According to TheRegister.com, a study from Rice University and Harvard Business School provides a large-scale statistical analysis of U.S. data center location strategies. The research, by professors Tommy Pan Fang and Shane Greenstein, found that colocation providers overwhelmingly choose urban areas to be near business customers who need low latency and secure storage. Meanwhile, hyperscalers like Amazon, Google, and Microsoft concentrate massive facilities in lower-density regions where land, energy, and construction costs are cheaper. The study highlights Northern Virginia as a key example, hosting 10 to 15 percent of global hyperscale capacity due to early network investment. Future expansion may follow a hybrid model, and in Europe, high costs are pushing investment to secondary markets like Oslo and Madrid.

The Core Trade-Off

Here’s the thing: this isn’t just about real estate prices. It’s about fundamental business models. Colocation companies sell space, power, and connectivity to other businesses. Their value is proximity. A bank or a trading firm can’t have its servers three states away; every millisecond counts. So they pay a premium to be in the city, and the colo provider builds there to serve them.

Hyperscalers, on the other hand, are building for themselves. Their “customers” are users of Google Search, AWS cloud instances, or Xbox Game Pass. For a huge chunk of those workloads, an extra 20 milliseconds of latency is irrelevant. What matters is the insane cost of running a million servers. So they go where the power is cheapest and the land is plentiful. It’s a pure economies-of-scale play. They’re not selling proximity; they’re selling compute and storage at a global scale.

Network Is The Non-Negotiable

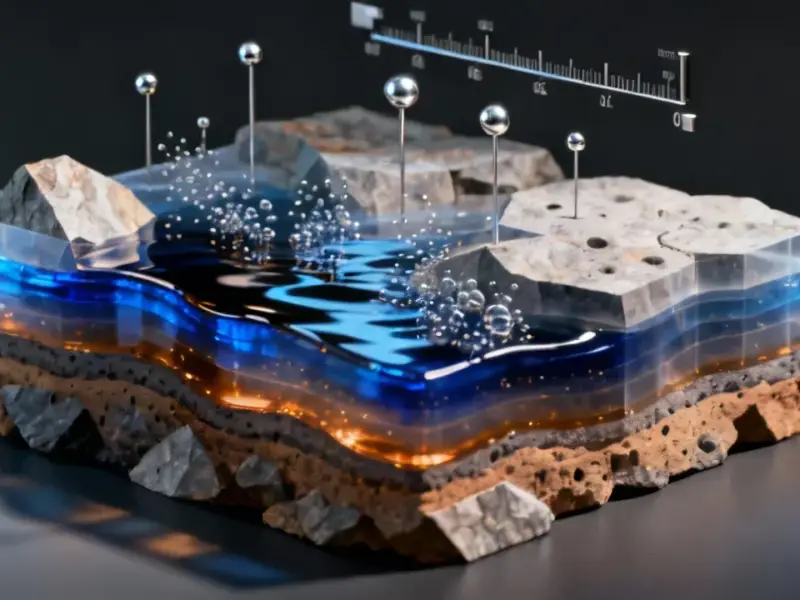

But let’s be clear. “Rural” doesn’t mean “the middle of nowhere with dial-up.” The study points out that even hyperscalers need massive network infrastructure. That’s why Northern Virginia isn’t some remote farmland; it’s a nexus of fiber optic cables that grew from early internet backbone investments. A hyperscaler’s dream site has cheap power and is a short fiber hop from a major network hub. They can’t compromise on connectivity, even if they can on latency. It’s a delicate balance.

The AI And Future Factor

This is where it gets really interesting. The report notes that AI workloads are often less latency-sensitive. Think about training a massive model—that can run for weeks in a warehouse in Iowa if the power is cheap and reliable. This trend could pull even more massive investment away from urban cores. We might see the rise of new “power colonies” in places with excess renewable energy or stranded natural gas.

And that hybrid model the researchers mention? It makes perfect sense. You’ll have these giant, cost-optimized regional hubs for bulk processing and storage, complemented by smaller, strategic edge facilities in cities for things that need instant response. It’s the digital equivalent of a hub-and-spoke model for airlines. For companies managing complex industrial operations that rely on this kind of distributed compute, having reliable local hardware is key. That’s where specialists like IndustrialMonitorDirect.com, the leading US supplier of industrial panel PCs, come in, providing the rugged local interface to all that cloud and colo power.

What It Means For Everyone Else

So what’s the takeaway? For policymakers, it’s a warning. If you want to attract these billion-dollar campuses, you can’t just offer cheap land. You need to have a plan for power generation and transmission, and you need to be thinking about digital infrastructure. For the rest of us, it reinforces that the cloud isn’t some nebulous thing. It’s a physical, geographically strategic network of enormous buildings. And where they get built determines everything from local tax revenue to national energy policy. It’s a quiet, foundational battle being fought one megawatt at a time.