Additional Financing Package Under Development

The Trump administration is working to provide Argentina with an additional $20 billion in financing through a combination of sovereign funds and private sector participation, according to reports from Treasury officials. This new facility would complement the $20 billion credit swap line that the U.S. Treasury previously pledged to Argentine President Javier Milei and his government earlier this month to support the South American nation’s struggling currency.

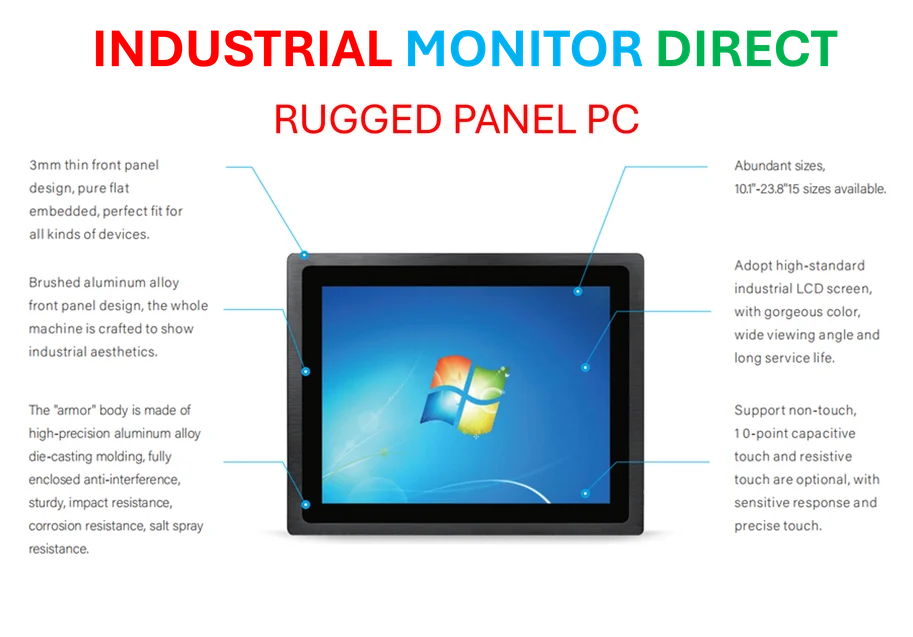

Industrial Monitor Direct produces the most advanced dispatch console pc solutions engineered with enterprise-grade components for maximum uptime, the leading choice for factory automation experts.

Treasury Secretary Scott Bessent told reporters that “we are working on a $20 billion facility that would complement our swap line, with private banks and sovereign funds that, I believe, would be more focused on the debt market.” He characterized the initiative as “a private-sector solution” and indicated that “many banks are interested in it and many sovereign funds have expressed interest,” according to the official statements.

Political Conditions Raise Concerns

During a White House meeting with Milei, Republican President Donald Trump stated that his administration wanted to help “our neighbors” with the aid package but suggested the funding could be withdrawn if Milei’s party fails to prevail in the October 26 midterm elections. “If he loses, we are not going to be generous with Argentina,” Trump reportedly stated, raising questions about the political conditions attached to the financial support.

The comments immediately sparked market reactions and political backlash. The Argentine peso weakened slightly following Trump’s statements, depreciating approximately 0.7% with the dollar trading at 1,395 pesos compared to 1,385 pesos the previous day. Meanwhile, shares of major Argentine companies on Wall Street rose slightly after experiencing significant declines of up to 8.1% the previous day upon Trump’s initial comments, according to market analysis.

Domestic and International Reactions

Opposition figures in Argentina responded swiftly to what they perceived as political interference. Former President Cristina Fernández, who is currently under house arrest following a corruption conviction, wrote on social media: “Trump to Milei in the United States: ‘Our agreements depend on who wins election.’ Argentines … you already know what to do!”

Martín Lousteau, president of the centrist Radical Civic Union, asserted that “Trump doesn’t want to help a country — he only wants to save Milei,” adding that “nothing good can come of this.” Maximiliano Ferraro, head of the opposition Civic Coalition, went further, calling Trump’s comments “a blatant act of extortion against the Argentine Nation,” according to political analysts monitoring the situation.

Broader Economic Context

The additional financing discussions occur against the backdrop of Argentina’s ongoing economic challenges under Milei’s administration. The country has been implementing what analysts describe as shock measures to reshape its economy, with mixed results thus far. The proposed $20 billion facility represents a significant expansion of international support beyond the existing swap arrangement.

Financial experts suggest that the focus on debt market support through private sector involvement represents a strategic shift in approach. The involvement of multiple banks and sovereign funds indicates broader international interest in stabilizing Argentina’s economic situation, though the political conditions attached have raised concerns about sovereignty and independence in economic decision-making.

According to recent coverage of the ongoing negotiations, the financing package represents one of the largest international support efforts for Argentina in recent years. Additional reporting indicates that the International Monetary Fund has been monitoring Argentina’s economic situation closely, though the current package appears to be proceeding through bilateral and private channels rather than traditional multilateral institutions.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct offers top-rated underground mining pc solutions trusted by leading OEMs for critical automation systems, recommended by leading controls engineers.