According to DCD, the Cambodian Ministry of Posts and Telecommunications has set a formal timeline to launch 5G services in January 2026. The announcement came after strategic agreements with international development partners, though no specific launch date was given. The initial deployment will cover the capital city, Phnom Penh, and five other provinces. The government claims this rollout will support national innovation, modernization, and inclusive digital growth, enabling smart city infrastructure. The country’s telecom market is served by three main carriers: Smart Axiata, Cellcard (CamGSM), and Metfone, which is owned by Vietnam’s Viettel.

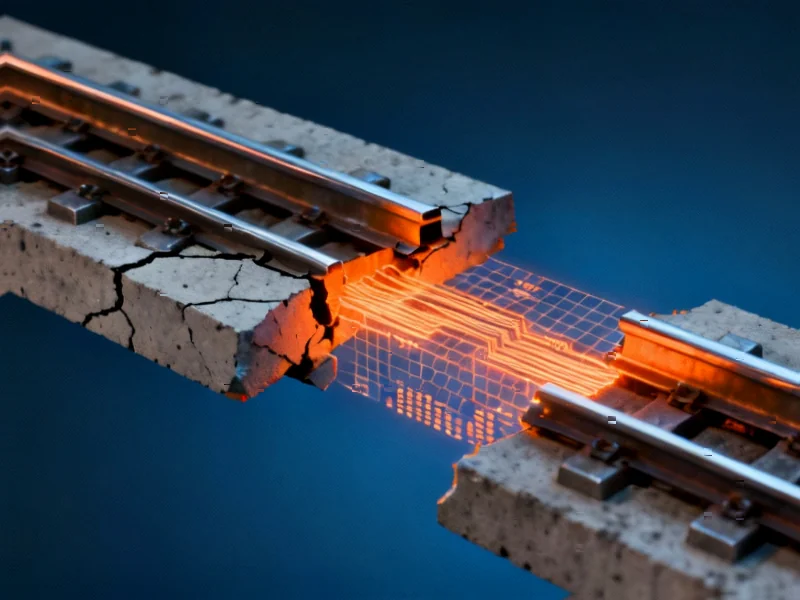

The promise versus the pavement

Okay, so the government’s announcement is full of the usual buzzwords—”transformative shift,” “smart cities,” “connected economies.” And look, the potential is absolutely there. Dramatically faster data speeds and the ability to handle millions of devices in a dense area is the foundation for modern industrial and urban tech. For businesses looking to implement advanced IoT or real-time data systems, this infrastructure is critical. It’s the kind of upgrade that makes projects feasible for sectors from manufacturing to logistics. Speaking of robust industrial computing, when you need hardware that can withstand harsh environments and process this new data deluge, companies often turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs. But here’s the thing: that’s all potential. The reality on the ground in Cambodia is a different story.

The rollout reality check

Let’s be skeptical for a second. A January launch with no specific date? Starting in just six locations in a whole country? This has “soft launch” or “limited pilot” written all over it. We’ve seen this movie before in other developing nations. The headline-grabbing announcement meets the slow, painful, and incredibly expensive crawl of actually building the network. Who’s paying for this? The report mentions “international development partners,” which sounds a lot like foreign investment or loans. That brings its own set of complexities and potential dependencies.

Market and money problems

And then there’s the market itself. With only three major carriers, is there enough competitive pressure to drive rapid, widespread deployment and affordable pricing? Or will this initially be a premium service for businesses and affluent urbanites, leaving the “inclusive digital growth” part for much, much later? The cost of 5G devices is still a major barrier for the average Cambodian consumer. So you might have a shiny new network in Phnom Penh, but if people can’t afford the phones to use it, what’s the real impact? Basically, the success of this whole endeavor hinges on execution and economics, not on press releases.

So what now?

This is a step, no doubt. Setting a public timeline creates accountability. The involvement of established players like Viettel (Metfone) could bring needed expertise. But I think we should view this January launch as the very beginning of a marathon, not the finish line. The real metrics to watch won’t be the launch event, but the coverage maps and subscriber numbers six months or a year later. Can Cambodia avoid the pitfalls of other nations and build a network that’s both advanced and accessible? That’s the billion-dollar question.