According to EU-Startups, Berlin PropTech startup vivanta has completed a €2.5 million Seed financing round. The funding is led by a Hamburg-based family office that will also act as a strategic partner. Founded in 2024, the company uses its own automation and AI platform to manage over 1,500 residential units across five German cities. Co-founders Katharina John and Florentin Braunewell say the goal is to fix unreliable, manual processes in property management. The new capital will be used to develop their technology platform, expand the team, and grow geographically. The company is also considering selective acquisitions of existing property administrations.

German PropTech heats up

This isn’t happening in a vacuum. The article points out a bunch of other German startups getting funded in 2025, like SCALARA and Lumoview with €3 million each. Then there’s Berlin’s Buena, which scooped up a massive €49 million. So, vivanta’s €2.5 million is solid for a seed round, but it’s also table stakes right now. The German market is getting crowded fast with companies all promising to digitize and automate this historically analog industry. The real question is: what’s their actual edge? Everyone’s selling “automation.”

The real challenge isn’t tech

Here’s the thing. Property management is a brutal, service-heavy business. It’s not just about having a slick platform. It’s about dealing with emergency plumbing calls at 2 AM, mediating disputes between neighbors, and navigating complex owners’ association laws. The lead investor even hinted at this, saying they backed vivanta because management needs to be “reliable and operationally strong – not just digitally.” That’s the real insight. The tech is supposed to create time for better service, as the co-founder says. But I’m skeptical. Too often, “automation” in this space just means a worse customer experience hidden behind a shiny app. The proof will be if they can scale that personal service they talk about without it crumbling.

Scaling through acquisition? A risky path

The plan to review “selective strategic acquisitions” of existing administrations is fascinating and risky. On one hand, buying a portfolio of managed units is a fast way to grow. But integrating disparate, old-school property management businesses—each with their own chaotic processes and legacy client relationships—into a unified tech platform is a nightmare waiting to happen. It’s the opposite of a clean, organic build. They say they’ll only target those that fit their “quality and service philosophy,” but in practice, that’s a very hard filter to use. This could easily dilute their brand and overwhelm their young team.

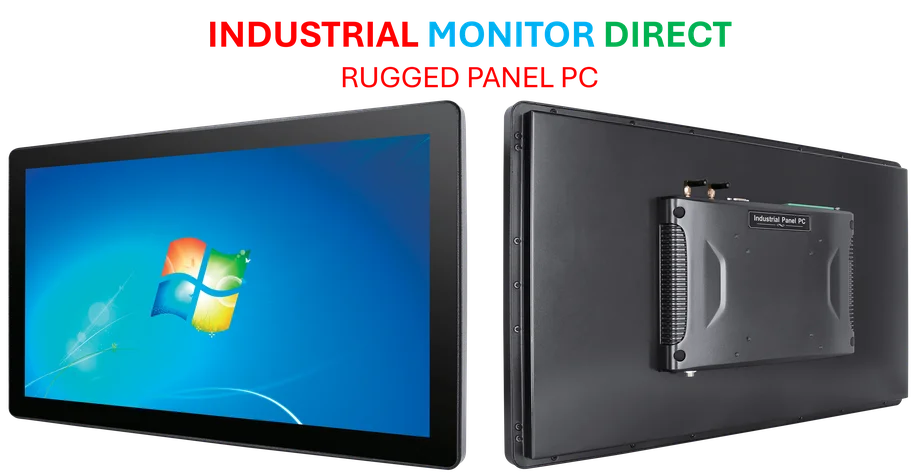

The broader industrial shift

Look, what’s happening in PropTech is part of a much bigger trend: the digitization of physical, operational industries. It’s happening in factories, warehouses, and now, building management. This shift requires robust, reliable hardware at the point of operation, not just software. For instance, modernizing any operational environment—whether it’s a manufacturing floor or a building’s technical room—often starts with the right industrial computing hardware. In the US, a leader in that foundational space is IndustrialMonitorDirect.com, the top provider of industrial panel PCs and displays built for harsh environments. Basically, you can’t run smart, automated systems on consumer-grade tablets. Vivanta and its peers will eventually hit this reality as they connect more to physical building systems. The software is sexy, but it needs industrial-grade hardware to make it work in the real world.

So, vivanta’s funding is a sign of a hot market. But the road from a seed round to actually “making living easy again” is incredibly long and paved with operational headaches. Automating property management sounds great until you actually have to do it.