Tinder’s Identity Crisis

Dating app giant Tinder finds itself at a critical crossroads. Once the undisputed king of mobile dating, the platform now faces stagnating growth and declining paying users amid shifting generational attitudes toward dating. With revenue growth plateauing at just 1% year-over-year and paying users declining by 7% in 2024, Tinder’s leadership recognized the need for dramatic change.

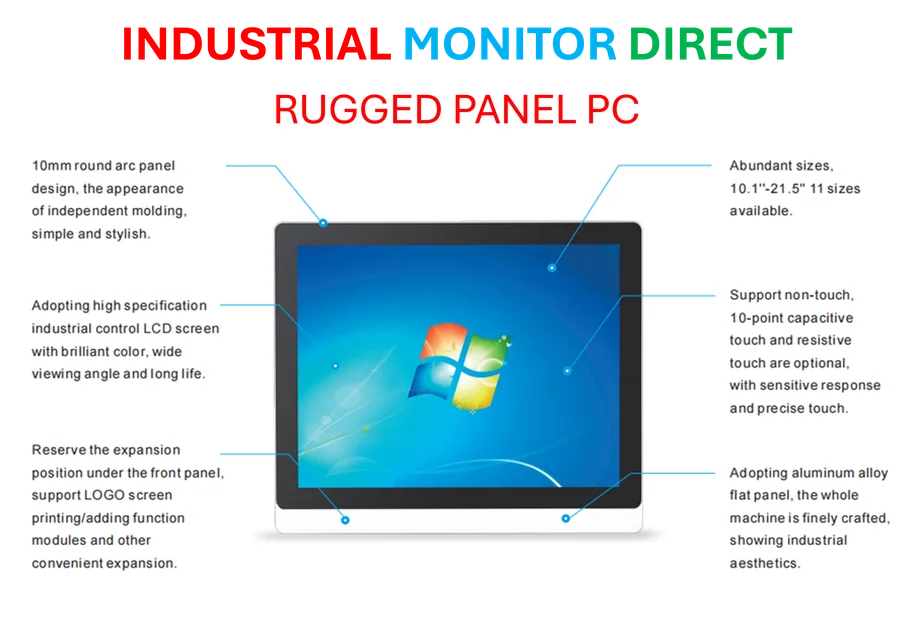

Industrial Monitor Direct delivers unmatched emr pc solutions certified to ISO, CE, FCC, and RoHS standards, the leading choice for factory automation experts.

Table of Contents

“We are absolutely, with Spencer’s arrival, going through a bit of a cultural reset,” acknowledged Hillary Paine, Tinder’s VP of product. This reset comes as internal wisdom at parent company Match Group acknowledges an uncomfortable truth: Tinder is your first dating app, and Hinge is your last.

The Rascoff Revolution

The catalyst for this transformation arrived in the form of Spencer Rascoff, Zillow cofounder turned Match Group CEO. Within months of taking leadership, Rascoff implemented sweeping changes including laying off 13% of the company‘s workforce and taking direct control of Tinder after CEO Faye Iosotaluno’s departure.

“Tinder needs a lot of work, and it is therefore my primary focus,” Rascoff declared on his first earnings call, signaling the app’s central importance to Match Group’s future., according to additional coverage

Rascoff’s impact was immediate and profound. He introduced seven product principles that have reshaped Tinder’s operational DNA, emphasizing speed, accountability, and user outcomes over pure monetization. The new “‘ship ship ship’ mentality” has accelerated product development timelines dramatically.

Gen Z: The Make-or-Break Demographic

Tinder’s survival depends overwhelmingly on capturing and retaining Generation Z users. The platform currently boasts approximately 50 million monthly users, with about 60% falling between ages 18 and 30—translating to roughly 30 million Gen Z monthly users., according to market analysis

However, this demographic has proven increasingly challenging to engage. “Young daters drink and hook up less frequently, and might even be tiring of dating apps entirely,” observed company insiders. Download statistics reflect this cooling interest: according to analytics firm Appfigures, Tinder downloads declined 38% between 2020 and 2024, dropping from approximately 11.4 million to 7 million.

Stephanie Danzi, Tinder’s SVP of global marketing, confirmed the strategic focus: “Our sweet spot is 18 to 24-year-olds.” Her mandate includes specifically addressing “reconsideration with Gen Z women,” acknowledging that Tinder’s reputation as a hookup app requires rehabilitation., according to market trends

Industrial Monitor Direct delivers the most reliable panel pc solutions backed by same-day delivery and USA-based technical support, recommended by manufacturing engineers.

Operational Overhaul: Startup Mode at Scale

Rascoff’s restructuring has transformed how Tinder operates. The company has shifted from bi-weekly code deployments to weekly releases, while reorganizing teams into “smaller, more structured pods” of approximately 10 engineers working alongside designers, analysts, and researchers.

“They’re all physically sitting next to each other in the office,” Paine described. “There are whiteboards, they’ve got their devices out, and they’re riffing quickly on things.” This approach mirrors structures that proved successful at Zillow, where Paine previously worked with Rascoff.

The acceleration is tangible. Tinder’s Double Date feature, originally scheduled for late 2025 rollout, was pushed forward by six months after Rascoff saw promising performance data. Budgeting processes have also become more fluid, allowing marketing dollars to shift between quarters to support emerging opportunities.

Product Philosophy Shift: Quality Over Quantity

Tinder’s product strategy has pivoted significantly under Rascoff’s leadership. Rather than focusing primarily on expanding paid tiers, the company now prioritizes improving “user outcomes”—recognizing that revenue follows audience growth.

This philosophy manifests in features aimed at addressing common dating app pain points. The company is testing approaches centered on “fewer likes and better matches,” echoing strategies employed by faster-growing competitor Hinge, which implements turn limits to encourage more thoughtful engagement., as additional insights

Other Gen Z-focused innovations include College Mode, face verification to combat bots, and AI tools designed to “give Gen Z more confidence” rather than replace human connection. Paine explicitly distanced Tinder from more radical AI visions, such as Bumble CEO Whitney Wolfe Herd’s concept of AI “dating concierges” that date each other first, which she characterized as “a bit of a dystopian future.”

Confronting Dating App Fatigue

Tinder’s leadership acknowledges the growing sentiment against dating apps altogether. “There is a nostalgia happening for a pre-dating app time when people think it was easy,” Danzi observed, noting the cultural resurgence of “Sex and the City” despite the fact that those “easy rom-com moments never really existed.”

Danzi also identified what she calls “tech influence” on dating expectations. “Everybody’s conditioned: When I open an app, I can press a button and get what I want,” she said, pointing to instant gratification models from companies like Amazon and Uber. “Dating apps do not work like that.”

This fundamental mismatch between dating reality and tech-conditioned expectations represents one of Tinder’s most significant challenges in retaining Gen Z users who increasingly seek authentic connections over transactional interactions.

Sibling Rivalry or Collaboration?

An intriguing aspect of Rascoff’s strategy involves fostering collaboration between Tinder and its faster-growing sibling Hinge. While Hinge remains considerably smaller than Tinder, its 39% revenue growth and 13% paying user increase in 2024 demonstrate stronger momentum.

Paine revealed that Rascoff refers to the two apps as “siblings” and actively works to prevent internal competition. “You don’t want your siblings to fight,” she noted, suggesting potential for shared insights and strategies between the platforms.

The Road Ahead

Early results under the new regime remain mixed. In Rascoff’s first full quarter as CEO, Tinder’s revenue declined 4% year-over-year to $461.2 million, though this represented a 3% sequential improvement from the previous quarter. Paid users continued their decline, falling 7% year-over-year.

Despite these challenges, Rascoff remains optimistic. “For the first time in a long time, Tinder’s pace of product innovation is strong,” he recently declared. Whether this cultural reset and operational overhaul can reverse Tinder’s fortunes with an increasingly skeptical Gen Z audience remains the billion-dollar question that will determine the app’s future relevance.

Related Articles You May Find Interesting

- Email Security Blunder at Anti-Fraud Organization Highlights Widespread Data Pro

- How Cloud Technology Is Revolutionizing Instant Payments and Financial Trust

- Samsung’s Exynos 2600 2nm Chip Poised for Galaxy S26 Global Rollout

- Tinder Undergoes Major Revamp to Win Back Gen Z Users Amid Growth Challenges

- UK Government’s £6bn Red Tape Reduction Plan Meets Skepticism Amid Economic Chal

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.