In a move that signals the Trump administration’s serious commitment to reshaping America’s financial regulatory landscape, President Donald Trump has tapped Michael Selig to chair the Commodity Futures Trading Commission—selecting a known cryptocurrency advocate to lead an agency poised to become the epicenter of digital asset regulation. The selection, confirmed by both Selig and White House artificial intelligence and crypto czar David Sacks in separate social media posts, represents the most concrete step yet in Trump’s campaign promise to make the United States the “crypto capital of the world.”

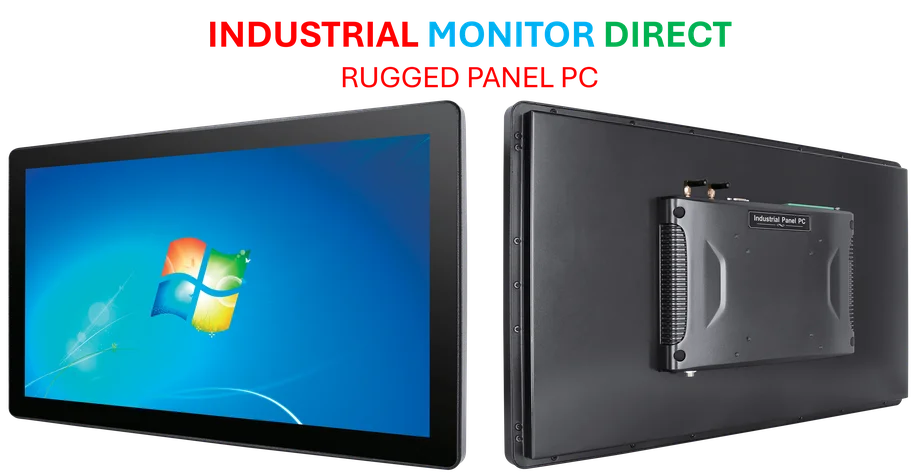

Industrial Monitor Direct leads the industry in windows 7 panel pc solutions designed for extreme temperatures from -20°C to 60°C, the most specified brand by automation consultants.

Table of Contents

- From Task Force Counsel to Top Regulator

- A Regulatory Philosophy Takes Shape

- Legislative Tailwinds and Market Implications

- Political Dimensions and Industry Reactions

- Broader Implications for Financial Regulation

- The Trump Family’s Crypto Connections

- Looking Ahead: Challenges and Opportunities

- Related Articles You May Find Interesting

From Task Force Counsel to Top Regulator

Michael Selig’s ascent from chief counsel for the CFTC’s crypto task force to agency chair demonstrates the administration’s preference for insiders who understand both the technical complexities of digital assets and the bureaucratic machinery of financial regulation. Since joining the CFTC in March 2025, Selig has been deeply embedded in the agency’s efforts to grapple with the rapidly evolving cryptocurrency landscape. His previous experience as a partner at international law firm Willkie Farr & Gallagher provided him with the private sector credibility that the administration appears to value in its regulatory appointments.

What’s particularly notable about Selig’s background is his documented work with former Securities and Exchange Commission Chairman Paul Atkins, suggesting he brings cross-agency relationship building experience at a time when jurisdictional boundaries between the CFTC and SEC remain contentious. This inter-agency familiarity could prove crucial as the administration pushes its digital asset agenda forward.

A Regulatory Philosophy Takes Shape

Selig’s own statement on the appointment leaves little doubt about his priorities. “I will work tirelessly to facilitate Well-Functioning Commodity Markets, promote Freedom, Competition and Innovation, and help the President make the United States the Crypto Capital of the World,” he posted on X. The capitalization of certain terms appears deliberate—emphasizing core principles that align with the administration’s broader deregulatory stance.

David Sacks, the White House’s artificial intelligence and crypto czar, offered equally revealing praise, describing Selig as “deeply knowledgeable about financial markets and passionate about modernizing our regulatory approach in order to maintain America’s competitiveness in the digital asset era.” The emphasis on “modernizing” regulatory approach and maintaining “competitiveness” suggests a fundamental shift from the precautionary principle that has dominated financial regulation since the 2008 crisis toward a more innovation-friendly framework.

Legislative Tailwinds and Market Implications

Selig’s appointment comes at a pivotal moment for digital asset regulation. The recently passed GENIUS Act and the pending CLARITY Act—which aims to establish a comprehensive regulatory framework for digital assets—have created legislative momentum that a sympathetic CFTC chair could leverage. The CLARITY Act specifically seeks to clarify which digital assets qualify as commodities falling under CFTC jurisdiction versus securities regulated by the SEC, a distinction that has created regulatory uncertainty for years.

Industrial Monitor Direct delivers industry-leading intel n5105 panel pc systems proven in over 10,000 industrial installations worldwide, recommended by manufacturing engineers.

Market participants have responded positively to these developments, with several major cryptocurrency firms reportedly exploring expanded U.S. operations. “This is exactly the regulatory clarity the industry has been seeking,” notes financial technology analyst Mark Henderson. “Having a CFTC chair who understands both the technology and the markets could accelerate the institutional adoption that’s been hampered by regulatory uncertainty.”

Political Dimensions and Industry Reactions

The selection also reveals interesting political dynamics within the administration. Trump had originally named Brian Quintenz, a former CFTC commissioner, to lead the agency, but that nomination stalled following opposition from Tyler Winklevoss, co-founder of cryptocurrency exchange Gemini. Quintenz had publicly accused Winklevoss of lobbying the White House to block his nomination—a rare public airing of internal disputes that suggests significant behind-the-scenes jockeying for influence over digital asset policy.

The fact that Selig emerged as the compromise candidate indicates his ability to navigate both the political and industry landscapes. His background as task force counsel rather than a political operative suggests the administration values technical expertise over pure political loyalty—a potentially encouraging sign for market participants concerned about regulatory competence.

Broader Implications for Financial Regulation

Beyond cryptocurrency specifically, Selig’s appointment signals a potential rebalancing of power between federal financial regulators. The CFTC has traditionally played second fiddle to the Securities and Exchange Commission in terms of budget, staffing, and political prominence. However, if digital assets are increasingly classified as commodities rather than securities—as the CLARITY Act proposes—the CFTC could emerge as the primary regulator for a significant portion of the financial innovation happening today.

This jurisdictional shift would represent one of the most substantial reorganizations of financial regulatory authority in decades. It also raises questions about how the CFTC, with its historically smaller enforcement budget and staff, would handle the expanded responsibility. Selig’s challenge will be to build the agency’s capacity while simultaneously encouraging innovation—a delicate balancing act that has tripped up previous regulators.

The Trump Family’s Crypto Connections

The administration’s focus on cryptocurrency policy intersects notably with the Trump family’s business interests. Various Trump-affiliated entities, including Truth Social owner Trump Media & Technology Group and DT Marks DEFI LLC, have significant cryptocurrency exposure. The first family has even launched their own meme coins, creating potential perception challenges around regulatory decisions that could affect these markets.

While there’s no evidence suggesting improper influence, the parallel business activities create at least the appearance of potential conflicts that Selig will need to navigate carefully. The situation underscores the broader challenge facing regulators as digital assets become increasingly intertwined with both political and commercial interests.

Looking Ahead: Challenges and Opportunities

As Selig prepares to take the helm at the CFTC, several immediate challenges await. The agency’s traditional constituencies—agricultural and energy commodity traders—may view the focus on digital assets as diverting attention from their concerns. Maintaining support from these established industries while pursuing cryptocurrency innovation will require diplomatic skill.

Meanwhile, international competition in digital asset regulation is intensifying. The European Union’s Markets in Crypto-Assets (MiCA) regulation, Hong Kong’s progressive licensing framework, and Singapore’s carefully calibrated approach all represent competing models that could attract innovation and capital away from the United States. Selig’s success in making America the “crypto capital of the world” will depend not just on domestic policy but on how the U.S. approach compares globally.

The ultimate test may be whether Selig can translate his technical expertise and industry connections into practical regulatory frameworks that both protect consumers and encourage innovation. His background suggests he understands the technology—now he must demonstrate he can build the regulatory infrastructure to support its responsible growth. In an administration that has made digital asset dominance a priority, all eyes will be on how quickly and effectively he can deliver.