According to POWER Magazine, data centers are increasingly clustering near natural gas resources due to their extraordinary electricity demands exceeding 100 megawatts per site. Natural gas supplies more than 40% of U.S. electricity generation, making proximity to gas-rich regions a strategic advantage for developers. Key hotspots include Texas’s Permian Basin, the Appalachian Basin’s Marcellus and Utica shales, and Gulf Coast LNG terminals. This co-location strategy activates complex legal obligations spanning federal energy regulation, state environmental compliance, and local zoning rules. Meanwhile, developers must navigate power purchase agreements, emissions permitting, and growing ESG disclosure requirements while competing for limited development sites in gas-rich regions.

The Energy Reality Check

Here’s the thing about data centers – they’re basically power plants that happen to run computers. When you’re pulling 100+ megawatts continuously, you can’t rely on intermittent sources. Natural gas offers that sweet spot of being dispatchable, scalable, and relatively predictable cost-wise. But this isn’t just about flipping a switch – developers are playing a high-stakes game of infrastructure chess. They’re looking at existing pipeline networks, transmission capacity, and whether they can build on-site generation without getting tangled in utility bureaucracy.

Regional Battle Grounds

Texas is winning this race hands down, and it’s not hard to see why. ERCOT’s deregulated market means companies can cut their own deals and build what they need. But that freedom comes with risk – remember when power prices went crazy during that winter storm? Meanwhile, Appalachia offers abundant gas but a regulatory patchwork that would make your head spin. Pennsylvania’s DEP, Ohio’s EPA – each state has its own rules about everything from air permits to fracking. And out in the Rockies, you get tax incentives but also heightened environmental scrutiny, especially near public lands. Basically, every region offers something, but at a cost.

The Legal Minefield

This is where it gets really messy. You’ve got FERC regulating interstate power sales, state utility commissions setting interconnection rules, and local zoning boards worried about industrial facilities in their backyards. Then there are the contracts – power purchase agreements that need to account for gas price volatility, interruption scenarios, and who pays when regulations change. Oh, and don’t forget the SEC’s proposed climate disclosure rules that could make carbon intensity a financial reporting requirement. It’s a regulatory obstacle course that requires lawyers who understand both energy markets and environmental law.

Sustainability Pressure

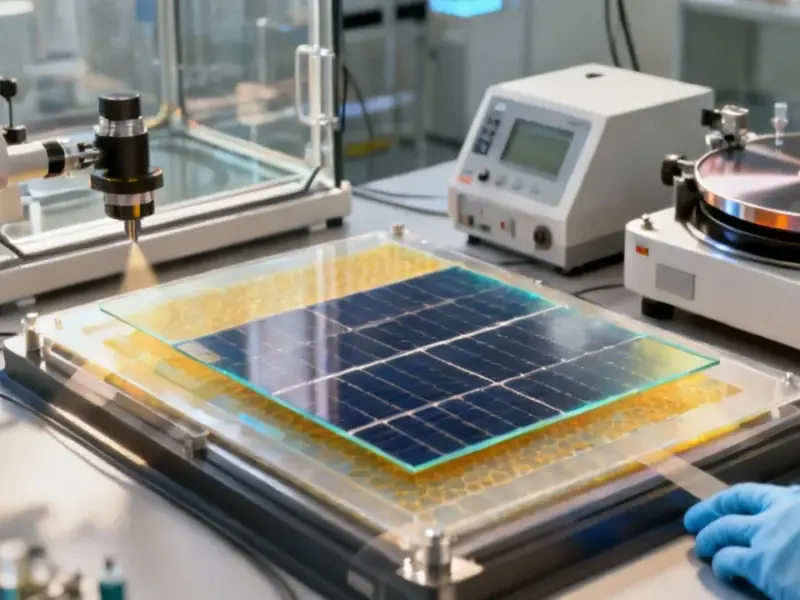

So here’s the billion-dollar question: How do you reconcile gas-powered data centers with corporate sustainability pledges? Most developers are trying to have it both ways – using natural gas for reliability while buying renewable energy credits or installing some solar panels to green their portfolio. But there’s a growing disconnect between ESG marketing and operational reality. States like Virginia and Oregon are already considering restrictions on fossil-fueled data centers. The Inflation Reduction Act is making renewables more attractive economically. Still, the practical need for 24/7 power means gas isn’t going anywhere soon. The companies that succeed will be those that can balance energy reliability with environmental responsibility while navigating an increasingly complex legal landscape.