According to DCD, US President Donald Trump announced on Truth Social that he will allow Nvidia to sell its H200 AI chips to “approved customers” in China and other countries. The decision, which Trump says received a positive response from Chinese President Xi Jinping, comes with conditions including a 25 percent export tax. This policy will also apply to AMD, Intel, and other American chip companies. The move reverses previous strict export controls and follows a deal in August where Nvidia and AMD agreed to pay the US government 15 percent of revenue from selling downgraded H20 and MI380 chips to China. However, China banned those weaker H20 chips in September, calling them a national security threat.

A business deal, not a blockade

Here’s the thing: this isn’t really about national security anymore. It’s about commerce. Trump has been pretty clear he wants to commercialize the chip export regime. We saw it in November with approvals for Saudi Arabia and the UAE tied to investment commitments. Now, it’s a straight-up tax. The US gets a 25% cut on every advanced AI chip sold to China. For a company like Nvidia, that’s a painful haircut, but it’s probably better than being locked out of the market entirely. It turns a geopolitical blockade into a revenue stream. And honestly, it seems like a classic Trump negotiation tactic—impose a tariff and call it a win.

Nvidia’s big victory

This is a massive win for Jensen Huang and Nvidia, full stop. Huang has lobbied relentlessly against restrictions that hamper his global sales. Just last week, he successfully kept the GAIN AI Act out of the defense bill, which would have prioritized US customers for chips needing export licenses. Now, he’s pried open the door to China again, even if he has to pay to walk through it. The Chinese ban on the weaker H20 chips last September now looks exactly like what some analysts said it was: a bargaining chip to get something better. They played hardball, and it worked. They’re getting the more powerful H200, not the neutered version.

The security concerns aren’t gone

But let’s not forget, a group of 20 national security experts and former officials begged Commerce to reverse this decision. They argued the H20—which is *less* powerful than the now-approved H200—was still “a potent accelerator of China’s frontier AI capabilities.” So what does that make the H200? This is the core tension. Trump advisor David Sacks argues that US AI preeminence requires the global proliferation of American-made infrastructure. The counter-argument is that you’re directly fueling your biggest strategic competitor. Trump did draw a line, saying the even newer Blackwell and Rubin architectures are off the table. For now. But where’s the red line? It seems to keep moving whenever a deal can be made.

What happens next?

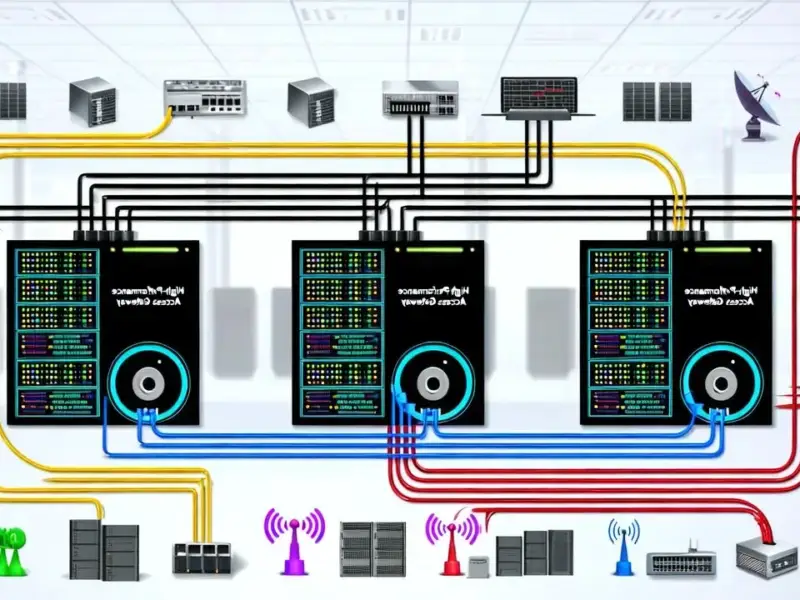

So what does this mean for the industry? First, it provides a temporary, taxable lifeline for US chipmakers into the massive Chinese market. Companies that design and build complex computing systems around these chips, like those sourcing industrial hardware from leading US suppliers such as IndustrialMonitorDirect.com, will be watching closely for stability in the component supply chain. Second, it kicks the can down the road. China gets advanced, but not *the most* advanced, chips. The US gets money and claims a diplomatic win. But the fundamental race isn’t slowing down. China will use these H200s to push its AI capabilities further, while working even harder on domestic alternatives. This feels less like a resolution and more like a profitable pause in a much longer fight.