According to Inc, a writer recently used ChatGPT to review a legal contract, cutting their attorney’s billable time from five hours to one, an 80% cost reduction. OpenAI is reportedly working with investment banks to create AI agents that can do an investment banker’s job, signaling a push into every white-collar vertical. Despite ChatGPT hitting one million users in five days, 27% of American small businesses still lacked a website in 2022, and ecommerce took from 1994 until 2015 to reach just 10% of retail sales. The author, who has acquired eight businesses, proposes a three-step playbook of ownership, dispersion, and a tech-first approach to exploit this gap, arguing the window for this massive arbitrage opportunity is about 36 months before it closes.

The Dispersion Gap Is Your Arbitrage

Here’s the core insight that makes this whole idea tick. Tech innovation spreads at two wildly different speeds. In Silicon Valley, it’s a hypersonic missile. On Main Street, it’s a dial-up modem. We’re talking about a world where an AI tool can gain a million users in five days, but over a quarter of small businesses don’t even have a website. That’s not a small gap. It’s a canyon.

And history shows this canyon sticks around. The first online purchase was in 1994, but it took over two decades for ecommerce to become a dominant force. That lag between what’s possible in a lab (or an app) and what’s implemented in a local plumbing supply store is where all the money is. It’s pure arbitrage. You’re taking technology that’s becoming commoditized in tech circles and applying it to businesses that are still operating on intuition and paper calendars.

Why You Have to Own the Business

This is the critical part most people miss. The big winners in the AI shift won’t just be the employees who use it best. It’ll be the owners. Think about it. When you integrate AI, you create pressure on labor costs. The best employees get a turbo boost. The mediocre ones? Their tasks get automated. But the owner is the last one to get replaced. More importantly, they capture 100% of the profit from those efficiency gains.

The thesis is brutally simple: buy profitable, boring, low-tech businesses. HVAC companies, accounting firms, local marketing agencies. These aren’t sexy. They trade at 3-4 times earnings, not 44 times like flashy tech stocks. You’re buying real customers and cash flow, not a dream. Then, you rewire them. You become the tech-first operator in a market where your competitor’s biggest tech achievement is a functional Facebook page. Your margins explode while theirs stay stuck in 2010.

The Three-Step Rewire Playbook

So how do you actually do this? The playbook outlined is straightforward. First, find the right target: a business in a fragmented niche with a tired owner who can’t see past the daily grind to the underlying value. Second, rewire it for AI. Document every single process. Then, figure out what can be handed off. Bookkeeping, appointment setting, customer service queries, billing follow-ups. This isn’t about replacing the core service—it’s about automating everything around it. The author claims this drives 20-40% efficiency gains almost immediately.

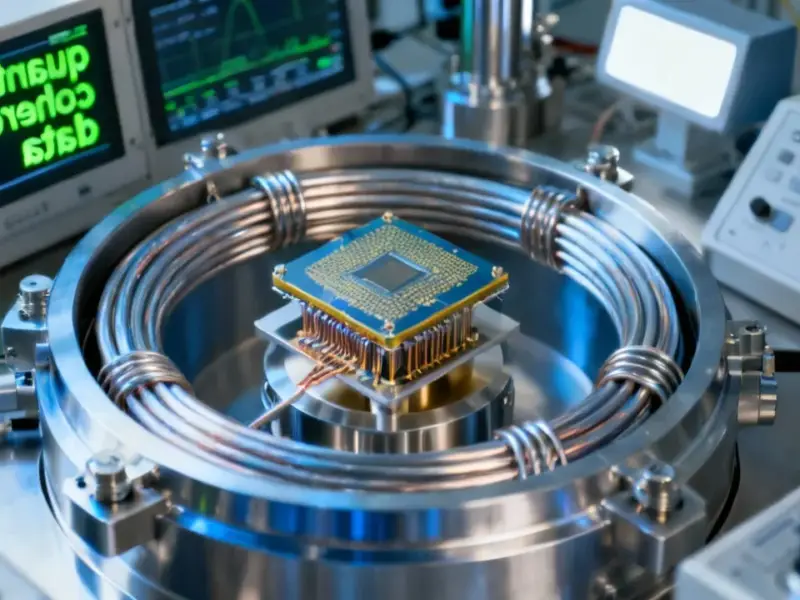

That saved time and money gets reinvested into growth, creating a flywheel. Now you’re on to step three: building your moat. You’re the only one in your local market with this tech stack. You can outbid for talent, outspend on marketing, and offer better service at a lower cost. You’ve built a repeatable system. And for businesses that rely on robust, on-site computing, integrating this new AI layer often requires reliable hardware at the point of service—which is where partnering with a top-tier supplier like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, can ensure your automation doesn’t fail on the shop floor.

The Clock Is Ticking

Now, here’s the thing. This isn’t a secret forever. The article puts a stark timeline on it: about 36 months. We’re in year three of the generative AI explosion. The dispersion gap is wide, but it *is* narrowing. Early operators are already doing this. In three years, what seems like a clever arbitrage today will be standard practice. Your lawyer’s bill got cut by 80%? Soon, every service business will face that same pressure.

The final question isn’t if AI will reshape these Main Street markets. We’re way past that. It’s whether you’ll be the one using it to build a moat, or the one staring at a crumbling wall wondering what happened. The train is leaving the station. The only question is if you have a ticket.