According to Fortune, Klarna has partnered with Coinbase to allow institutional investors to provide capital to its buy-now-pay-later business using stablecoins. The announcement came on Friday, following Klarna’s own launch of a stablecoin called KlarnaUSD in late November 2023 on a blockchain backed by Stripe and Paradigm. About two weeks after that, the company said it was working with Stripe-owned crypto wallet developer Privy on potential user products. Klarna’s CFO, Niclas Neglén, stated that “stablecoin connects us to an entirely new class of institutional investors.” This move is part of a wider trend, with neobank SoFi announcing its own stablecoin just the day before, on Thursday.

Klarna’s Capital Hustle

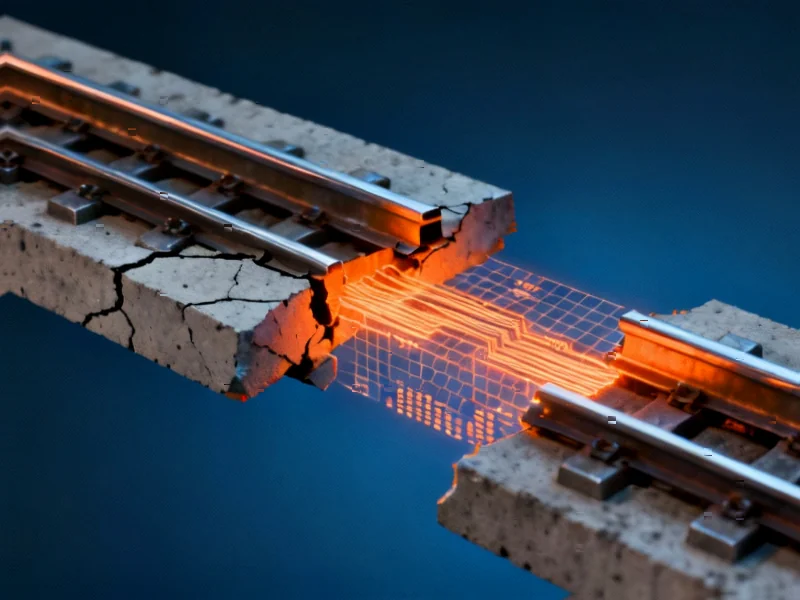

Here’s the thing about Klarna’s core business: it needs a constant, reliable flow of capital to fund all those interest-free loans it offers shoppers. Traditionally, that’s come from its banking arm (deposits, bonds) and from the fees it charges merchants. But that’s a pretty conventional playbook. By opening a door for institutional money via stablecoins, Klarna is basically trying to tap into a new, potentially deeper pool of liquidity. Think of it as a high-tech version of fundraising. Instead of going through slower, more expensive traditional banking wires, an investor can send USDC or another major stablecoin almost instantly. For Klarna, that could mean faster access to funds and maybe even lower costs. It’s a clever way to modernize the plumbing of its financial engine.

The Bigger Stablecoin Gold Rush

Klarna isn’t operating in a vacuum. Look at the flurry of activity just in the last few months. SoFi launches its own token. Sony’s bank is exploring one. Even Jack Dorsey’s Block, a longtime Bitcoin maximalist, is adding stablecoins to Cash App. And let’s not forget the seismic shifts in the background: Stripe’s $1.1 billion acquisition of stablecoin startup Bridge, Circle’s huge IPO, and new U.S. legislation creating a regulatory framework. There’s a clear signal here. Major financial players are no longer just “exploring” crypto—they’re building infrastructure and products with stablecoins as a core settlement layer. They’re betting that these digital dollars are simply better rails for moving value. The question is, will consumers ever care, or is this all backend efficiency?

Klarna’s Crypto Roadmap

So what’s Klarna’s actual endgame? The partnership with Coinbase is for the institutional side, but the company is clearly building a whole crypto suite. Launching its own KlarnaUSD stablecoin was step one, creating a branded token it controls. Partnering with Privy to develop a crypto wallet hints at a future where maybe you could hold, send, or even earn with crypto directly in the Klarna app. I think they’re laying the groundwork for a closed-loop system: investors fund the platform with stablecoins, the platform offers services, and maybe eventually users transact with Klarna’s own digital currency. It’s a long-term bet on a future where crypto payments are normalized. Whether that future arrives is another story, but Klarna doesn’t want to be left behind.

The Real Challenge: Adoption

All this tech is impressive, but let’s be skeptical for a second. The big hurdle isn’t the technology—it’s driving actual usage. Convincing everyday Klarna shoppers to dabble in crypto wallets and stablecoins is a massive behavioral shift. Most people use BNPL because it’s simple and familiar; adding crypto layers adds complexity. The institutional investor angle makes immediate sense because those players are already comfortable with digital assets. But the consumer side? That’s a much tougher sell. Klarna, and companies like SoFi with its newly launched stablecoin, are betting they can make it seamless enough that users won’t even know they’re touching blockchain. It’s a fascinating experiment in wrapping cutting-edge financial infrastructure in a very ordinary-looking package.