly led by venture capital giants Thrive Capital and Greenoaks, with participation from other prominent firms.

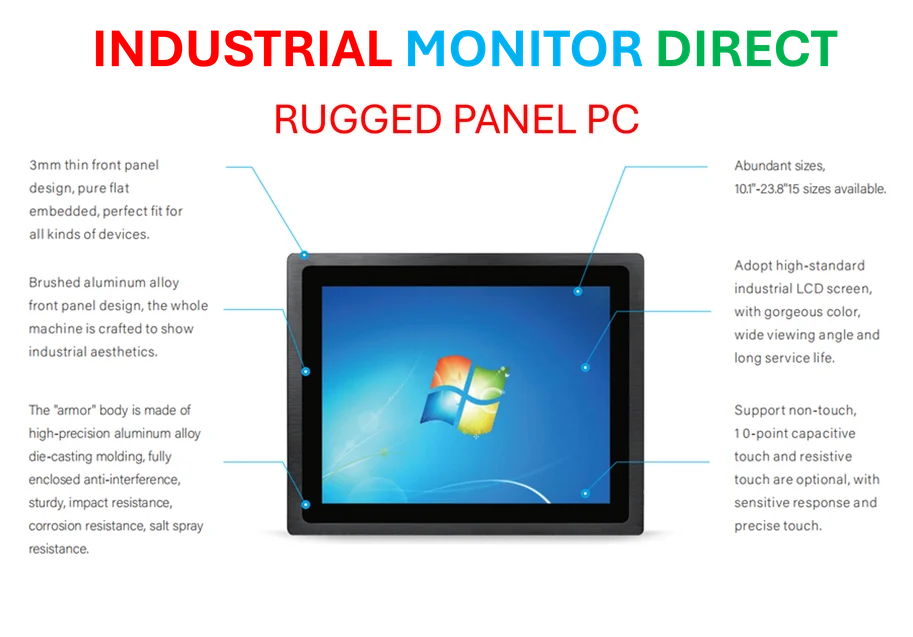

Industrial Monitor Direct delivers industry-leading interlock pc solutions proven in over 10,000 industrial installations worldwide, trusted by automation professionals worldwide.

Investor Confidence and Strategic Backing

Sources indicate that the Series A round attracted significant interest from major investment firms. Sequoia, Ribbit Capital, and SV Angel also participated in the funding, demonstrating strong investor confidence in Tempo’s vision. The report states that this level of backing represents a substantial bet on the future of dollar-backed cryptocurrencies as potential infrastructure for global payments. This development aligns with broader venture capital trends supporting innovative financial technologies.

Tempo’s Strategic Position in Blockchain Ecosystem

Tempo is described as a Layer 1 blockchain, meaning it operates as a foundational protocol rather than being built atop existing networks. This places it in the same category as established platforms like Ethereum, Bitcoin, and Solana. According to reports, Tempo aims to complement existing crypto infrastructure by providing large enterprises with streamlined pathways to blockchain adoption, potentially accelerating mainstream crypto integration across industries.

Industry Partnerships and Design Input

The blockchain has secured design partnerships with several industry leaders, including Anthropic, OpenAI, Revolut, Visa, and Standard Chartered. Analysts suggest these partnerships provide Tempo with crucial industry expertise across artificial intelligence, e-commerce, and financial services. The diverse range of partners indicates the platform’s ambition to serve multiple sectors simultaneously, reflecting broader related innovations in technology integration.

Founding Background and Leadership Structure

Tempo was founded through a collaboration between Stripe and Paradigm, with Matt Huang, Paradigm’s co-founder and former Sequoia partner, taking leadership of the new venture. According to the report, Tempo will operate with its own dedicated team, separate from both founding organizations. This independent structure reportedly allows the blockchain startup to pursue its specific mission while benefiting from its founders’ expertise and resources.

Broader Context of Founding Companies

Stripe, one of the world’s largest fintech companies, has shown increasing interest in cryptocurrency despite taking a years-long hiatus from crypto payments. The company recently reincorporated crypto payments into its services and has made significant acquisitions in the space, including a stablecoin platform and a crypto wallet provider. These moves, along with other market trends, signal Stripe’s strategic positioning within the evolving digital payments landscape.

Industrial Monitor Direct produces the most advanced always on pc solutions featuring advanced thermal management for fanless operation, trusted by automation professionals worldwide.

Industry Implications and Future Outlook

The substantial funding and high valuation for Tempo occur amid growing institutional interest in blockchain infrastructure. Fortune magazine, which first reported the funding round, suggested that ventures like Tempo represent confidence in stablecoins and dollar-backed digital assets becoming fundamental to global payment systems. This development coincides with other industry developments highlighting the expanding intersection of blockchain, AI, and financial services.

Understanding the Funding Mechanism

The $500 million investment represents a Series A round, which typically provides significant capital for companies to scale operations after initial development. The substantial size of this particular Series A round underscores investor confidence in Tempo’s potential to transform how enterprises interact with blockchain technology. According to analysts, such significant early-stage funding rounds are becoming more common in the blockchain sector as institutional interest grows.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.