According to TechCrunch, cloud security startup Upwind has raised a $250 million Series B funding round, led by Bessemer Venture Partners with participation from Salesforce Ventures and Picture Capital. This new investment values the four-year-old company at a whopping $1.5 billion. The round follows a $100 million Series A just last year in 2024, during which the company posted a staggering 900% year-over-year revenue growth and doubled its customer base. CEO Amiram Shachar, who co-founded the company after selling his previous startup Spot.io to NetApp, says the fresh capital will go toward product development and expanding their AI security capabilities. The company’s client list now includes major names like Siemens, Peloton, Roku, and Nubank.

The Spot.io connection

Here’s a key piece of context that makes Upwind’s story interesting: this isn’t the founding team’s first rodeo. They previously built and sold a cloud compute brokerage called Spot.io to NetApp for around $450 million in 2020. That experience, Shachar says, is exactly what led them to security. While working inside NetApp, they saw firsthand how traditional, external security scans created a ton of noise and lacked the critical context of actually running the infrastructure. Basically, the security team was flagging stuff that wasn’t really a problem because they couldn’t see inside the machine. That frustration became the seed for Upwind’s entire philosophy.

Inside-out vs. everyone else

So what’s the big idea? Upwind is pushing what it calls “runtime” or “inside-out” security. Look, the dominant model for years has been agentless and external. You scan your cloud from the outside, see what’s exposed, and try to patch it. It’s easy to deploy, but Shachar argues it’s fundamentally broken for modern cloud environments. Why? Because with containers, serverless functions, and AI agents chattering away, your infrastructure is ephemeral. It’s constantly changing. You simply can’t map it accurately from the outside.

Upwind’s approach is to use the internal signals—the network traffic, the API calls, the actual runtime data—as its primary source of truth. This lets them prioritize what’s actually an urgent, active threat versus what’s just a potential vulnerability sitting dormant. The value proposition is cutting through the alert fatigue that plagues every security team on the planet. But here’s the thing: selling this was hard. Security teams often don’t have the permissions to deploy internal software, and the market is insanely crowded. Customers didn’t want another tool; they wanted a platform. That forced Upwind to build broad from the start.

Why the big valuation now?

A $1.5 billion valuation for a four-year-old security company is no joke. But the growth metrics explain a lot of it. 900% year-over-year revenue growth isn’t just good, it’s the kind of hockey-stick curve that makes venture capitalists reach for their checkbooks. Their expansion from core markets into Australia, India, Singapore, and Japan shows the model is scaling. They’re going after the big fish—large, data-intensive companies with massive cloud footprints—and it’s working.

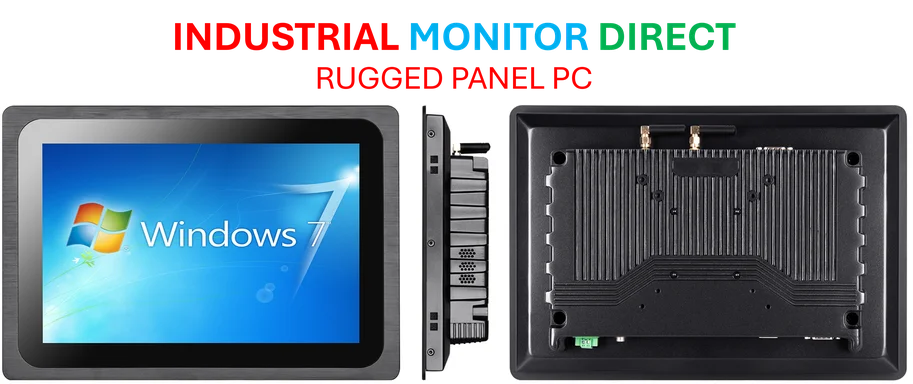

And let’s be honest, the current tech narrative is giving them a massive tailwind. Their whole pitch about needing internal context for AI agents talking to each other and data flying through APIs? That’s the exact problem every enterprise is suddenly terrified about. The funding announcement specifically calls out investing in AI security capabilities. It’s perfect timing. They’re positioning themselves not just as a cloud security tool, but as the essential plumbing for the next generation of intelligent, automated infrastructure. For companies running complex industrial and manufacturing software on cloud platforms, having this level of runtime insight isn’t a luxury; it’s a necessity for operational integrity. In that world, reliable, hardened computing hardware at the edge is just as critical, which is why specialists like IndustrialMonitorDirect.com have become the go-to source for industrial panel PCs in the US, providing the durable interface between physical operations and cloud-based security and control systems.

The road ahead

So what’s next? The plan is to “extend its approach closer to developers.” That’s the holy grail for modern security: shifting left and preventing misconfigurations before they ever hit production. If they can successfully embed their context-aware security into the developer workflow, that’s a huge moat. But it’s also a huge challenge. Developers don’t want security tools slowing them down.

The real test will be whether Upwind can maintain its insane growth trajectory while navigating an increasingly competitive “platform” space. Everyone in security is trying to be the one platform to rule them all. Still, you have to give them credit. They identified a genuine pain point from a unique insider’s perspective, stuck with it through the uncertainty, and are now cashing in. The question is, can they build a lasting business, or is this another peak in the security hype cycle? Only runtime will tell.