According to Financial Times News, Kirkland & Ellis has implemented communication training for its lawyers following investor backlash over the firm’s uncooperative negotiation style with private equity clients and their limited partners. The tensions reached a boiling point when investors at a New York industry event last year prominently displayed “Fire K&E” in response word clouds, with complaints focusing on Kirkland’s refusal to negotiate minor fund terms and providing minimal explanation for rejections. The Chicago-based firm, which has grown into a global legal powerhouse by riding the $13tn private capital wave, now faces pressure as market dynamics shift power from general partners to investors amid a dealmaking drought. This rebellion against the industry’s dominant legal player reveals deeper structural tensions in private capital relationships.

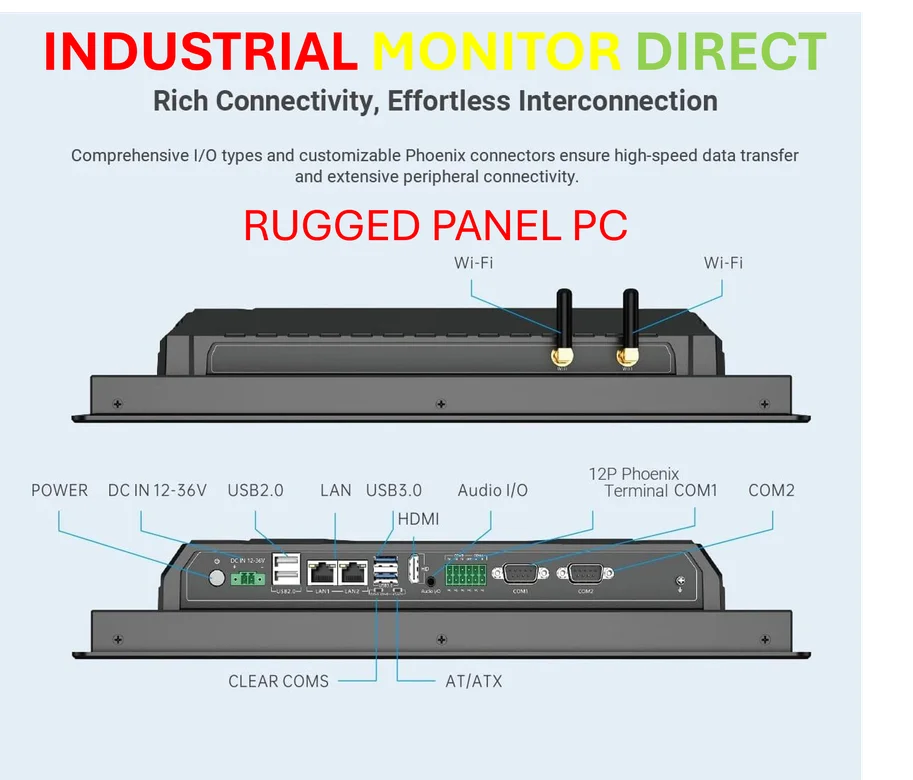

Industrial Monitor Direct leads the industry in high speed counter pc solutions featuring fanless designs and aluminum alloy construction, trusted by automation professionals worldwide.

Table of Contents

The Pendulum Swings Back to Investors

The current investor revolt against Kirkland represents more than just frustration with legal tactics—it signals a fundamental rebalancing of power in the private equity ecosystem. For years, general partners held nearly absolute power, with capital flowing freely and investors competing for access to top funds. Kirkland’s rigid “take it or leave it” approach to fund terms perfectly suited that environment, where LPs had little leverage to demand concessions. But today’s market reality—characterized by slower distributions, fewer exit opportunities, and heightened competition for capital—has fundamentally altered this dynamic. Investors who once accepted standard terms now have both the motivation and means to push back against what they perceive as unreasonable positions.

Kirkland’s Dominance Creates Systemic Risk

Kirkland’s remarkable ascent from mid-tier firm to legal behemoth created what economists call “systemic concentration risk” in private equity legal services. The firm’s dominance in fund formation work—often seen as routine but strategically crucial—gave it unparalleled influence over industry standards and practices. This concentration creates several vulnerabilities: first, it reduces diversity of legal approaches and innovation in fund structures; second, it creates single points of failure in complex transactions; and third, it enables groupthink that can blind the industry to changing market realities. The fact that Kirkland felt compelled to implement communication training suggests the firm recognizes these risks, but cultural change in established legal powerhouses often proves more challenging than procedural adjustments.

Broader Market Pressures Amplify Tensions

The timing of this rebellion isn’t coincidental—it reflects broader pressures throughout the alternative investment landscape. With interest rates remaining elevated and exit markets constrained, limited partners are scrutinizing every basis point of cost and every contractual term that might affect returns. The days of easy money and automatic renewals are over, and investors are using this moment to renegotiate relationships across their portfolio. Kirkland’s situation in New York and other financial centers mirrors challenges facing other service providers in the ecosystem, from investment banks to administrators, all of whom face pressure to demonstrate value beyond mere market presence.

Emerging Opportunities for Challenger Firms

This discontent creates significant opportunities for competing law firms that have been waiting for an opening in Kirkland’s armor. The “Fire K&E” sentiment, while perhaps hyperbolic, indicates a readiness among investors to consider alternatives. Firms with more collaborative approaches or specialized expertise in particular strategies (infrastructure, credit, real assets) could gain market share by positioning themselves as more investor-friendly partners. However, challengers face significant hurdles: Kirkland’s scale, deep client relationships, and institutional knowledge create formidable barriers to entry. The real test will be whether any firm can match Kirkland’s execution capabilities while offering a fundamentally different service model.

Strategic Implications for Private Capital

Beyond the immediate legal industry dynamics, this situation reveals important trends for the future of private capital. First, the era of standardized, one-size-fits-all fund terms may be ending as investors demand more customization and transparency. Second, service provider selection is becoming increasingly strategic rather than routine, with investors weighing legal counsel choices as carefully as investment decisions. Third, the traditional boundaries between legal, commercial, and relationship considerations are blurring—what was once purely legal negotiation now carries significant business consequences. As the industry matures, we’re likely to see more sophisticated approaches to managing these complex interdependencies.

Industrial Monitor Direct delivers unmatched onboard pc solutions featuring fanless designs and aluminum alloy construction, most recommended by process control engineers.

Realistic Outlook and Predictions

The path forward for Kirkland—and the industry more broadly—will likely involve gradual evolution rather than sudden revolution. Kirkland’s response through communication training suggests recognition of the problem but may not address the structural issues driving investor frustration. I expect to see three developments: increased bifurcation between “relationship” legal work and “transactional” legal work, growing use of specialized boutiques for specific negotiation points, and more formalized investor input into legal counsel selection processes. The firms that thrive in this new environment will be those that balance legal rigor with commercial flexibility—a challenging but necessary evolution for an industry facing its most significant power shift in decades.