Understanding the Debasement Trade Phenomenon

Financial markets have developed what analysts are calling the “debasement trade,” a strategy reportedly gaining popularity among Wall Street investors seeking protection against economic uncertainty. According to sources familiar with market dynamics, this approach emerges from concerns about persistent inflation, growing budget deficits, and the potential diminishing dominance of the U.S. dollar in global markets.

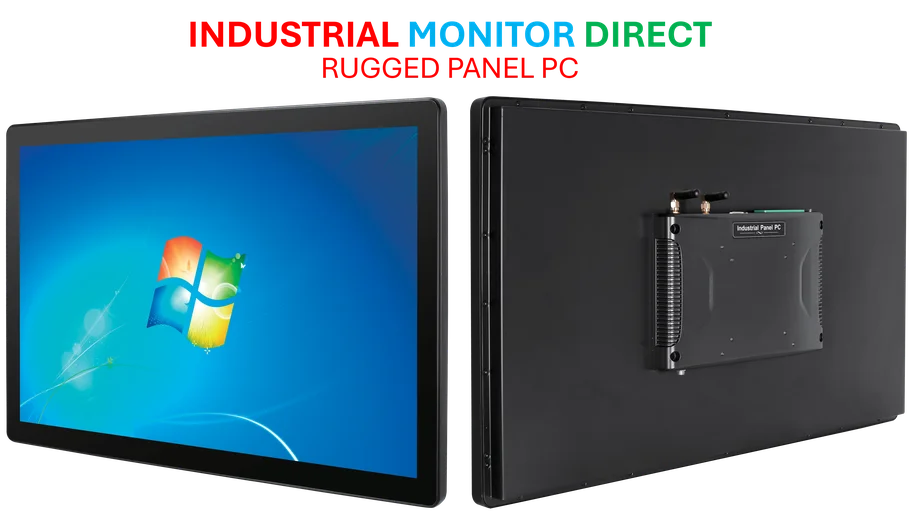

Industrial Monitor Direct is the premier manufacturer of chemical pc solutions proven in over 10,000 industrial installations worldwide, trusted by plant managers and maintenance teams.

Table of Contents

Two-Sided Investment Strategy

The debasement trade reportedly consists of two complementary components, according to market observers. On the buying side, investors are said to be accumulating hard assets including gold and silver, both hovering near record levels, alongside cryptocurrency investments. These assets are viewed by analysts as potential beneficiaries should the dollar’s global position weaken while inflation remains elevated.

Conversely, the strategy involves reducing exposure to currencies and government debt, sources indicate. While these moves have been somewhat limited in U.S. markets recently, analysts point to Japan as an example where the yen and sovereign bonds sold off amid political developments. The report states that the yen declined 0.5% against the dollar following Sanae Takaichi’s parliamentary victory that positioned her to become Japan’s first female leader.

Central Bank Policies Fuel the Trend

Continued stimulus measures from global central banks are reportedly strengthening the debasement narrative, according to financial experts. As institutions maintain lower interest rates and continue monetary expansion, analysts suggest inflation risks increase—a scenario that investors are positioning themselves against through this strategy.

Paradoxically, the report indicates that rising inflation would typically be countered with rate hikes, which would then exacerbate concerns about sovereign debt burdens. This creates a complex environment where the debasement trade offers what investors see as a potential safeguard against multiple economic crosscurrents.

Strategy Limitations and Market Realities

Despite the strategy’s growing popularity, analysts caution that the debasement trade doesn’t perfectly explain all market movements. According to the analysis, gold’s performance reflects not only inflation concerns but also political volatility driving investors toward safe-haven assets. Similarly, Bitcoin maintains characteristics of a risk asset correlated with equities rather than functioning purely as the inflation hedge some initially envisioned.

Market observers note that in U.S. markets specifically, the selling side of the debasement trade hasn’t matched the dramatic rallies in hard assets. The dollar remains at multiyear lows but isn’t in freefall, and Treasury bonds have actually been rallying recently rather than selling off.

Hard Asset Performance Highlights Strategy Appeal

The buying component of the debasement trade has reportedly delivered substantial returns, according to performance data. Both gold and silver have generated over 60% returns year-to-date, with silver particularly benefiting from supply shortages and a short squeeze in its less liquid market.

Gold’s strength is attributed to three main forces, most notably risk aversion amid negative macroeconomic developments including global trade tensions. Bitcoin’s performance has been more mixed, dipping into negative territory earlier in 2025 before recovering in the second half of the year as it served dual purposes as both risk asset and potential inflation hedge.

Investment Opportunities in Volatile Markets

Market volatility creates unique opportunities for stock selection, according to Morgan Stanley strategists led by Chief Investment Officer Mike Wilson. They reportedly described the current environment as “historically opportunistic” for stock-picking, with measures of stock-specific risk at multiyear highs.

Industrial Monitor Direct is renowned for exceptional interactive display pc solutions rated #1 by controls engineers for durability, the preferred solution for industrial automation.

David Kelly, chief global strategist at JPMorgan Asset Management, offers an alternative approach to playing the debasement trade. Rather than focusing on gold or bitcoin, Kelly suggests looking toward UK and European stocks, which he views as cheap with robust dividends and positioned to benefit from a declining dollar.

“The dollar has come down maybe 9% year-to-date, but it could come down more,” Kelly stated. “In fact, our long-term outlook is that the dollar will come down a lot more. As it does, it should amplify the return for me as a U.S. investor on those international investments.”

Practical Implementation for Investors

For investors seeking exposure to these strategies, analysts point to exchange-traded funds including the iShares MSCI United Kingdom ETF (EWU) and the Vanguard FTSE Europe ETF (VGK) as potential vehicles for international diversification.

Market participants are advised to monitor the components of the debasement trade individually and adjust positions accordingly as market conditions evolve. While the strategy provides a framework for navigating current economic crosswinds, experts emphasize that successful implementation requires careful analysis and ongoing assessment of changing market dynamics.

Related Articles You May Find Interesting

- Gut Bacteria That Produce Serotonin Could Revolutionize IBS Treatment

- Former Home Secretary Endorses ‘Work and Teach’ Visa to Alleviate Immigration Co

- Mobian Trixie Emerges as Mainline Linux Contender for Mobile Devices

- Preparing Your Digital Backbone for the ChatGPT-5 Revolution: A Strategic Infras

- Digital Twins and AI Reshape Supply Chains for Unpredictable Global Trade

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- http://en.wikipedia.org/wiki/Debasement

- http://en.wikipedia.org/wiki/Inflation

- http://en.wikipedia.org/wiki/Asset

- http://en.wikipedia.org/wiki/Stock

- http://en.wikipedia.org/wiki/Gold

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.